- Page 3 and 4:

World Oil Outlook 2012 Organization

- Page 5 and 6:

OPEC is a permanent, intergovernmen

- Page 7 and 8:

Contents Foreword 1 Executive summa

- Page 9 and 10:

Section Two Oil downstream outlook

- Page 11 and 12:

Table 2.16 Growth in oil demand in

- Page 13 and 14:

Figure 2.8 Increase in number of pa

- Page 16 and 17:

Foreword

- Page 18 and 19:

2 It should be stressed, however, t

- Page 20 and 21:

4 with all stakeholders aimed at fo

- Page 22 and 23:

Executive summary

- Page 24 and 25:

e 6.3 6.1 8 that year. The impact i

- Page 26 and 27:

10 Total shale gas production in th

- Page 28 and 29:

12 Demand for OPEC crude stays esse

- Page 30 and 31:

14 6 4 2 OPEC Non-crude Non-OPEC No

- Page 32 and 33:

16 3 2 1 0 -1 almost 5 mb/d and mor

- Page 34 and 35:

6.2 6.3 .1 1,100 18 1,000 2.6 mb/d,

- Page 36 and 37:

20 energy sector. At that time many

- Page 38 and 39:

Section One

- Page 41 and 42:

Chapter 1 World oil trends: overvie

- Page 43 and 44:

Box 1.1 Regulatory reform: swap der

- Page 45 and 46:

of swaps, as well as a complete aud

- Page 47 and 48:

Medium-term economic growth This WO

- Page 49 and 50:

Domestic Product (GDP), Italy and S

- Page 51 and 52:

Figure 2 Exports from China to the

- Page 53 and 54:

which average global fertility decl

- Page 55 and 56:

India Nigeria gional increase conti

- Page 57 and 58:

Figure 1.6 Figure 1.6 Real GDP by r

- Page 59 and 60:

By 2035, the Chinese economy will b

- Page 61 and 62:

imported technologies. Trends in TF

- Page 63 and 64:

Figure 1.8 World supply of primary

- Page 65 and 66:

Figure 1.10 Coal: proven reserves a

- Page 67 and 68:

to accelerate, averaging more than

- Page 69 and 70:

Figure 1.15 Evolution of energy dem

- Page 71 and 72:

• The Reference Case assumes high

- Page 73 and 74:

• New policies since WOO 2011, sp

- Page 75 and 76:

Figure 1.20 OECD and non-OECD oil d

- Page 77 and 78:

Figure 1.24 Average annual global g

- Page 79 and 80:

Figure 1.26 Proven oil reserves at

- Page 81 and 82:

Table 1.7. 7 The growth in non-OPEC

- Page 83 and 84:

The total increase of non-crude liq

- Page 85 and 86:

Figure 1.30 Incremental OPEC and no

- Page 87 and 88:

1970 1975 1980 1985 1990 1995 2000

- Page 89:

2 0 Figure 1.36 Per capita CO2 emis

- Page 92 and 93:

76 Figure 2.1 Percentage shares of

- Page 94 and 95:

78 870 million cars across the glob

- Page 96 and 97:

80 Table 2.1 (continued) Vehicle an

- Page 98 and 99:

82 Figure 2.7 Figure 2.7 Passenger

- Page 100 and 101:

84 Commercial vehicles The projecti

- Page 102 and 103:

86 In terms of the ICE vehicle effi

- Page 104 and 105:

88 a key question concerns the exte

- Page 106 and 107:

90 Table 2.5 Oil demand in road tra

- Page 108 and 109:

92 Oil demand growth in this sector

- Page 110 and 111:

94 300 200 2,000 Developing countri

- Page 112 and 113:

96 particularly due to the movement

- Page 114 and 115:

98 China 0 0.1 0.2 0.3 0.4 0.5 mboe

- Page 116 and 117:

100 Table 2.14 Growth in oil demand

- Page 118 and 119:

102 Table 2.15 Oil demand in other

- Page 120 and 121:

104 developing countries, by 2009 i

- Page 122 and 123:

106 this sector was in these countr

- Page 124 and 125:

108 Table 2.19 Oil demand in electr

- Page 126 and 127:

110 Figure 3.1 Changes to non-OPEC

- Page 128 and 129:

112 I), Russkoye (Yamal-Nenets), Su

- Page 130 and 131:

114 Table 3.1 Non-OPEC crude oil an

- Page 132 and 133:

116 The medium-term Reference Case

- Page 134 and 135:

118 Table 3.4 Estimates of world cr

- Page 136 and 137:

120 oil resources, particularly giv

- Page 138 and 139:

122 further indication of the large

- Page 140 and 141:

124 Figure 3.3 Table 3.6 billion ba

- Page 142 and 143:

126 The Reference Case sees biofuel

- Page 144 and 145:

128 much OPEC oil will be needed) g

- Page 146 and 147:

130 Table 4.1 Oil demand in the LEG

- Page 148 and 149:

132 considerably swifter than in th

- Page 150 and 151:

134 24 2000 2005 2010 2015 2020 202

- Page 152 and 153:

