Attention! Your ePaper is waiting for publication!

By publishing your document, the content will be optimally indexed by Google via AI and sorted into the right category for over 500 million ePaper readers on YUMPU.

This will ensure high visibility and many readers!

Your ePaper is now published and live on YUMPU!

You can find your publication here:

Share your interactive ePaper on all platforms and on your website with our embed function

Sales Tax Instructions

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Sales</strong> <strong>Tax</strong> <strong>Instructions</strong>, 2009<br />

I am directed to invite attention to CBR‘s d.o. letter No.4/47-STB/98, dated 25 th<br />

September, 1998 (copy enclosed) and to say that certain queries have been made by<br />

various quarters about this scheme. The clarification is given in the following paragraphs.<br />

2. The exemption threshold of annual turnover of Rs.5 million does not<br />

apply to such suppliers of sales taxable goods and their supply of taxable goods,<br />

irrespective of the annual turnover of the supplier, is liable to sales tax. No<br />

certificate/declaration of annual turnover should be entertained, being of no avail.<br />

3. Prescribed tax invoice has to be issued by the supplier himself against his<br />

own sales tax registration number. Use of tax invoices of persons other than the supplier<br />

himself is not admissible.<br />

4. For contracts entered prior to 1 st July, 1998, the provisions of section 64-<br />

A of the <strong>Sales</strong> of Goods Act, 1930 (copy enclosed), applies. However, where such<br />

contracts were for a price inclusive of all duties and taxes, the liability shall not be on the<br />

buyers except for non-agricultural insecticides and pesticides which are the only new<br />

goods levied to sales tax in the 1998-99 budget. All other goods were already liable to<br />

sales tax since prior to 1998-99 budget.<br />

5. For contracts made on or after 1 st July, 1998 but prior to 1 st December,<br />

1998, for the rate difference of 2.5% (sales tax rate increasing from 12.5% to 15% w.e.f.<br />

1 st December, 1998), the provisions of section 64-A of the Sale of Goods Act, 1930, shall<br />

again apply and the buyer shall bear the differential so invoiced.<br />

6. It has been learnt that many of the suppliers have not so far got<br />

themselves registered and huge payments of their bills are outstanding in various<br />

Accounts Offices working under your control. It has also been learnt that some of the<br />

Accounts Offices have paid 80% of the bills to the suppliers with the condition that they<br />

will provide proof of payment of sales tax before 20% balance amount is paid to them.<br />

Due to the above situation, on the one hand lot of payment to suppliers are withheld and<br />

on the other lot of sales tax revenue is held up.<br />

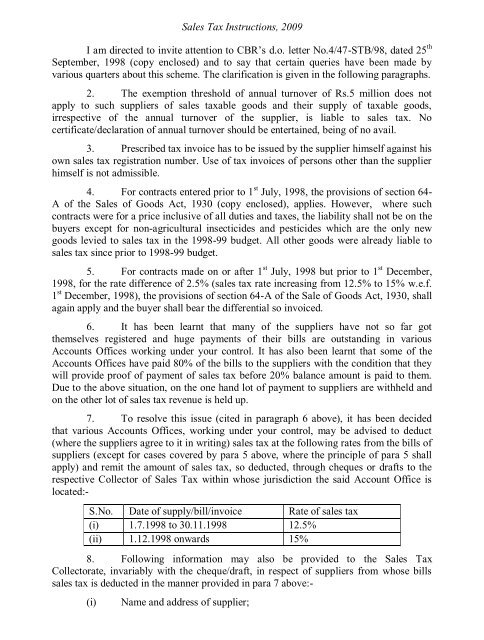

7. To resolve this issue (cited in paragraph 6 above), it has been decided<br />

that various Accounts Offices, working under your control, may be advised to deduct<br />

(where the suppliers agree to it in writing) sales tax at the following rates from the bills of<br />

suppliers (except for cases covered by para 5 above, where the principle of para 5 shall<br />

apply) and remit the amount of sales tax, so deducted, through cheques or drafts to the<br />

respective Collector of <strong>Sales</strong> <strong>Tax</strong> within whose jurisdiction the said Account Office is<br />

located:-<br />

S.No. Date of supply/bill/invoice Rate of sales tax<br />

(i) 1.7.1998 to 30.11.1998 12.5%<br />

(ii) 1.12.1998 onwards 15%<br />

8. Following information may also be provided to the <strong>Sales</strong> <strong>Tax</strong><br />

Collectorate, invariably with the cheque/draft, in respect of suppliers from whose bills<br />

sales tax is deducted in the manner provided in para 7 above:-<br />

(i)<br />

Name and address of supplier;

<strong>Sales</strong> <strong>Tax</strong> <strong>Instructions</strong>, 2009 I am directed to invite attention to CBR‘s d.o. letter No.4/47-STB/98, dated 25 th September, 1998 (copy enclosed) and to say that certain queries have been made by various quarters about this scheme. The clarification is given in the following paragraphs. 2. The exemption threshold of annual turnover of Rs.5 million does not apply to such suppliers of sales taxable goods and their supply of taxable goods, irrespective of the annual turnover of the supplier, is liable to sales tax. No certificate/declaration of annual turnover should be entertained, being of no avail. 3. Prescribed tax invoice has to be issued by the supplier himself against his own sales tax registration number. Use of tax invoices of persons other than the supplier himself is not admissible. 4. For contracts entered prior to 1 st July, 1998, the provisions of section 64- A of the <strong>Sales</strong> of Goods Act, 1930 (copy enclosed), applies. However, where such contracts were for a price inclusive of all duties and taxes, the liability shall not be on the buyers except for non-agricultural insecticides and pesticides which are the only new goods levied to sales tax in the 1998-99 budget. All other goods were already liable to sales tax since prior to 1998-99 budget. 5. For contracts made on or after 1 st July, 1998 but prior to 1 st December, 1998, for the rate difference of 2.5% (sales tax rate increasing from 12.5% to 15% w.e.f. 1 st December, 1998), the provisions of section 64-A of the Sale of Goods Act, 1930, shall again apply and the buyer shall bear the differential so invoiced. 6. It has been learnt that many of the suppliers have not so far got themselves registered and huge payments of their bills are outstanding in various Accounts Offices working under your control. It has also been learnt that some of the Accounts Offices have paid 80% of the bills to the suppliers with the condition that they will provide proof of payment of sales tax before 20% balance amount is paid to them. Due to the above situation, on the one hand lot of payment to suppliers are withheld and on the other lot of sales tax revenue is held up. 7. To resolve this issue (cited in paragraph 6 above), it has been decided that various Accounts Offices, working under your control, may be advised to deduct (where the suppliers agree to it in writing) sales tax at the following rates from the bills of suppliers (except for cases covered by para 5 above, where the principle of para 5 shall apply) and remit the amount of sales tax, so deducted, through cheques or drafts to the respective Collector of <strong>Sales</strong> <strong>Tax</strong> within whose jurisdiction the said Account Office is located:- S.No. Date of supply/bill/invoice Rate of sales tax (i) 1.7.1998 to 30.11.1998 12.5% (ii) 1.12.1998 onwards 15% 8. Following information may also be provided to the <strong>Sales</strong> <strong>Tax</strong> Collectorate, invariably with the cheque/draft, in respect of suppliers from whose bills sales tax is deducted in the manner provided in para 7 above:- (i) Name and address of supplier;

