World Oil Outlook - Opec

World Oil Outlook - Opec

World Oil Outlook - Opec

- TAGS

- world

- outlook

- opec

- www.opec.org

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

12<br />

Demand for OPEC crude stays essentially flat over the medium-term<br />

Turning to supply, the medium-term Reference Case outlook sees growth in non-OPEC<br />

liquids supply over 2011–2016. It rises by over 4 mb/d, mainly from shale oil in the<br />

US, Canadian oil sands, and crude oil from the Caspian and Brazil. These compensate<br />

for expected declines elsewhere. For example, combined supply from OECD Europe<br />

and Mexico falls by close to 1 mb/d over this period. As with earlier Reference Cases, a<br />

rise in OPEC natural gas liquids (NGLs) is expected over the medium-term, increasing<br />

from 5.2 mb/d in 2011 to 6.4 mb/d in 2016. These supply projections, along with those<br />

already outlined for demand, imply that the amount of OPEC crude required over the<br />

medium-term will stay essentially flat. However, total OPEC liquids supply rises. OPEC<br />

crude oil spare capacity is expected to exceed 5 mb/d as early as 2013/14.<br />

OPEC is investing heavily<br />

Even in the face of uncertainties about future oil demand, OPEC Member Countries<br />

continue to invest heavily in exploration, development, refining and transport in order<br />

to maintain and expand supply capacities. According to the latest list of upstream<br />

projects in the OPEC Secretariat’s database, Member Countries are undertaking or<br />

planning around 116 development projects during the five-year period 2012–2016.<br />

This corresponds to an estimated investment of about $270 billion, and demonstrates<br />

the scale of OPEC’s portfolio of projects. It is estimated, given Reference Case assumptions<br />

and projections, as well as natural declines in existing fields, that total<br />

OPEC liquids capacity will rise by 5 mb/d over this period, although investment<br />

decisions and plans will obviously be influenced by various factors, such as the global<br />

economic situation, policies and the price of oil.<br />

Large diversity of liquids supply sources over the long-term<br />

A central result that emerges from the assessment of long-term liquids supply is<br />

that resources are plentiful, and the sources of supply are diverse. Total non-OPEC<br />

liquids supply in the long-term increases strongly, by more than 10 mb/d over these years:<br />

supply increases in crude and NGLs from the Caspian, Russia, Brazil and US shale oil, as<br />

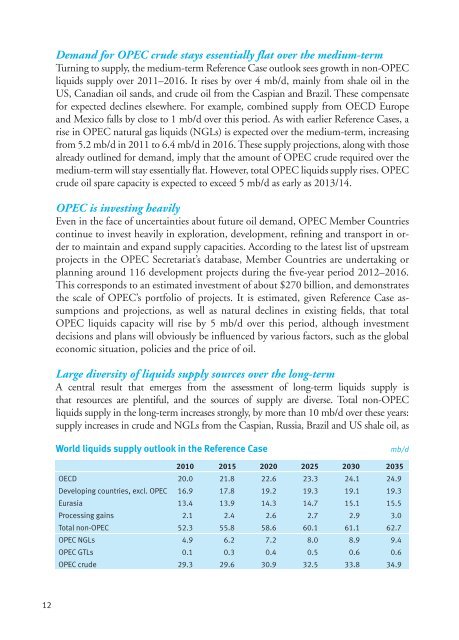

<strong>World</strong> liquids supply outlook in the Reference Case mb/d<br />

2010 2015 2020 2025 2030 2035<br />

OECD 20.0 21.8 22.6 23.3 24.1 24.9<br />

Developing countries, excl. OPEC 16.9 17.8 19.2 19.3 19.1 19.3<br />

Eurasia 13.4 13.9 14.3 14.7 15.1 15.5<br />

Processing gains 2.1 2.4 2.6 2.7 2.9 3.0<br />

Total non-OPEC 52.3 55.8 58.6 60.1 61.1 62.7<br />

OPEC NGLs 4.9 6.2 7.2 8.0 8.9 9.4<br />

OPEC GTLs 0.1 0.3 0.4 0.5 0.6 0.6<br />

OPEC crude 29.3 29.6 30.9 32.5 33.8 34.9