136 The improved acquisition, treat

- Page 154 and 155: 138 While access to electricity for

- Page 156 and 157: 140 In September 2012, OPEC and Rus

- Page 158 and 159: Section Two

- Page 161 and 162: Chapter 5 Demand outlook to 2035 Re

- Page 163 and 164: Figure 5.1 Figure 5.1 Global produc

- Page 165 and 166: Figure 5.3 presents the details of

- Page 167 and 168: At first glance, retrofitting scrub

- Page 169 and 170: Moreover, as already underscored, p

- Page 171 and 172: Regional product demand to 2035 Tur

- Page 173 and 174: e el el* cts** 0 8 mb/d of addition

- Page 175 and 176: Figure 5.7 Figure 5.7 Outlook for o

- Page 177 and 178: The increases already highlighted a

- Page 179 and 180: Demand for fuel oil will remain rel

- Page 181 and 182: Shell Chemicals and Formosa Plastic

- Page 183 and 184: equirement of 10 ppm. China is expe

- Page 185 and 186: observed in several countries since

- Page 187 and 188: Germany, provide tax incentives for

- Page 189 and 190: Chapter 6 Medium-term refining outl

- Page 191 and 192: Figure 6.1 Distillation capacity ad

- Page 193 and 194: expansion, however, remains to be s

- Page 195 and 196: Russia and other FSU countries Refi

- Page 197 and 198: Europe For the next few years, refi

- Page 199 and 200: came onstream during 2011, combined

- Page 201 and 202: Box figure 1 Figure 1 Estimated dis

- Page 203: Box figure 1 mb/d The situation on

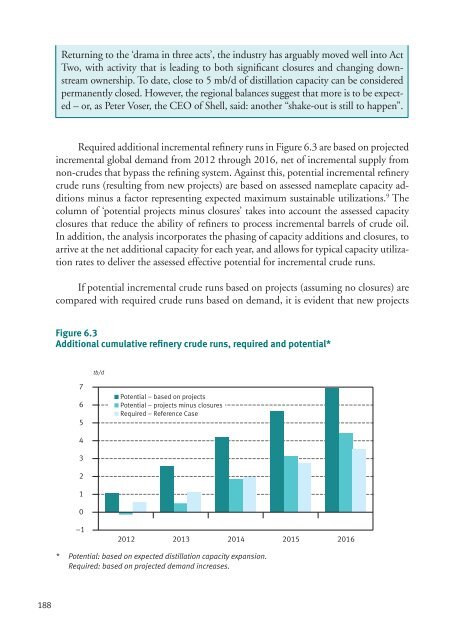

- Page 207 and 208: -1 2012 2013 2014 2015 2016 Figure

- Page 209 and 210: Figure 6.7 Global secondary units a

- Page 211 and 212: The situation in Europe is differen

- Page 213 and 214: fuels mandates call for the continu

- Page 215 and 216: costly and have shorter lead times.

- Page 217 and 218: 80 70 with 60 1.3 mb/d globally. Th

- Page 219 and 220: One implication of this is that reg

- Page 221 and 222: Chapter 7 Long-term refining outloo

- Page 223 and 224: Table 7.1 Global demand growth and

- Page 225 and 226: Europe lose 5.5 mb/d of throughput

- Page 227 and 228: Figure 7.2 Figure 7.2 Total gasolin

- Page 229 and 230: 2035. As a result, crude throughput

- Page 231 and 232: Table 7.3 Global capacity requireme

- Page 233 and 234: 0 US & Canada Latin America Africa

- Page 235 and 236: 5 of the refining base and demand,

- Page 237 and 238: Chapter 8 Downstream investment req

- Page 239 and 240: Other Asia, in the long-term, the p

- Page 241 and 242: Figure 8.3 also summarizes total in

- Page 243 and 244: Chapter 9 Oil movements Generally,

- Page 245 and 246: 60 Figure 9.1 In summary, the combi

- Page 247 and 248: cant decline in US crude imports -

- Page 249 and 250: The Seaway line used to flow north

- Page 251 and 252: Ford crude east along the Gulf and

- Page 253 and 254: 20 16 2011 2020 2035 For the Asia-P

- Page 255 and 256:

Figure 9.7 in these two regions. Th

- Page 257 and 258:

Chapter 10 Downstream challenges Th

- Page 259 and 260:

Shale gas developments could change

- Page 261 and 262:

Upgrading At around 18 mb/d install

- Page 263 and 264:

conversion. Advances have been made

- Page 265 and 266:

Section One 1. The OPEC Reference B

- Page 267 and 268:

Section Two 1. The World Oil Refini

- Page 269:

Abbreviations

- Page 272 and 273:

256 G-20 Group of Twenty GDP Gross

- Page 274 and 275:

Annex B

- Page 277 and 278:

OECD OECD America Canada Puerto Ric

- Page 279 and 280:

Côte d’Ivoire Rwanda Democratic

- Page 281 and 282:

Gibraltar Turkmenistan Kazakhstan U

- Page 283:

World Oil Refining Logistics and De

- Page 286 and 287:

270 Bolivia (Plurinational State of

- Page 288 and 289:

272 Eastern Europe Albania Poland B

- Page 290 and 291:

Annex D

- Page 292 and 293:

276

- Page 294 and 295:

278 EnSys Energy & Systems, Inc Eur

- Page 296 and 297:

280 Petroleum Economist PFC Energy

- Page 298:

Organization of the Petroleum Expor