(ii) (iii) (iv) (v) (vi) (vii) <strong>Sales</strong> <strong>Tax</strong> <strong>Instructions</strong>, 2009 National <strong>Tax</strong> Number, if any, of supplier; <strong>Sales</strong> tax registration, if any, of supplier; Name and address of buyer; Value of supplies of taxable goods; Amount of sales tax deducted; and Cheque/draft number through which the amount was remitted to the Collectorate. 9. The above procedure may apply to all bills received (but not cleared/paid for want of sales tax registration and prescribed tax invoices) in the Accounts Offices by 30 th April, 1999, as a special case. 10. Necessary instructions to the field/subordinate offices may kindly be issued urgently for early clearance of the withheld cases of payments. [Issued by the CBR, Islamabad under the signature of Mr. Muhammad Tahir, Secretary (STP) addressed to the Auditor General of Pakistan, Islamabad and the Military Accountant General of Pakistan, Rawalpindi. Copy to all the Collectors of <strong>Sales</strong> tax/Mirpur(AJ&K), Chief Accounts Officer, Ministry of Foreign Affairs, Islamabad/Karachi, AGPR, Islamabad, Accountant General, Punjab/Sind/NWFP/Balochistan and S(ST.Edu.),CBR.] ******** C. NO.3(5)STP/99 DATED 15 TH MARCH, 1999 SUBJECT:- CLARIFICATION IN RESPECT OF 1% ADDITIONAL SALES TAX LEVY FOR MALAKAND DIVISION. I am directed to refer to your letter C.No.NS/S.<strong>Tax</strong>/14/98, dated 10-03-1999 on the above subject and to say that your Distributor in Malakand has an option to get voluntary registration under section 13(4) and 18 of the <strong>Sales</strong> <strong>Tax</strong> Act, 1990, but, then, he shall have to comply with the provisions of the <strong>Sales</strong> <strong>Tax</strong> Act, 1990 and issue prescribed tax invoices maintain prescribed records and file prescribed monthly Return-cum- Payment Challan. For such voluntary registration, he may contact Collector of <strong>Sales</strong> <strong>Tax</strong>, Peshawar. 2. Under section 3(3)(a) of <strong>Sales</strong> <strong>Tax</strong> Act, 1990, the liability to pay the tax on your supplies is on you and not on your Distributor in Malakand or any other area. For all your taxable supplies to any un-registered persons, you are also liable to pay the 1% further tax levied under section 3(1A) thereof. The taxable supplies made to unregistered persons in Malakand are, therefore, liable to the 1% further tax under section 3(1A) of the <strong>Sales</strong> <strong>Tax</strong> Act, 1990. [Issued by the CBR, Islamabad, under the signature of Mr.Muhammad Tahir, Secretary (STP), addressed to Mr. Nawaz Saiyed, Accounting Manager, Reckitt & Colman (Pak.)Ltd., Karachi & copy to the Collector of <strong>Sales</strong> <strong>Tax</strong> (East)Karachi (West)Karachi/Hub(Baluchistan)/ Hyderabad/ Multan/ Faisalabad/Lahore/Gujranwala/Rawalpindi/Peshawar/Mirpur(AJ&K).] Copy of letter No.NS/S.<strong>Tax</strong>/14/98, dated 10-3-1999 is reproduced below:- C. NO.NS/S.TAX/14/98, DATED 10 TH MARCH, 1999 S. M. Kazmi,Member <strong>Sales</strong> <strong>Tax</strong>, Central Board of Revenue, Islamabad. SUBJECT: CLARIFICATION IN RESPECT OF 1% ADDITIONAL SALES TAX LEVY

- Page 1 and 2:

Sales Tax Instructions, 2009 Sales

- Page 3 and 4:

Sales Tax Instructions, 2009 Sales

- Page 5 and 6:

Sales Tax Instructions, 2009 Sales

- Page 7 and 8:

Sales Tax Instructions, 2009 Sales

- Page 9 and 10:

Sales Tax Instructions, 2009 Sales

- Page 11 and 12:

Sales Tax Instructions, 2009 PREFAC

- Page 13 and 14:

Sales Tax Instructions, 2009 Forewo

- Page 15 and 16:

Sales Tax Instructions, 2009 CHRONO

- Page 17 and 18:

Sales Tax Instructions, 2009 contai

- Page 19 and 20:

Sales Tax Instructions, 2009 30 Leg

- Page 21 and 22:

Sales Tax Instructions, 2009 48 Loc

- Page 23 and 24:

Sales Tax Instructions, 2009 66 Enh

- Page 25 and 26:

Sales Tax Instructions, 2009 82 The

- Page 27 and 28:

Sales Tax Instructions, 2009 99 Lev

- Page 29 and 30:

Sales Tax Instructions, 2009 118 In

- Page 31 and 32:

Sales Tax Instructions, 2009 138 C.

- Page 33 and 34:

Sales Tax Instructions, 2009 157 Is

- Page 35 and 36:

Sales Tax Instructions, 2009 178 Ex

- Page 37 and 38:

Sales Tax Instructions, 2009 [See a

- Page 39 and 40:

Sales Tax Instructions, 2009 217 Ex

- Page 41 and 42:

Sales Tax Instructions, 2009 237 Sa

- Page 43 and 44:

Sales Tax Instructions, 2009 255 Tr

- Page 45 and 46:

Sales Tax Instructions, 2009 278 Sa

- Page 47 and 48:

Sales Tax Instructions, 2009 295 Cl

- Page 49 and 50:

Sales Tax Instructions, 2009 317 Ex

- Page 51 and 52:

Sales Tax Instructions, 2009 beef a

- Page 53 and 54:

Sales Tax Instructions, 2009 359 Pu

- Page 55 and 56:

Sales Tax Instructions, 2009 postal

- Page 57 and 58:

Sales Tax Instructions, 2009 input-

- Page 59 and 60:

Sales Tax Instructions, 2009 412 En

- Page 61 and 62:

Sales Tax Instructions, 2009 434 Ex

- Page 63 and 64:

Sales Tax Instructions, 2009 453 Re

- Page 65 and 66:

Sales Tax Instructions, 2009 473 Tr

- Page 67 and 68:

Sales Tax Instructions, 2009 remain

- Page 69 and 70:

Sales Tax Instructions, 2009 513 Ad

- Page 71 and 72:

Sales Tax Instructions, 2009 534 Sa

- Page 73 and 74:

Sales Tax Instructions, 2009 555 Re

- Page 75 and 76:

Sales Tax Instructions, 2009 576 Bu

- Page 77 and 78:

Sales Tax Instructions, 2009 594 Sa

- Page 79 and 80:

Sales Tax Instructions, 2009 615 Sa

- Page 81 and 82:

Sales Tax Instructions, 2009 636 Ve

- Page 83 and 84:

Sales Tax Instructions, 2009 in the

- Page 85 and 86:

Sales Tax Instructions, 2009 675 Pr

- Page 87 and 88:

Sales Tax Instructions, 2009 notice

- Page 89 and 90:

Sales Tax Instructions, 2009 716 Cl

- Page 91 and 92:

Sales Tax Instructions, 2009 735 Wa

- Page 93 and 94:

Sales Tax Instructions, 2009 754 Co

- Page 95 and 96:

Sales Tax Instructions, 2009 779 Le

- Page 97 and 98:

Sales Tax Instructions, 2009 799 SR

- Page 99 and 100:

Sales Tax Instructions, 2009 2001.

- Page 101 and 102:

Sales Tax Instructions, 2009 840 Re

- Page 103 and 104:

Sales Tax Instructions, 2009 858 Cl

- Page 105 and 106:

Sales Tax Instructions, 2009 876 Ex

- Page 107 and 108:

Sales Tax Instructions, 2009 898 Cl

- Page 109 and 110:

Sales Tax Instructions, 2009 917 CB

- Page 111 and 112:

Sales Tax Instructions, 2009 934 Re

- Page 113 and 114:

Sales Tax Instructions, 2009 954 Wa

- Page 115 and 116:

Sales Tax Instructions, 2009 from a

- Page 117 and 118:

Sales Tax Instructions, 2009 Drafts

- Page 119 and 120:

Sales Tax Instructions, 2009 1012 C

- Page 121 and 122:

Sales Tax Instructions, 2009 1032 S

- Page 123 and 124:

Sales Tax Instructions, 2009 1052 E

- Page 125 and 126:

Sales Tax Instructions, 2009 1071 E

- Page 127 and 128:

Sales Tax Instructions, 2009 1089 E

- Page 129 and 130:

Sales Tax Instructions, 2009 1105 M

- Page 131 and 132:

Sales Tax Instructions, 2009 1120 C

- Page 133 and 134:

Sales Tax Instructions, 2009 suppli

- Page 135 and 136:

Sales Tax Instructions, 2009 No. 50

- Page 137 and 138:

Sales Tax Instructions, 2009 1167 C

- Page 139 and 140:

Sales Tax Instructions, 2009 1186 D

- Page 141 and 142:

Sales Tax Instructions, 2009 throug

- Page 143 and 144:

Sales Tax Instructions, 2009 1222 C

- Page 145 and 146:

on supply of plant, machinery & equ

- Page 147 and 148:

Sales Tax Instructions, 2009 1262 R

- Page 149 and 150:

Sales Tax Instructions, 2009 1279 I

- Page 151 and 152:

Sales Tax Instructions, 2009 1299 I

- Page 153 and 154:

Sales Tax Instructions, 2009 1318 C

- Page 155 and 156:

Sales Tax Instructions, 2009 weight

- Page 157 and 158:

Sales Tax Instructions, 2009 1351 C

- Page 159 and 160:

Sales Tax Instructions, 2009 1370 A

- Page 161 and 162:

Sales Tax Instructions, 2009 1389 C

- Page 163 and 164:

Sales Tax Instructions, 2009 1407 N

- Page 165 and 166:

Sales Tax Instructions, 2009 1425 Z

- Page 167 and 168:

Sales Tax Instructions, 2009 ived f

- Page 169 and 170:

Sales Tax Instructions, 2009 24 th

- Page 171 and 172:

Sales Tax Instructions, 2009 1479 W

- Page 173 and 174:

Sales Tax Instructions, 2009 1501 E

- Page 175 and 176:

