Download - Academy Publisher

Download - Academy Publisher

Download - Academy Publisher

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

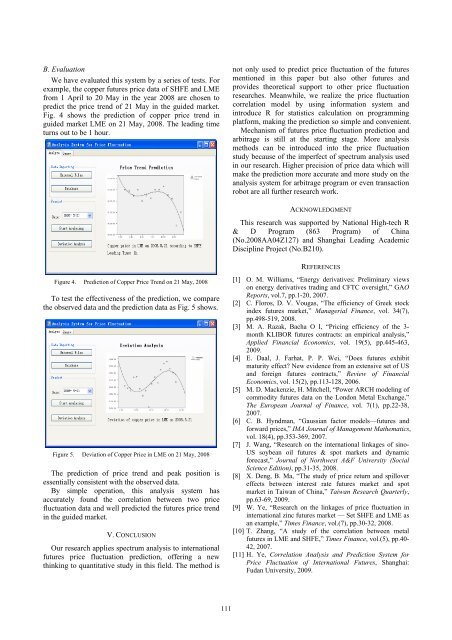

B. Evaluation<br />

We have evaluated this system by a series of tests. For<br />

example, the copper futures price data of SHFE and LME<br />

from 1 April to 20 May in the year 2008 are chosen to<br />

predict the price trend of 21 May in the guided market.<br />

Fig. 4 shows the prediction of copper price trend in<br />

guided market LME on 21 May, 2008. The leading time<br />

turns out to be 1 hour.<br />

not only used to predict price fluctuation of the futures<br />

mentioned in this paper but also other futures and<br />

provides theoretical support to other price fluctuation<br />

researches. Meanwhile, we realize the price fluctuation<br />

correlation model by using information system and<br />

introduce R for statistics calculation on programming<br />

platform, making the prediction so simple and convenient.<br />

Mechanism of futures price fluctuation prediction and<br />

arbitrage is still at the starting stage. More analysis<br />

methods can be introduced into the price fluctuation<br />

study because of the imperfect of spectrum analysis used<br />

in our research. Higher precision of price data which will<br />

make the prediction more accurate and more study on the<br />

analysis system for arbitrage program or even transaction<br />

robot are all further research work.<br />

ACKNOWLEDGMENT<br />

This research was supported by National High-tech R<br />

& D Program (863 Program) of China<br />

(No.2008AA04Z127) and Shanghai Leading Academic<br />

Discipline Project (No.B210).<br />

REFERENCES<br />

Figure 4. Prediction of Copper Price Trend on 21 May, 2008<br />

To test the effectiveness of the prediction, we compare<br />

the observed data and the prediction data as Fig. 5 shows.<br />

Figure 5. Deviation of Copper Price in LME on 21 May, 2008<br />

The prediction of price trend and peak position is<br />

essentially consistent with the observed data.<br />

By simple operation, this analysis system has<br />

accurately found the correlation between two price<br />

fluctuation data and well predicted the futures price trend<br />

in the guided market.<br />

V. CONCLUSION<br />

Our research applies spectrum analysis to international<br />

futures price fluctuation prediction, offering a new<br />

thinking to quantitative study in this field. The method is<br />

[1] O. M. Williams, “Energy derivatives: Preliminary views<br />

on energy derivatives trading and CFTC oversight,” GAO<br />

Reports, vol.7, pp.1-20, 2007.<br />

[2] C. Floros, D. V. Vougas, “The efficiency of Greek stock<br />

index futures market,” Managerial Finance, vol. 34(7),<br />

pp.498-519, 2008.<br />

[3] M. A. Razak, Bacha O I, “Pricing efficiency of the 3-<br />

month KLIBOR futures contracts: an empirical analysis,”<br />

Applied Financial Economics, vol. 19(5), pp.445-463,<br />

2009.<br />

[4] E. Daal, J. Farhat, P. P. Wei, “Does futures exhibit<br />

maturity effect New evidence from an extensive set of US<br />

and foreign futures contracts,” Review of Financial<br />

Economics, vol. 15(2), pp.113-128, 2006.<br />

[5] M. D. Mackenzie, H. Mitchell, “Power ARCH modeling of<br />

commodity futures data on the London Metal Exchange,”<br />

The European Journal of Finance, vol. 7(1), pp.22-38,<br />

2007.<br />

[6] C. B. Hyndman, “Gaussian factor models—futures and<br />

forward prices,” IMA Journal of Management Mathematics,<br />

vol. 18(4), pp.353-369, 2007.<br />

[7] J. Wang, “Research on the international linkages of sino-<br />

US soybean oil futures & spot markets and dynamic<br />

forecast,” Journal of Northwest A&F University (Social<br />

Science Edition), pp.31-35, 2008.<br />

[8] X. Deng, B. Ma, “The study of price return and spillover<br />

effects between interest rate futures market and spot<br />

market in Taiwan of China,” Taiwan Research Quarterly,<br />

pp.63-69, 2009.<br />

[9] W. Ye, “Research on the linkages of price fluctuation in<br />

international zinc futures market — Set SHFE and LME as<br />

an example,” Times Finance, vol.(7), pp.30-32, 2008.<br />

[10] T. Zhang, “A study of the correlation between metal<br />

futures in LME and SHFE,” Times Finance, vol.(5), pp.40-<br />

42, 2007.<br />

[11] H. Ye, Correlation Analysis and Prediction System for<br />

Price Fluctuation of International Futures, Shanghai:<br />

Fudan University, 2009.<br />

111