World Oil Outlook - Opec

World Oil Outlook - Opec

World Oil Outlook - Opec

- TAGS

- world

- outlook

- opec

- www.opec.org

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

–1<br />

tb/d<br />

0<br />

US &<br />

Additional cumulative refinery crude runs<br />

Canada<br />

required and potential*<br />

Potential – based on projects<br />

Potential – projects minus closures<br />

Required – Reference Case<br />

2012 2013 2014 2015 2016<br />

*Potential: based on expected capacity expansion and 0.5 closures.<br />

*Required: based on projected demand increases.<br />

Further scope (and need) for more capacity rationalization<br />

Refinery Distillation closures capacity in 2011 additions and from existing projects<br />

2012 – primarily in 2012–2016 OECD<br />

regions mb/d – reduced spare ca-<br />

mb/d<br />

2.5 pacity levels below 4 mb/d, 10<br />

but unless more refineries<br />

2.0<br />

are closed, new refining proj-<br />

8<br />

Effect of refinery closures<br />

ects in developing countries<br />

1.5<br />

should bring it back above<br />

6<br />

Figure 6.1<br />

5 1.0mb/d<br />

towards the end of the<br />

4<br />

medium-term. This indicates<br />

0.5 that there is scope (and need) for<br />

2<br />

more capacity rationalization to 0<br />

0<br />

improve US & refinery Latin utilizations Africa Europe and FSU Middle China Other<br />

Canada<br />

margins.<br />

America<br />

East<br />

Asia<br />

China Other<br />

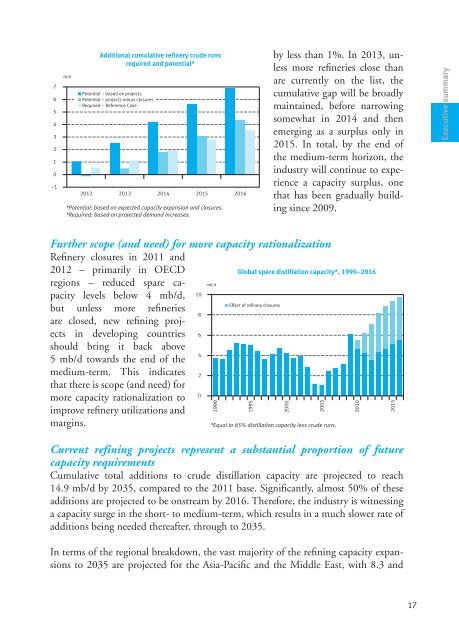

by less than 1%. In 2013, un-<br />

East<br />

Asia<br />

less more refineries close than<br />

are currently on the list, the<br />

cumulative gap will be broadly<br />

2008–2014<br />

maintained, before narrowing<br />

somewhat in 2014 and then<br />

emerging Figure as 6.3 a surplus only in<br />

2015. In total, by the end of<br />

the medium-term horizon, the<br />

industry will continue to experience<br />

a capacity surplus, one<br />

that has been gradually building<br />

since 2009.<br />

Current Estimated refining distillation projects capacity closures represent as of mid-2012 a substantial proportion of future<br />

capacity requirements 2008–2014<br />

mb/d Cumulative total additions to crude distillation capacity are projected to reach<br />

2.0<br />

14.9 mb/d by 2035, compared to the 2011 base. Significantly, almost 50% of these<br />

additions are projected to be onstream by 2016. Therefore, the industry is witnessing<br />

1.5 a capacity surge in the short- to medium-term, which results in a much slower rate of<br />

additions being needed thereafter, through to 2035.<br />

1.0<br />

In terms of the regional breakdown, the vast majority of the refining capacity expansions<br />

0.5 to 2035 are projected for the Asia-Pacific and the Middle East, with 8.3 and<br />

0<br />

Europe US & Canada Asia Latin America<br />

1.0<br />

0.5<br />

2.0<br />

1.5<br />

1.0<br />

1990<br />

Global spare distillation capacity*, 1990–2016<br />

0<br />

mb/d<br />

Latin<br />

America<br />

Estimated distillation capacity closures as of mid-2012<br />

Global spare distillation capacity*, 1990–2016<br />

1995<br />

Africa Europe FSU Middle<br />

Europe US & Canada Asia Latin America<br />

2000<br />

2005<br />

*Equal to 85% distillation capacity less crude runs.<br />

2010<br />

2015<br />

17<br />

Executive summary<br />

Figu