Sales Tax Instructions, 2009 1521 R

- Page 177 and 178:

Sales Tax Instructions, 2009 1539 S

- Page 179 and 180:

Sales Tax Instructions, 2009 Intern

- Page 181 and 182:

1581 Chargeability of sales tax on

- Page 183 and 184:

Sales Tax Instructions, 2009 1599 F

- Page 185 and 186:

Sales Tax Instructions, 2009 1611 S

- Page 187 and 188:

Sales Tax Instructions, 2009 1626 S

- Page 189 and 190:

Sales Tax Instructions, 2009 1645 S

- Page 191 and 192:

Sales Tax Instructions, 2009 1662 E

- Page 193 and 194:

Sales Tax Instructions, 2009 Februa

- Page 195 and 196:

Sales Tax Instructions, 2009 1700 C

- Page 197 and 198:

Sales Tax Instructions, 2009 1720 S

- Page 199 and 200:

Sales Tax Instructions, 2009 1739 E

- Page 201 and 202:

Sales Tax Instructions, 2009 1755 S

- Page 203 and 204:

Sales Tax Instructions, 2009 1774 S

- Page 205 and 206:

Sales Tax Instructions, 2009 CONTEN

- Page 207 and 208:

Sales Tax Instructions, 2009 Billet

- Page 209 and 210:

Sales Tax Instructions, 2009 Fixed

- Page 211 and 212:

Sales Tax Instructions, 2009 Retail

- Page 213 and 214:

Sales Tax Instructions, 2009 ALPHAB

- Page 215 and 216:

Sales Tax Instructions, 2009 9 Resp

- Page 217 and 218:

Sales Tax Instructions, 2009 /appea

- Page 219 and 220:

Sales Tax Instructions, 2009 14 Pro

- Page 221 and 222:

Sales Tax Instructions, 2009 2 Dela

- Page 223 and 224:

Sales Tax Instructions, 2009 16 Bud

- Page 225 and 226:

Sales Tax Instructions, 2009 4 Sale

- Page 227 and 228:

Sales Tax Instructions, 2009 1 The

- Page 229 and 230:

Sales Tax Instructions, 2009 24 Sal

- Page 231 and 232:

45 Situation paper on paper & paper

- Page 233 and 234:

Sales Tax Instructions, 2009 AUTHOR

- Page 235 and 236:

Sales Tax Instructions, 2009 4 Cons

- Page 237 and 238:

Sales Tax Instructions, 2009 12 Sal

- Page 239 and 240:

Sales Tax Instructions, 2009 6 Impl

- Page 241 and 242:

Sales Tax Instructions, 2009 4 Clas

- Page 243 and 244:

Sales Tax Instructions, 2009 6 Clar

- Page 245 and 246:

Sales Tax Instructions, 2009 ds by

- Page 247 and 248:

Sales Tax Instructions, 2009 26 Cla

- Page 249 and 250:

Sales Tax Instructions, 2009 import

- Page 251 and 252:

Sales Tax Instructions, 2009 cases

- Page 253 and 254:

Sales Tax Instructions, 2009 excess

- Page 255 and 256:

Sales Tax Instructions, 2009 1990.

- Page 257 and 258:

Sales Tax Instructions, 2009 June,

- Page 259 and 260:

Sales Tax Instructions, 2009 lity o

- Page 261 and 262:

Sales Tax Instructions, 2009 /96 da

- Page 263 and 264:

Sales Tax Instructions, 2009 20 Rec

- Page 265 and 266:

Sales Tax Instructions, 2009 tax an

- Page 267 and 268:

Sales Tax Instructions, 2009 regard

- Page 269 and 270:

Sales Tax Instructions, 2009 6 Proc

- Page 271 and 272:

Sales Tax Instructions, 2009 27 Exp

- Page 273 and 274:

Sales Tax Instructions, 2009 EDIBLE

- Page 275 and 276:

Sales Tax Instructions, 2009 21 Ext

- Page 277 and 278:

Sales Tax Instructions, 2009 37 Lev

- Page 279 and 280:

Sales Tax Instructions, 2009 17 Gen

- Page 281 and 282:

25.4. 08, STGO 23/08 dt 28. 6.08, S

- Page 283 and 284:

Sales Tax Instructions, 2009 48 Sal

- Page 285 and 286:

Sales Tax Instructions, 2009 7 Clar

- Page 287 and 288:

Sales Tax Instructions, 2009 20 App

- Page 289 and 290:

Sales Tax Instructions, 2009 40 Exe

- Page 291 and 292:

Sales Tax Instructions, 2009 ry‖

- Page 293 and 294:

Sales Tax Instructions, 2009 78 Sal

- Page 295 and 296:

Sales Tax Instructions, 2009 March,

- Page 297 and 298:

Sales Tax Instructions, 2009 statio

- Page 299 and 300:

Sales Tax Instructions, 2009 135 Re

- Page 301 and 302:

Sales Tax Instructions, 2009 terms

- Page 303 and 304:

Sales Tax Instructions, 2009 oil.

- Page 305 and 306:

Sales Tax Instructions, 2009 EXEMPT

- Page 307 and 308:

Sales Tax Instructions, 2009 18 Cla

- Page 309 and 310:

STGO No.3 of 2004 dated 12 th June,

- Page 311 and 312:

Sales Tax Instructions, 2009 export

- Page 313 and 314:

Sales Tax Instructions, 2009 45 Rej

- Page 315 and 316:

4 Claim of refund of input tax by M

- Page 317 and 318:

Sales Tax Instructions, 2009 25 Reg

- Page 319 and 320:

Sales Tax Instructions, 2009 FERTIL

- Page 321 and 322:

Sales Tax Instructions, 2009 6 Sale

- Page 323 and 324:

Sales Tax Instructions, 2009 12 Fed

- Page 325 and 326:

Sales Tax Instructions, 2009 June,

- Page 327 and 328:

Sales Tax Instructions, 2009 direct

- Page 329 and 330:

Sales Tax Instructions, 2009 2000 (

- Page 331 and 332:

Sales Tax Instructions, 2009 53 Eli

- Page 333 and 334:

Sales Tax Instructions, 2009 vide s

- Page 335 and 336:

Sales Tax Instructions, 2009 22 Rel

- Page 337 and 338:

-nts/departments/companies authoriz

- Page 339 and 340:

Sales Tax Instructions, 2009 respec

- Page 341 and 342:

Sales Tax Instructions, 2009 12 Cla

- Page 343 and 344:

16 Registration of comme rcial impo

- Page 345 and 346:

Sales Tax Instructions, 2009 Act, 1

- Page 347 and 348:

Sales Tax Instructions, 2009 51 Sal

- Page 349 and 350:

Sales Tax Instructions, 2009 and as

- Page 351 and 352:

Sales Tax Instructions, 2009 excise

- Page 353 and 354:

Sales Tax Instructions, 2009 exempt

- Page 355 and 356:

Sales Tax Instructions, 2009 3 Proc

- Page 357 and 358:

Sales Tax Instructions, 2009 Circul

- Page 359 and 360:

Sales Tax Instructions, 2009 sales

- Page 361 and 362:

Sales Tax Instructions, 2009 59 Inp

- Page 363 and 364:

Sales Tax Instructions, 2009 object

- Page 365 and 366:

Sales Tax Instructions, 2009 100 Is

- Page 367 and 368:

Sales Tax Instructions, 2009 ed by

- Page 369 and 370:

Sales Tax Instructions, 2009 138 Cl

- Page 371 and 372:

157 Issues relating to solvent extr

- Page 373 and 374:

Sales Tax Instructions, 2009 6 Sale

- Page 375 and 376:

Sales Tax Instructions, 2009 18 Cla

- Page 377 and 378:

Sales Tax Instructions, 2009 1 Fina

- Page 379 and 380:

15 Chargeability of sales tax on el

- Page 381 and 382:

Sales Tax Instructions, 2009 bean o

- Page 383 and 384:

Sales Tax Instructions, 2009 57 Lev

- Page 385 and 386:

Sales Tax Instructions, 2009 2000).

