ASi" kUCTURE FlOR DEVELOPMENT

ASi" kUCTURE FlOR DEVELOPMENT

ASi" kUCTURE FlOR DEVELOPMENT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

f<br />

r,' . ,: '. : . .-<br />

to projects that 'would be commercially viable if fl- ously seeking high-yielding investments in develinanced<br />

on market terms.<br />

oping countries. Construction conglomerates are active<br />

in toll-road construction and in power projects,<br />

IHE NEED FOR NEW APPRoAC1rES. In the coming where they sometimes take an equity Interest, Some<br />

decade, demand for infrastructure investments will companies or groups of companies also specialize in<br />

simultaneously increase in two different sets of stand-alone infrastructure projects, putting together<br />

coulntries: those that have, undertaken macroeco- financing packages and overseeing project developnomic<br />

adjustment with consequent low investment ment and operation.<br />

levels and, at the other extreme, those whose rapid Most indicators of infrastructure investment<br />

growth is now placing a heavy burden on infra- under private sponsorship reveal rapid growth. Pristructure.<br />

Infrastructure investments in developing vatized telecommunications and electricity utilities<br />

countries represent, on average, 4 percent of GDP, in Latin America and Asia are undertaking large<br />

but they often need to be substantially higher. and growing new investments. The number of tlese<br />

Where telecommunications or. power-supply net- so-called greenfield. projects-especially in the road<br />

works are expanding rapidly, annual investments in and electric power sectors-has grown rapidly (as<br />

either sector can be as high as 2 percent of GDP A discussed below). Infrastructure investments by thespecial<br />

factor increasing investrnent demand in 'Intemational Finance Corporation (IFC), a World<br />

many countries is the rapid pace of urbanization, re- Bank affiliate that invests only in private entities,<br />

quirng investnents in water supply as well as have experienced a surge, from modest amounts in<br />

waste treatment and disposal.<br />

the lite 1980s to $330 million in fiscal 1993. Thie<br />

In Asia, the share of infastructure investment in amount invested by the IFC was leveraged more<br />

CDP is expected to rise from 4 percent today to more than ten times, so that, in 1993, IFC particpated in<br />

than 7 percent by the turn of the century, with trans- private investments of $3.5 billion.<br />

port and energy likely to demand the most re- The most important development during the<br />

sources, followed by telecommunications and envi- past four years has been the explosion in interna-<br />

-rounental infrastructure. Some of the planned tional flows of long-term private capital to developinvestments<br />

are without precedenL China, for exam- ing ountries, especially in the formn of foreign direct<br />

pIe, has set a target of installing at least 5 million investment and portfolio flows. Aggregate flows<br />

telephone lines annually up to 1995 and at least 8 stood at more than $80 billion in 1992 and were pro-<br />

* 0 million lines per year thereafter, to more than triple jected to reach $112 billion in 1993 (Table 5.1): Infraits<br />

1992 base of 18 millon lines by the year 2000.<br />

Private entrereneurshtip: trends and opportunities<br />

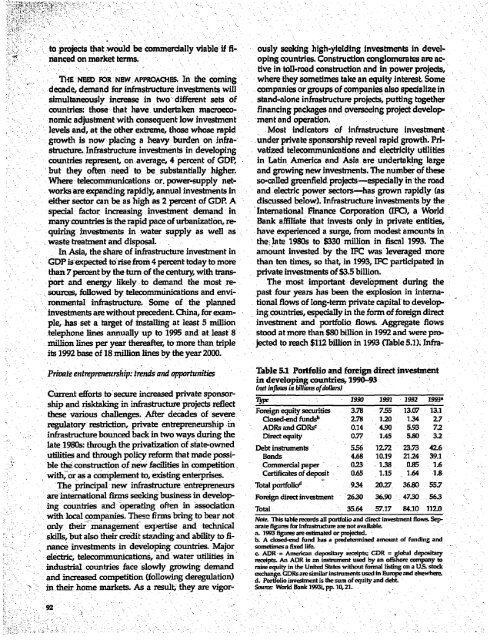

Table 5.1 Portfolio and foreign direct investment<br />

in developing countries, 1990-93<br />

(net inflows in biUlions of dollars)<br />

Current efforts to'secure increased private sponsorship<br />

and risktaldng in infrastructure projects reflect yre 1990 199- 1992 199M<br />

these various challenges. After decades of severe Forgnequitysecities 3.7s 755 13.07 131<br />

Closed-end fundsb 2.78 1.20 1.34 2.7<br />

regulatory restriction, private entreprneurship in ADRSandGDRsC 034 4.90 593 72<br />

infrastructure bounced back in two ways during the Direct equity . 0.77 1.45 5J80 3.2<br />

late 1980s: through the privatization of state-owned 556 12.72 23.73 42.6<br />

utilities and through policy reform that made possi- Bonds 4.68 10.19 21.24 39.1<br />

ble the construction of new facilities in competition - Conimerial paper 0.23 1.38 0.85 1.6<br />

with, or as a complement to, existing enterprses. Certificates of deposit 0.65 1.15 1.64 1.8<br />

'The principal new infrastructure entrepreneurs Total portfoliod 9.34 20.27 36.80 55.7<br />

are international firms seeking business in develop- Foreign direct investment 26.30 36.90 47.30 56.3<br />

ing countries and operating often in association Tota 35.64 57.17 84.10 1120<br />

: : with local companies. These firms bring to bear not- Not This table records all portfolio and direct investnent flows. Seponly<br />

their management expertise and technical aratefigures forinfrastuctuare notavailable.<br />

skills, but also their credit standing and ability to fib.<br />

1993<br />

A closed-end<br />

figuresawrestimated<br />

fund has a<br />

orproed.<br />

predetermined amount of funding and<br />

nance investments in developing countries. Major sometimes a fixed life.-<br />

-- ': ' electric, telecomimunications, and water utilities in GCADR = Amneican depositary receipts; CDR = global depoitay<br />

md-stna- countries face slowly growing demand receipts. An ADR is an instrument used by an offshore company to<br />

-industrial - - - - = courttries face slowly growing demand raiseequity in the United States without formal listing on a US. stock<br />

exhangeGCDRs aresimilarinsftrments used in Europe and elsewhere<br />

and increased competition (following deregulation) d. Portfolio investment is the sum of equity and debt<br />

mtheir home markets. As a result, they are vigor- - Sou World Bank 1993i, pp. 10,21.<br />

92