World Oil Outlook - Opec

World Oil Outlook - Opec

World Oil Outlook - Opec

- TAGS

- world

- outlook

- opec

- www.opec.org

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

6.1<br />

re 6.6<br />

India<br />

rate and raise the savings ratio, thus 1,000supporting<br />

Chinainvestment.<br />

The share of developing<br />

Asian countries in the world’s economic activity rises in the Reference Case from 26%<br />

900<br />

in 2010 to 43% by 2035. OECD regions will nevertheless continue to benefit from<br />

800<br />

higher GDP per capita. Poverty, though retreating, unfortunately remains widespread<br />

in the developing world.<br />

700<br />

The Reference Case considers only current policies<br />

500<br />

The WOO has consistently presented a Reference Case based on policies already in<br />

place. Recent policies that have been 400factored<br />

in include the EU package of measures<br />

1990 1995 2000 2005 2010 2015 2020 2025 2030 2035<br />

for climate change and renewable objectives, and the US Energy Independence and<br />

Security Act (EISA). The Reference Case does not, however, include effects from policies<br />

that are currently being proposed or that may be thought to be more likely in the<br />

longer term. This is left for scenario analysis.<br />

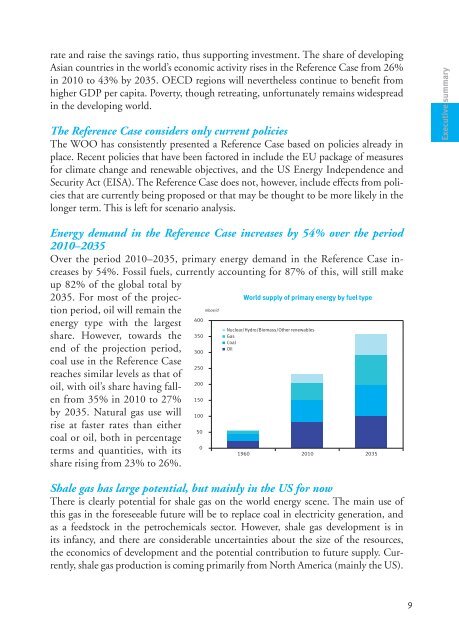

Energy demand in the Reference Case increases by 54% over the period<br />

2010–2035<br />

Over the period 2010–2035, primary energy demand in the Reference Case increases<br />

by 54%. Fossil fuels, currently accounting for 87% of this, will still make<br />

up 82% of the global total by<br />

2035. For most of the projection<br />

period, oil will remain the<br />

energy type with the largest<br />

share. However, towards the<br />

end of the projection period,<br />

coal use in the Reference Case<br />

reaches similar levels as that of<br />

oil, with oil’s share having fallen<br />

from 35% in 2010 to 27%<br />

by 2035. Natural gas use will<br />

rise at faster rates than either<br />

coal or oil, both in percentage<br />

terms and quantities, with its<br />

share rising from 23% to 26%.<br />

1,100<br />

600<br />

millions<br />

Working age population in China and India<br />

<strong>World</strong> supply of primary energy by fuel type<br />

mboe/d<br />

400<br />

Nuclear/Hydro/Biomass/Other renewables<br />

350<br />

Gas<br />

Coal<br />

<strong>Oil</strong><br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

1960 2010 2035<br />

Shale gas has large potential, but mainly in the US for now<br />

There is clearly potential for shale gas on the world energy scene. The main use of<br />

this gas in the foreseeable future will be to replace coal in electricity generation, and<br />

as a feedstock in the petrochemicals sector. However, shale gas development is in<br />

its infancy, and there are considerable uncertainties about the size of the resources,<br />

the economics of development and the potential contribution to future supply. Currently,<br />

shale gas production is coming primarily from North America (mainly the US).<br />

9<br />

Executive summary<br />

F<br />

B<br />

F