- Page 387 and 388:

Sales Tax Instructions, 2009 99 M/s

- Page 389 and 390:

Sales Tax Instructions, 2009 owners

- Page 391 and 392:

Sales Tax Instructions, 2009 2 Prob

- Page 393 and 394:

Sales Tax Instructions, 2009 14 Spe

- Page 395 and 396:

Sales Tax Instructions, 2009 1 The

- Page 397 and 398:

Sales Tax Instructions, 2009 11 th

- Page 399 and 400:

Sales Tax Instructions, 2009 counte

- Page 401 and 402:

Sales Tax Instructions, 2009 16 Ord

- Page 403 and 404:

Sales Tax Instructions, 2009 12 Fur

- Page 405 and 406:

Sales Tax Instructions, 2009 adjust

- Page 407 and 408:

Sales Tax Instructions, 2009 Instru

- Page 409 and 410:

Sales Tax Instructions, 2009 Sixth

- Page 411 and 412:

Sales Tax Instructions, 2009 2 Char

- Page 413 and 414:

Sales Tax Instructions, 2009 19 Gra

- Page 415 and 416:

Sales Tax Instructions, 2009 Vide I

- Page 417 and 418:

Sales Tax Instructions, 2009 taken

- Page 419 and 420:

Sales Tax Instructions, 2009 8 Sale

- Page 421 and 422:

Sales Tax Instructions, 2009 13 Cla

- Page 423 and 424:

Sales Tax Instructions, 2009 sectio

- Page 425 and 426:

12 Sales Tax: Instructions for the

- Page 427 and 428:

Sales Tax Instructions, 2009 33 Rec

- Page 429 and 430:

Sales Tax Instructions, 2009 sales

- Page 431 and 432:

Sales Tax Instructions, 2009 basis

- Page 433 and 434:

Sales Tax Instructions, 2009 45 Ref

- Page 435 and 436:

Sales Tax Instructions, 2009 64 Dir

- Page 437 and 438:

sumes in the manufacture of exempt

- Page 439 and 440:

Sales Tax Instructions, 2009 [Resci

- Page 441 and 442:

Additional Collectors for sanction

- Page 443 and 444:

Sales Tax Instructions, 2009 142 Ra

- Page 445 and 446:

Sales Tax Instructions, 2009 161 Vi

- Page 447 and 448:

Sales Tax Instructions, 2009 under

- Page 449 and 450:

Sales Tax Instructions, 2009 Limite

- Page 451 and 452:

Sales Tax Instructions, 2009 2 Fede

- Page 453 and 454:

Sales Tax Instructions, 2009 22 Cla

- Page 455 and 456:

Sales Tax Instructions, 2009 21.07.

- Page 457 and 458:

Sales Tax Instructions, 2009 62 Uni

- Page 459 and 460:

80 Sales Tax Budget Instructions 20

- Page 461 and 462:

Sales Tax Instructions, 2009 specif

- Page 463 and 464:

Sales Tax Instructions, 2009 Instru

- Page 465 and 466:

Sales Tax Instructions, 2009 16 Sal

- Page 467 and 468:

Sales Tax Instructions, 2009 7 Levy

- Page 469 and 470:

Sales Tax Instructions, 2009 paid t

- Page 471 and 472:

Sales Tax Instructions, 2009 14 Cla

- Page 473 and 474:

Sales Tax Instructions, 2009 by dis

- Page 475 and 476:

Sales Tax Instructions, 2009 52 Ext

- Page 477 and 478:

Sales Tax Instructions, 2009 71 Ext

- Page 479 and 480:

Sales Tax Instructions, 2009 1 Char

- Page 481 and 482:

Sales Tax Instructions, 2009 2 Sale

- Page 483 and 484:

Sales Tax Instructions, 2009 22 Col

- Page 485 and 486:

Sales Tax Instructions, 2009 42 Pay

- Page 487 and 488:

Sales Tax Instructions, 2009 62 Imp

- Page 489 and 490:

Sales Tax Instructions, 2009 compan

- Page 491 and 492:

Sales Tax Instructions, 2009 Fathe

- Page 493 and 494:

Sales Tax Instructions, 2009 12 Cla

- Page 495 and 496:

Sales Tax Instructions, 2009 15 th

- Page 497 and 498:

Sales Tax Instructions, 2009 1 Requ

- Page 499 and 500:

Sales Tax Instructions, 2009 12 Imp

- Page 501 and 502:

Sales Tax Instructions, 2009 Nov.,

- Page 503 and 504:

Sales Tax Instructions, 2009 input

- Page 505 and 506:

Sales Tax Instructions, 2009 sales

- Page 507 and 508:

Sales Tax Instructions, 2009 for se

- Page 509 and 510:

Sales Tax Instructions, 2009 Ordina

- Page 511 and 512:

Sales Tax Instructions, 2009 12 Sal

- Page 513 and 514:

Sales Tax Instructions, 2009 No. 11

- Page 515 and 516:

Sales Tax Instructions, 2009 dated

- Page 517 and 518:

75 Representation regarding value o

- Page 519 and 520:

Sales Tax Instructions, 2009 2006 d

- Page 521 and 522:

Sales Tax Instructions, 2009 ingred

- Page 523 and 524:

Sales Tax Instructions, 2009 11 Iss

- Page 525 and 526:

Sales Tax Instructions, 2009 Genera

- Page 527 and 528:

Sales Tax Instructions, 2009 4 DTRE

- Page 529 and 530:

Sales Tax Instructions, 2009 20 Imp

- Page 531 and 532:

Sales Tax Instructions, 2009 07.01.

- Page 533 and 534:

Sales Tax Instructions, 2009 proces

- Page 535 and 536:

Sales Tax Instructions, 2009 31 Sup

- Page 537 and 538:

Sales Tax Instructions, 2009 9.8.20

- Page 539 and 540:

Sales Tax Instructions, 2009 17.06.

- Page 541 and 542:

Sales Tax Instructions, 2009 dated

- Page 543 and 544:

108 Clarification of levy of sales

- Page 545 and 546:

Sales Tax Instructions, 2009 25.4.0

- Page 547 and 548:

Sales Tax Instructions, 2009 136 Sa

- Page 549 and 550:

Sales Tax Instructions, 2009 153 Sa

- Page 551 and 552:

Sales Tax Instructions, 2009 173 Sa

- Page 553 and 554:

Sales Tax Instructions, 2009 195 Sa

- Page 555 and 556:

Sales Tax Instructions, 2009 215 Sa

- Page 557 and 558:

Sales Tax Instructions, 2009 From s

- Page 559 and 560:

Sales Tax Instructions, 2009 55 Exe

- Page 561 and 562:

Sales Tax Instructions, 2009 06.11.

- Page 563 and 564:

Sales Tax Instructions, 2009 outsid

- Page 565 and 566:

Sales Tax Instructions, 2009 the cl

- Page 567 and 568:

Sales Tax Instructions, 2009 134 Ap

- Page 569 and 570:

Sales Tax Instructions, 2009 forwar

- Page 571 and 572:

Sales Tax Instructions, 2009 filed

- Page 573 and 574:

Sales Tax Instructions, 2009 44 Exe

- Page 575 and 576:

Sales Tax Instructions, 2009 63 Reg

- Page 577 and 578:

Sales Tax Instructions, 2009 sales

- Page 579 and 580:

Sales Tax Instructions, 2009 12 Col

- Page 581 and 582:

Sales Tax Instructions, 2009 manufa

- Page 583 and 584:

Sales Tax Instructions, 2009 16 Sal

- Page 585 and 586:

Sales Tax Instructions, 2009 39 Cla

- Page 587 and 588:

Sales Tax Instructions, 2009 59 Sal

- Page 589 and 590:

78 Fixation of value of sugar for s

- Page 591 and 592:

committee under section 2(46) of th

- Page 593 and 594:

Sales Tax Instructions, 2009 32 Min

- Page 595 and 596:

Sales Tax Instructions, 2009 19 Cla

- Page 597 and 598:

in plastic disposable containers. 3

- Page 599 and 600:

Sales Tax Instructions, 2009 machin

- Page 601 and 602:

sales tax on the manufacture and on

- Page 603 and 604:

Sales Tax Instructions, 2009 65 Sal

- Page 605 and 606:

Sales Tax Instructions, 2009 techno

- Page 607 and 608:

Sales Tax Instructions, 2009 made o

- Page 609 and 610:

Sales Tax Instructions, 2009 auctio

- Page 611 and 612:

Sales Tax Instructions, 2009 withdr

- Page 613 and 614:

Sales Tax Instructions, 2009 under

- Page 615 and 616:

Sales Tax Instructions, 2009 118 15

- Page 617 and 618:

Sales Tax Instructions, 2009 26 Sal

- Page 619 and 620:

Sales Tax Instructions, 2009 price

- Page 621 and 622:

Sales Tax Instructions, 2009 2 Adju

- Page 623 and 624:

Sales Tax Instructions, 2009 21 Sal

- Page 625 and 626:

es of Messers M.T.M. Int ernational

- Page 627 and 628:

Sales Tax Instructions, 2009 for Pa

- Page 629 and 630:

Sales Tax Instructions, 2009 value

- Page 631 and 632:

Sales Tax Instructions, 2009 Vide I

- Page 633 and 634:

Sales Tax Instructions, 2009 SRO 65

- Page 635 and 636:

Sales Tax Instructions, 2009 manufa

- Page 637 and 638:

Sales Tax Instructions, 2009 3 Paym

- Page 639 and 640:

Sales Tax Instructions, 2009 SECTIO

- Page 641 and 642:

Sales Tax Instructions, 2009 SECTIO

- Page 643 and 644:

Sales Tax Instructions, 2009 used.

