World Oil Outlook - Opec

World Oil Outlook - Opec

World Oil Outlook - Opec

- TAGS

- world

- outlook

- opec

- www.opec.org

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

10<br />

8<br />

6<br />

4<br />

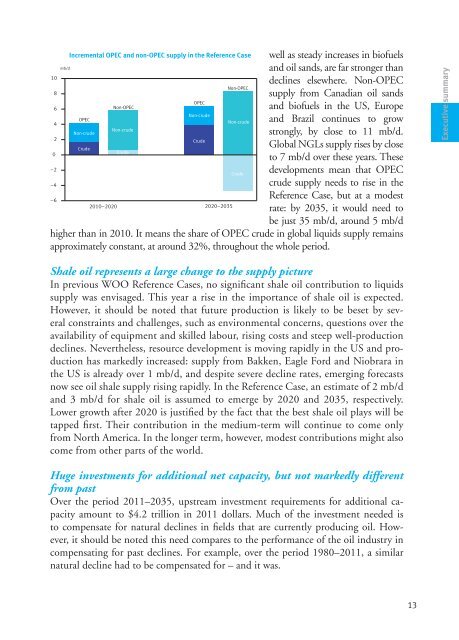

Incremental OPEC and non-OPEC supply in the Reference Case<br />

well as steady increases in biofuels<br />

and oil sands, are far stronger than<br />

declines elsewhere. Non-OPEC<br />

supply from Canadian oil sands<br />

and biofuels in the US, Europe<br />

and Figure Brazil 1.30 continues to grow<br />

Non-crude<br />

Non-crude<br />

strongly, by close to 11 mb/d.<br />

2<br />

0<br />

Crude<br />

Crude<br />

Crude<br />

Global NGLs supply rises by close<br />

to 7 mb/d over these years. These<br />

–2<br />

–4<br />

Crude developments mean that OPEC<br />

crude supply needs to rise in the<br />

–6<br />

2010–2020 2020–2035<br />

Reference Case, but at a modest<br />

rate: by 2035, it would need to<br />

be just 35 mb/d, around 5 mb/d<br />

higher than in 2010. It means the share of OPEC crude in global liquids supply remains<br />

approximately constant, at around 32%, throughout the whole period.<br />

Shale oil represents a large change to the supply picture<br />

In previous WOO Reference Cases, no significant shale oil contribution to liquids<br />

supply was envisaged. This year a rise in the importance of shale oil is expected.<br />

However, it should be noted that future production is likely to be beset by several<br />

constraints and challenges, such as environmental concerns, questions over the<br />

availability of equipment and skilled labour, rising costs and steep well-production<br />

declines. Nevertheless, resource development is moving rapidly in the US and production<br />

has OPEC markedly crude oil supply increased: in the three supply scenarios from Bakken, Eagle Ford and Niobrara in<br />

the mb/d US is already over 1 mb/d, and despite severe decline rates, emerging forecasts<br />

now 44 see oil shale supply rising rapidly. In the Reference Case, an estimate of 2 mb/d<br />

42 and 3 mb/d for shale oil is assumed to emerge by 2020 and 2035, respectively.<br />

40<br />

Lower growth after 2020 is justified by HEGthe<br />

fact that the best shale oil plays will be<br />

38<br />

tapped 36 first. Their contribution in the medium-term will continue to come only<br />

Reference Case<br />

from 34 North America. In the longer term, however, modest Figure contributions 4.1 might also<br />

32 come from other parts of the world.<br />

30<br />

28<br />

mb/d<br />

OPEC<br />

Non-OPEC<br />

OPEC<br />

Non-crude<br />

Non-OPEC<br />

Non-crude<br />

LEG<br />

Huge investments for additional net capacity, but not markedly different<br />

26<br />

from 24 past<br />

LSS<br />

Over 22 the period 2011–2035, upstream investment requirements for additional ca-<br />

2000 2005 2010 2015 2020 2025 2030 2035<br />

pacity amount to $4.2 trillion in 2011 dollars. Much of the investment needed is<br />

to compensate for natural declines in fields that are currently producing oil. However,<br />

it should be noted this need compares to the performance of the oil industry in<br />

compensating for past declines. For example, over the period 1980–2011, a similar<br />

natural decline had to be compensated for – and it was.<br />

13<br />

Executive summary