- Page 645 and 646:

Sales Tax Instructions, 2009 Genera

- Page 647 and 648:

Sales Tax Instructions, 2009 57 Sal

- Page 649 and 650:

Sales Tax Instructions, 2009 06.06.

- Page 651 and 652:

Sales Tax Instructions, 2009 of con

- Page 653 and 654:

Sales Tax Instructions, 2009 115 Ze

- Page 655 and 656:

Sales Tax Instructions, 2009 127 Sa

- Page 657 and 658:

Sales Tax Instructions, 2009 143 Ex

- Page 659 and 660:

Sales Tax Instructions, 2009 No.11/

- Page 661 and 662:

Sales Tax Instructions, 2009 No.34/

- Page 663 and 664:

203 Sales Tax General Order No.01/2

- Page 665 and 666:

Sales Tax Instructions, 2009 SECTIO

- Page 667 and 668:

Sales Tax Instructions, 2009 58 Iss

- Page 669 and 670:

Sales Tax Instructions, 2009 goods

- Page 671 and 672:

Sales Tax Instructions, 2009 67 Imp

- Page 673 and 674:

Sales Tax Instructions, 2009 86 Ref

- Page 675 and 676:

Sales Tax Instructions, 2009 3 Expo

- Page 677 and 678:

Sales Tax Instructions, 2009 exchan

- Page 679 and 680:

Sales Tax Instructions, 2009 Instru

- Page 681 and 682:

Sales Tax Instructions, 2009 income

- Page 683 and 684:

Sales Tax Instructions, 2009 Order

- Page 685 and 686:

due-date payments‘ of sales tax.

- Page 687 and 688:

Sales Tax Instructions, 2009 50 Spe

- Page 689 and 690:

Sales Tax Instructions, 2009 44 Cla

- Page 691 and 692:

Sales Tax Instructions, 2009 5 Refu

- Page 693 and 694:

Sales Tax Instructions, 2009 proces

- Page 695 and 696:

Sales Tax Instructions, 2009 operat

- Page 697 and 698:

Sales Tax Instructions, 2009 60 Adj

- Page 699 and 700:

Sales Tax Instructions, 2009 78 Adj

- Page 701 and 702:

Sales Tax Instructions, 2009 damage

- Page 703 and 704:

Sales Tax Instructions, 2009 120 Sa

- Page 705 and 706:

Sales Tax Instructions, 2009 13-08-

- Page 707 and 708:

Sales Tax Instructions, 2009 extrac

- Page 709 and 710:

Sales Tax Instructions, 2009 dated

- Page 711 and 712:

Sales Tax Instructions, 2009 5 Refu

- Page 713 and 714:

Sales Tax Instructions, 2009 docume

- Page 715 and 716:

Sales Tax Instructions, 2009 of dep

- Page 717 and 718:

Sales Tax Instructions, 2009 Chief

- Page 719 and 720:

Sales Tax Instructions, 2009 were s

- Page 721 and 722:

2004] 106 Additional checks for ref

- Page 723 and 724:

Additional Collectors for sanction

- Page 725 and 726:

Sales Tax Instructions, 2009 142 Ra

- Page 727 and 728:

Sales Tax Instructions, 2009 161 Vi

- Page 729 and 730:

Sales Tax Instructions, 2009 183 Au

- Page 731 and 732:

Sales Tax Instructions, 2009 Limite

- Page 733 and 734:

Sales Tax Instructions, 2009 75 Sal

- Page 735 and 736:

119 Locally manufactured electric m

- Page 737 and 738:

Sales Tax Instructions, 2009 granul

- Page 739 and 740:

the Sales Tax Act, 1990 relating to

- Page 741 and 742:

Sales Tax Instructions, 2009 agains

- Page 743 and 744:

Sales Tax Instructions, 2009 196 Cu

- Page 745 and 746:

Sales Tax Instructions, 2009 196 Re

- Page 747 and 748:

Sales Tax Instructions, 2009 under

- Page 749 and 750:

Sales Tax Instructions, 2009 228 Sa

- Page 751 and 752:

Sales Tax Instructions, 2009 70(I)/

- Page 753 and 754:

Sales Tax Instructions, 2009 2008 b

- Page 755 and 756:

Sales Tax Instructions, 2009 prior

- Page 757 and 758:

Sales Tax Instructions, 2009 person

- Page 759 and 760:

Sales Tax Instructions, 2009 No.3 o

- Page 761 and 762:

Sales Tax Instructions, 2009 180 Sa

- Page 763 and 764:

Sales Tax Instructions, 2009 200 Am

- Page 765 and 766:

Sales Tax Instructions, 2009 219 Ze

- Page 767 and 768:

Sales Tax Instructions, 2009 No.6 O

- Page 769 and 770:

Sales Tax Instructions, 2009 releva

- Page 771 and 772:

Sales Tax Instructions, 2009 43 Fak

- Page 773 and 774:

Sales Tax Instructions, 2009 13 Aud

- Page 775 and 776:

Sales Tax Instructions, 2009 35 Rec

- Page 777 and 778:

Sales Tax Instructions, 2009 commer

- Page 779 and 780:

Sales Tax Instructions, 2009 82 Rep

- Page 781 and 782:

Sales Tax Instructions, 2009 thereu

- Page 783 and 784:

Sales Tax Instructions, 2009 119 Co

- Page 785 and 786:

Sales Tax Instructions, 2009 138 Re

- Page 787 and 788:

Sales Tax Instructions, 2009 6 The

- Page 789 and 790:

Sales Tax Instructions, 2009 26 Sal

- Page 791 and 792:

Sales Tax Instructions, 2009 2000.

- Page 793 and 794:

Sales Tax Instructions, 2009 34-a o

- Page 795 and 796:

Sales Tax Instructions, 2009 246(I)

- Page 797 and 798:

Sales Tax Instructions, 2009 24 Sal

- Page 799 and 800:

Sales Tax Instructions, 2009 2 Trea

- Page 801 and 802:

Sales Tax Instructions, 2009 35 In-

- Page 803 and 804:

Sales Tax Instructions, 2009 54 Sal

- Page 805 and 806:

Sales Tax Instructions, 2009 Collec

- Page 807 and 808:

Sales Tax Instructions, 2009 47D of

- Page 809 and 810:

Sales Tax Instructions, 2009 4 Sale

- Page 811 and 812:

Sales Tax Instructions, 2009 64 Rev

- Page 813 and 814:

Sales Tax Instructions, 2009 82 Val

- Page 815 and 816:

Sales Tax Instructions, 2009 multip

- Page 817 and 818:

Sales Tax Instructions, 2009 to vol

- Page 819 and 820:

Sales Tax Instructions, 2009 for th

- Page 821 and 822:

Sales Tax Instructions, 2009 weedin

- Page 823 and 824:

Sales Tax Instructions, 2009 sales

- Page 825 and 826:

Sales Tax Instructions, 2009 refund

- Page 827 and 828:

Sales Tax Instructions, 2009 Indust

- Page 829 and 830:

Sales Tax Instructions, 2009 electr

- Page 831 and 832:

Sales Tax Instructions, 2009 Vol-1

- Page 833 and 834:

Sales Tax Instructions, 2009 (ii) T

- Page 835 and 836:

Sales Tax Instructions, 2009 A ques

- Page 837 and 838:

Sales Tax Instructions, 2009 2. Ite

- Page 839 and 840:

Sales Tax Instructions, 2009 ******

- Page 841 and 842:

Sales Tax Instructions, 2009 for ex

- Page 843 and 844:

Sales Tax Instructions, 2009 C. NO.

- Page 845 and 846:

Sales Tax Instructions, 2009 (2) Th

- Page 847 and 848:

Sales Tax Instructions, 2009 4. Tim

- Page 849 and 850:

Sales Tax Instructions, 2009 ANNEX-

- Page 851 and 852:

Sales Tax Instructions, 2009 West F

- Page 853 and 854:

Sales Tax Instructions, 2009 C. NO.

- Page 855 and 856:

Sales Tax Instructions, 2009 10. Kn

- Page 857 and 858:

Step-2: Step-3: Sales Tax Instructi

- Page 859 and 860:

Sales Tax Instructions, 2009 6. Not

- Page 861 and 862:

Sales Tax Instructions, 2009 ******

- Page 863 and 864:

Sales Tax Instructions, 2009 Otherw

- Page 865 and 866:

Sales Tax Instructions, 2009 Locall

- Page 867 and 868:

Sales Tax Instructions, 2009 [Issue

- Page 869 and 870:

Sales Tax Instructions, 2009 [Issue

- Page 871 and 872:

Sales Tax Instructions, 2009 compon

- Page 873 and 874:

Sales Tax Instructions, 2009 85.34;

- Page 875 and 876:

Sales Tax Instructions, 2009 (iv) C

- Page 877 and 878:

Sales Tax Instructions, 2009 6. Oil

- Page 879 and 880:

Sales Tax Instructions, 2009 C. NO.

- Page 881 and 882:

Sales Tax Instructions, 2009 ******

- Page 883 and 884:

Sales Tax Instructions, 2009 C. NO.

- Page 885 and 886:

Sales Tax Instructions, 2009 C. NO.

- Page 887 and 888:

Sales Tax Instructions, 2009 (b) Th

- Page 889 and 890:

Sales Tax Instructions, 2009 C. NO.

- Page 891 and 892:

Sales Tax Instructions, 2009 clarif

- Page 893 and 894:

Sales Tax Instructions, 2009 Act, 1

- Page 895 and 896:

Sales Tax Instructions, 2009 2. A c

- Page 897 and 898:

Sales Tax Instructions, 2009 ******

- Page 899 and 900:

Sales Tax Instructions, 2009 4. It

- Page 901 and 902:

Sales Tax Instructions, 2009 3. It

- Page 903 and 904:

Sales Tax Instructions, 2009 (c) th

- Page 905 and 906:

Sales Tax Instructions, 2009 [Amend

- Page 907 and 908:

Sales Tax Instructions, 2009 C. NO.

- Page 909 and 910:

Sales Tax Instructions, 2009 (24) S

- Page 911 and 912:

\ Sales Tax Instructions, 2009 June

- Page 913 and 914:

Sales Tax Instructions, 2009 (10) T

- Page 915 and 916:

Sales Tax Instructions, 2009 10. SR

- Page 917 and 918:

Sales Tax Instructions, 2009 (c)

- Page 919 and 920:

Sales Tax Instructions, 2009 13. Ot

- Page 921 and 922:

(v) (vi) (vii) Sales Tax Instructio

- Page 923 and 924:

Sales Tax Instructions, 2009 SALES

- Page 925 and 926:

Sales Tax Instructions, 2009 Revenu

- Page 927 and 928:

Sales Tax Instructions, 2009 [Issue

- Page 929 and 930:

Sales Tax Instructions, 2009 Water

- Page 931 and 932:

Sales Tax Instructions, 2009 ******

- Page 933 and 934:

Sales Tax Instructions, 2009 input

- Page 935 and 936:

Sales Tax Instructions, 2009 3. You

- Page 937 and 938:

Sales Tax Instructions, 2009 2. It

- Page 939 and 940:

Sales Tax Instructions, 2009 (i) (i

- Page 941 and 942:

Sales Tax Instructions, 2009 manufa

- Page 943 and 944:

Sales Tax Instructions, 2009 C. NO.

- Page 945 and 946:

value and give reference of the Bil

- Page 947 and 948:

Sales Tax Instructions, 2009 Mr.Per

- Page 949 and 950:

Sales Tax Instructions, 2009 C.No.1

- Page 951 and 952:

Sales Tax Instructions, 2009 C. NO.

- Page 953 and 954:

31. Floppy discs (8523.2010). Sales

- Page 955 and 956:

Sales Tax Instructions, 2009 3. Whi

- Page 957 and 958:

Sales Tax Instructions, 2009 GOVERN

- Page 959 and 960:

Sales Tax Instructions, 2009 (d) In

- Page 961 and 962:

Sales Tax Instructions, 2009 may be

- Page 963 and 964:

Akhtar Ali, Secretary (STB), Centra

- Page 965 and 966:

Sales Tax Instructions, 2009 Baloch

- Page 967 and 968:

Sales Tax Instructions, 2009 (iii)

- Page 969 and 970:

Sales Tax Instructions, 2009 10. Pa

- Page 971 and 972:

Sales Tax Instructions, 2009 C. B.

- Page 973 and 974:

Sales Tax Instructions, 2009 C. B.

- Page 975 and 976:

Sales Tax Instructions, 2009 6. If

- Page 977 and 978:

Sales Tax Instructions, 2009 What i

- Page 979 and 980:

Sales Tax Instructions, 2009 -- you

- Page 981 and 982:

Sales Tax Instructions, 2009 conces

- Page 983 and 984:

Sales Tax Instructions, 2009 (a) Na

- Page 985 and 986:

Sales Tax Instructions, 2009 -- in

- Page 987 and 988:

Sales Tax Instructions, 2009 -- sal

- Page 989 and 990:

Sales Tax Instructions, 2009 Buyer

- Page 991 and 992:

Sales Tax Instructions, 2009 if you

- Page 993 and 994:

Sales Tax Instructions, 2009 7. Can

- Page 995 and 996:

(09-A) Sales Tax Instructions, 2009

- Page 997 and 998:

Sales Tax Instructions, 2009 -- A c

- Page 999 and 1000:

Sales Tax Instructions, 2009 If any

- Page 1001 and 1002:

Sales Tax Instructions, 2009 The au

- Page 1003 and 1004:

Sales Tax Instructions, 2009 The fr

- Page 1005 and 1006:

Sales Tax Instructions, 2009 read w

- Page 1007 and 1008:

Sales Tax Instructions, 2009 (b) (c

- Page 1009 and 1010:

Sales Tax Instructions, 2009 admiss

- Page 1011 and 1012:

Sales Tax Instructions, 2009 3. The

- Page 1013 and 1014:

Sales Tax Instructions, 2009 [Issue

- Page 1015 and 1016:

Sales Tax Instructions, 2009 [Issue

- Page 1017 and 1018:

Sales Tax Instructions, 2009 (ii) P

- Page 1019 and 1020:

Sales Tax Instructions, 2009 payer

- Page 1021 and 1022:

Sales Tax Instructions, 2009 [Issue

- Page 1023 and 1024:

Sales Tax Instructions, 2009 have c

- Page 1025 and 1026:

Sales Tax Instructions, 2009 Notifi

- Page 1027 and 1028:

Sales Tax Instructions, 2009 manufa

- Page 1029 and 1030:

Sales Tax Instructions, 2009 C. NO.

- Page 1031 and 1032:

Sales Tax Instructions, 2009 sales

- Page 1033 and 1034:

Sales Tax Instructions, 2009 2. The

- Page 1035 and 1036:

Sales Tax Instructions, 2009 contin

- Page 1037 and 1038:

Sales Tax Instructions, 2009 Sales

- Page 1039 and 1040:

Sales Tax Instructions, 2009 to the

- Page 1041 and 1042:

Sales Tax Instructions, 2009 THE SA

- Page 1043 and 1044:

Sales Tax Instructions, 2009 (5) An

- Page 1045 and 1046:

Sales Tax Instructions, 2009 certif

- Page 1047 and 1048:

Sales Tax Instructions, 2009 1997 w

- Page 1049 and 1050:

Sales Tax Instructions, 2009 2. Not

- Page 1051 and 1052:

Sales Tax Instructions, 2009 SUBJEC

- Page 1053 and 1054:

Sales Tax Instructions, 2009 LAHORE

- Page 1055 and 1056:

Sales Tax Instructions, 2009 2. It

- Page 1057 and 1058:

Sales Tax Instructions, 2009 SUBJEC

- Page 1059 and 1060:

Sales Tax Instructions, 2009 4. Tax

- Page 1061 and 1062:

Sales Tax Instructions, 2009 (a) (b

- Page 1063 and 1064:

Sales Tax Instructions, 2009 tariff

- Page 1065 and 1066:

Sales Tax Instructions, 2009 2. It

- Page 1067 and 1068:

Sales Tax Instructions, 2009 (vi) (

- Page 1069 and 1070:

Sales Tax Instructions, 2009 C.No.3

- Page 1071 and 1072:

Sales Tax Instructions, 2009 SUBJEC

- Page 1073 and 1074:

Sales Tax Instructions, 2009 Please

- Page 1075 and 1076:

Sales Tax Instructions, 2009 machin

- Page 1077 and 1078:

Sales Tax Instructions, 2009 C. NO.

- Page 1079 and 1080:

Sales Tax Instructions, 2009 ceased

- Page 1081 and 1082:

Sales Tax Instructions, 2009 Act, 1

- Page 1083 and 1084:

Sales Tax Instructions, 2009 (i) Ce

- Page 1085 and 1086:

Sales Tax Instructions, 2009 I am d

- Page 1087 and 1088:

Sales Tax Instructions, 2009 (4) Ce

- Page 1089 and 1090:

Sales Tax Instructions, 2009 ii) Im

- Page 1091 and 1092:

Sales Tax Instructions, 2009 notifi

- Page 1093 and 1094:

Sales Tax Instructions, 2009 liabil

- Page 1095 and 1096:

Sales Tax Instructions, 2009 of Sal

- Page 1097 and 1098:

Sales Tax Instructions, 2009 author

- Page 1099 and 1100:

Sales Tax Instructions, 2009 STAGE

- Page 1101 and 1102:

Sales Tax Instructions, 2009 It is

- Page 1103 and 1104:

Sales Tax Instructions, 2009 I am d

- Page 1105 and 1106:

Sales Tax Instructions, 2009 C.No.3

- Page 1107 and 1108:

Sales Tax Instructions, 2009 NOTIFI

- Page 1109 and 1110:

Sales Tax Instructions, 2009 and th

- Page 1111 and 1112:

Sales Tax Instructions, 2009 2. As

- Page 1113 and 1114:

Sales Tax Instructions, 2009 (a) th

- Page 1115 and 1116:

Sales Tax Instructions, 2009 I am d

- Page 1117 and 1118:

Sales Tax Instructions, 2009 2. Wit

- Page 1119 and 1120:

Sales Tax Instructions, 2009 ******

- Page 1121 and 1122:

Sales Tax Instructions, 2009 STOCKI

- Page 1123 and 1124:

(viii) Sales Tax Instructions, 2009

- Page 1125 and 1126:

Sales Tax Instructions, 2009 Please

- Page 1127 and 1128:

Sales Tax Instructions, 2009 JUNE 1

- Page 1129 and 1130:

Sales Tax Instructions, 2009 2. How

- Page 1131 and 1132:

Karachi. SUB: Sales Tax Instruction

- Page 1133 and 1134:

Sales Tax Instructions, 2009 SUBJEC

- Page 1135 and 1136:

Sales Tax Instructions, 2009 the Sa

- Page 1137 and 1138:

Sales Tax Instructions, 2009 4. The

- Page 1139 and 1140:

Sales Tax Instructions, 2009 had be

- Page 1141 and 1142:

Sales Tax Instructions, 2009 NON-AC

- Page 1143 and 1144:

Sales Tax Instructions, 2009 regist

- Page 1145 and 1146:

Sales Tax Instructions, 2009 C. NO.

- Page 1147 and 1148:

Sales Tax Instructions, 2009 I am d

- Page 1149 and 1150:

The Secretary (STT), (Sales Tax Win

- Page 1151 and 1152:

Sales Tax Instructions, 2009 APEX/C

- Page 1153 and 1154:

Sales Tax Instructions, 2009 as a r

- Page 1155 and 1156:

Sales Tax Instructions, 2009 2. The

- Page 1157 and 1158:

Sales Tax Instructions, 2009 import

- Page 1159 and 1160:

Sales Tax Instructions, 2009 Please

- Page 1161 and 1162: Sales Tax Instructions, 2009 [Issue

- Page 1163 and 1164: Sales Tax Instructions, 2009 2. Thi

- Page 1165 and 1166: CERTIFICATE. Sales Tax Instructions

- Page 1167 and 1168: Sales Tax Instructions, 2009 Act, 1

- Page 1169 and 1170: Sales Tax Instructions, 2009 3. The

- Page 1171 and 1172: (b) (c) (d) Sales Tax Instructions,

- Page 1173 and 1174: Sales Tax Instructions, 2009 office

- Page 1175 and 1176: Sales Tax Instructions, 2009 No.F.2

- Page 1177 and 1178: Sales Tax Instructions, 2009 The un

- Page 1179 and 1180: Sales Tax Instructions, 2009 to reg

- Page 1181 and 1182: Sales Tax Instructions, 2009 3. Lah

- Page 1183 and 1184: Sales Tax Instructions, 2009 Financ

- Page 1185 and 1186: Sales Tax Instructions, 2009 Lahore

- Page 1187 and 1188: Sales Tax Instructions, 2009 I am d

- Page 1189 and 1190: Sales Tax Instructions, 2009 In vie

- Page 1191 and 1192: Sales Tax Instructions, 2009 (ii) t

- Page 1193 and 1194: Sales Tax Instructions, 2009 Vol-2

- Page 1195 and 1196: Sales Tax Instructions, 2009 C.No.1

- Page 1197 and 1198: Sales Tax Instructions, 2009 (i) (i

- Page 1199 and 1200: Sales Tax Instructions, 2009 3. In

- Page 1201 and 1202: Sales Tax Instructions, 2009 [Issue

- Page 1203 and 1204: Sales Tax Instructions, 2009 2. It

- Page 1205 and 1206: Sales Tax Instructions, 2009 No.1(8

- Page 1207 and 1208: Sales Tax Instructions, 2009 C. NO.

- Page 1209 and 1210: Sales Tax Instructions, 2009 plaste

- Page 1211: Sales Tax Instructions, 2009 ______

- Page 1215 and 1216: Sales Tax Instructions, 2009 regist

- Page 1217 and 1218: Sales Tax Instructions, 2009 2. The

- Page 1219 and 1220: Thanking you. Yours truly, Abdul La

- Page 1221 and 1222: Sales Tax Instructions, 2009 with t

- Page 1223 and 1224: Sales Tax Instructions, 2009 dated

- Page 1225 and 1226: Sales Tax Instructions, 2009 liquor

- Page 1227 and 1228: Sales Tax Instructions, 2009 Tax Ac

- Page 1229 and 1230: Sales Tax Instructions, 2009 sales

- Page 1231 and 1232: Sales Tax Instructions, 2009 (viii)

- Page 1233 and 1234: Note: Sales Tax Instructions, 2009

- Page 1235 and 1236: Sales Tax Instructions, 2009 C. NO.

- Page 1237 and 1238: Sales Tax Instructions, 2009 [Issue

- Page 1239 and 1240: Sales Tax Instructions, 2009 6. Alu

- Page 1241 and 1242: Sales Tax Instructions, 2009 of non

- Page 1243 and 1244: Sales Tax Instructions, 2009 Divisi

- Page 1245 and 1246: Sales Tax Instructions, 2009 SRO No

- Page 1247 and 1248: Sales Tax Instructions, 2009 Mr. Ta

- Page 1249 and 1250: Sales Tax Instructions, 2009 2. The

- Page 1251 and 1252: Sales Tax Instructions, 2009 (i) as

- Page 1253 and 1254: Sales Tax Instructions, 2009 catego

- Page 1255 and 1256: Sales Tax Instructions, 2009 C. NO.

- Page 1257 and 1258: Sales Tax Instructions, 2009 tax on

- Page 1259 and 1260: Sales Tax Instructions, 2009 C. NO.

- Page 1261 and 1262: Sales Tax Instructions, 2009 C. NO.

- Page 1263 and 1264:

Sales Tax Instructions, 2009 2. The

- Page 1265 and 1266:

Sales Tax Instructions, 2009 3. Con

- Page 1267 and 1268:

Sales Tax Instructions, 2009 sales

- Page 1269 and 1270:

Sales Tax Instructions, 2009 decisi

- Page 1271 and 1272:

Sales Tax Instructions, 2009 (2) Ex

- Page 1273 and 1274:

Sales Tax Instructions, 2009 II)/JD

- Page 1275 and 1276:

Sales Tax Instructions, 2009 also c

- Page 1277 and 1278:

Sales Tax Instructions, 2009 achiev

- Page 1279 and 1280:

Sales Tax Instructions, 2009 C. NO.

- Page 1281 and 1282:

Mr. M. Iqbal Farid Chairman, Centra

- Page 1283 and 1284:

Sales Tax Instructions, 2009 4. Ame

- Page 1285 and 1286:

(b) \ Sales Tax Instructions, 2009

- Page 1287 and 1288:

Sales Tax Instructions, 2009 Copy o

- Page 1289 and 1290:

Sales Tax Instructions, 2009 Yours

- Page 1291 and 1292:

Sales Tax Instructions, 2009 ******

- Page 1293 and 1294:

Sales Tax Instructions, 2009 2. The

- Page 1295 and 1296:

(b) (c) (d) (e) Sales Tax Instructi

- Page 1297 and 1298:

Sales Tax Instructions, 2009 C. NO.

- Page 1299 and 1300:

Sales Tax Instructions, 2009 SALES

- Page 1301 and 1302:

Sales Tax Instructions, 2009 SALES

- Page 1303 and 1304:

Sales Tax Instructions, 2009 With r

- Page 1305 and 1306:

Sales Tax Instructions, 2009 \No.2(

- Page 1307 and 1308:

Sales Tax Instructions, 2009 suppli

- Page 1309 and 1310:

Sales Tax Instructions, 2009 1. Sho

- Page 1311 and 1312:

Sales Tax Instructions, 2009 ANNEX-

- Page 1313 and 1314:

Sales Tax Instructions, 2009 M/s. S

- Page 1315 and 1316:

Sales Tax Instructions, 2009 12 of

- Page 1317 and 1318:

Sales Tax Instructions, 2009 C. NO.

- Page 1319 and 1320:

Sales Tax Instructions, 2009 SUBJEC

- Page 1321 and 1322:

Sales Tax Instructions, 2009 author

- Page 1323 and 1324:

Sales Tax Instructions, 2009 No.3(5

- Page 1325 and 1326:

Sales Tax Instructions, 2009 [Issue

- Page 1327 and 1328:

Sales Tax Instructions, 2009 The un

- Page 1329 and 1330:

Sales Tax Instructions, 2009 [Issue

- Page 1331 and 1332:

S.N o Name of Ginning Unit(s) from

- Page 1333 and 1334:

1-A) Sales Tax Instructions, 2009 W

- Page 1335 and 1336:

Sales Tax Instructions, 2009 from n

- Page 1337 and 1338:

Sales Tax Instructions, 2009 of add

- Page 1339 and 1340:

Sales Tax Instructions, 2009 The af

- Page 1341 and 1342:

Sales Tax Instructions, 2009 2. You

- Page 1343 and 1344:

Sales Tax Instructions, 2009 ******

- Page 1345 and 1346:

Sales Tax Instructions, 2009 ******

- Page 1347 and 1348:

Sales Tax Instructions, 2009 I am d

- Page 1349 and 1350:

Sales Tax Instructions, 2009 6. The

- Page 1351 and 1352:

Sales Tax Instructions, 2009 Eversi

- Page 1353 and 1354:

Sales Tax Instructions, 2009 (ii) A

- Page 1355 and 1356:

Sales Tax Instructions, 2009 C.No.

- Page 1357 and 1358:

Sales Tax Instructions, 2009 1) the

- Page 1359 and 1360:

Sales Tax Instructions, 2009 have t

- Page 1361 and 1362:

(i) (ii) Sales Tax Instructions, 20

- Page 1363 and 1364:

Sales Tax Instructions, 2009 THE ST

- Page 1365 and 1366:

III. Sales Tax Instructions, 2009 P

- Page 1367 and 1368:

Sales Tax Instructions, 2009 (i) (i

- Page 1369 and 1370:

Sales Tax Instructions, 2009 ******

- Page 1371 and 1372:

Sales Tax Instructions, 2009 ii) Th

- Page 1373 and 1374:

Sales Tax Instructions, 2009 expend

- Page 1375 and 1376:

Sales Tax Instructions, 2009 purpos

- Page 1377 and 1378:

Sales Tax Instructions, 2009 [Issue

- Page 1379 and 1380:

Sales Tax Instructions, 2009 SUBJEC

- Page 1381 and 1382:

Sales Tax Instructions, 2009 [Issue

- Page 1383 and 1384:

Sales Tax Instructions, 2009 about

- Page 1385 and 1386:

(ii) Sales Tax Instructions, 2009 j

- Page 1387 and 1388:

2. 3. Dumentatio n of National Econ

- Page 1389 and 1390:

10. Survey Techniques

- Page 1391 and 1392:

Sales Tax Instructions, 2009 2. Mr.

- Page 1393 and 1394:

Sales Tax Instructions, 2009 C.No.3

- Page 1395 and 1396:

Sales Tax Instructions, 2009 ―tax

- Page 1397 and 1398:

Sales Tax Instructions, 2009 5. The

- Page 1399 and 1400:

Sales Tax Instructions, 2009 [Issue

- Page 1401 and 1402:

Sales Tax Instructions, 2009 Notifi

- Page 1403 and 1404:

Sales Tax Instructions, 2009 Provid

- Page 1405 and 1406:

Sales Tax Instructions, 2009 sale,

- Page 1407 and 1408:

measures taken: Sales Tax Instructi

- Page 1409 and 1410:

Sales Tax Instructions, 2009 cases

- Page 1411 and 1412:

Sales Tax Instructions, 2009 AND WH

- Page 1413 and 1414:

Sales Tax Instructions, 2009 (a) Cu

- Page 1415 and 1416:

Sales Tax Instructions, 2009 2. Int

- Page 1417 and 1418:

Sales Tax Instructions, 2009 6. Ser

- Page 1419 and 1420:

Sales Tax Instructions, 2009 3. Sco

- Page 1421 and 1422:

Sales Tax Instructions, 2009 (a) up

- Page 1423 and 1424:

Sales Tax Instructions, 2009 Servic

- Page 1425 and 1426:

Sales Tax Instructions, 2009 SECTIO

- Page 1427 and 1428:

Sales Tax Instructions, 2009 SINDH

- Page 1429 and 1430:

Sales Tax Instructions, 2009 1. Ser

- Page 1431 and 1432:

Sales Tax Instructions, 2009 ―dis

- Page 1433 and 1434:

Sales Tax Instructions, 2009 furnac

- Page 1435 and 1436:

Sales Tax Instructions, 2009 been e

- Page 1437 and 1438:

(iv) Sales Tax Instructions, 2009 I

- Page 1439 and 1440:

Sales Tax Instructions, 2009 [Withd

- Page 1441 and 1442:

Sales Tax Instructions, 2009 (4) Th

- Page 1443 and 1444:

Sales Tax Instructions, 2009 conduc

- Page 1445 and 1446:

Sales Tax Instructions, 2009 [Issue

- Page 1447 and 1448:

Sales Tax Instructions, 2009 The un

- Page 1449 and 1450:

Sales Tax Instructions, 2009 conduc

- Page 1451 and 1452:

Sales Tax Instructions, 2009 govern

- Page 1453 and 1454:

Sales Tax Instructions, 2009 (g) S.

- Page 1455 and 1456:

Sales Tax Instructions, 2009 2. How

- Page 1457 and 1458:

Sales Tax Instructions, 2009 I am d

- Page 1459 and 1460:

(iv) Sales Tax Instructions, 2009 o

- Page 1461 and 1462:

Sales Tax Instructions, 2009 with s

- Page 1463 and 1464:

Sales Tax Instructions, 2009 2. Sin

- Page 1465 and 1466:

Sales Tax Instructions, 2009 ******

- Page 1467 and 1468:

Sales Tax Instructions, 2009 (ST-L&

- Page 1469 and 1470:

Sales Tax Instructions, 2009 and wo

- Page 1471 and 1472:

(ii) Sales Tax Instructions, 2009 M

- Page 1473 and 1474:

Sales Tax Instructions, 2009 (i) As

- Page 1475 and 1476:

Sales Tax Instructions, 2009 Law an

- Page 1477 and 1478:

Sales Tax Instructions, 2009 For th

- Page 1479 and 1480:

Sales Tax Instructions, 2009 admiss

- Page 1481 and 1482:

Sales Tax Instructions, 2009 UPTO 4

- Page 1483 and 1484:

Sales Tax Instructions, 2009 appeal

- Page 1485 and 1486:

Sales Tax Instructions, 2009 C. NO.

- Page 1487 and 1488:

Yours faithfully For Meezan Enterpr

- Page 1489 and 1490:

Sales Tax Instructions, 2009 commer

- Page 1491 and 1492:

Sales Tax Instructions, 2009 (i) It

- Page 1493 and 1494:

Sales Tax Instructions, 2009 2. The

- Page 1495 and 1496:

Sales Tax Instructions, 2009 k. Aud

- Page 1497 and 1498:

Sales Tax Instructions, 2009 (k) (l

- Page 1499 and 1500:

Sales Tax Instructions, 2009 demand

- Page 1501 and 1502:

Sales Tax Instructions, 2009 I am d

- Page 1503 and 1504:

Sales Tax Instructions, 2009 [Issue

- Page 1505 and 1506:

Sales Tax Instructions, 2009 2. Wit

- Page 1507 and 1508:

Sales Tax Instructions, 2009 2. It

- Page 1509 and 1510:

Sales Tax Instructions, 2009 Answer

- Page 1511 and 1512:

Sales Tax Instructions, 2009 (v) It

- Page 1513 and 1514:

Sales Tax Instructions, 2009 ******

- Page 1515 and 1516:

Sales Tax Instructions, 2009 C. NO.

- Page 1517 and 1518:

Sales Tax Instructions, 2009 (b) (c

- Page 1519 and 1520:

Sales Tax Instructions, 2009 7.3 Th

- Page 1521 and 1522:

Sales Tax Instructions, 2009 Sixth

- Page 1523 and 1524:

Sales Tax Instructions, 2009 Please

- Page 1525 and 1526:

Sales Tax Instructions, 2009 (ii) (

- Page 1527 and 1528:

Sales Tax Instructions, 2009 [Issue

- Page 1529 and 1530:

Sales Tax Instructions, 2009 Custom

- Page 1531 and 1532:

Sales Tax Instructions, 2009 [Issue

- Page 1533 and 1534:

Sales Tax Instructions, 2009 [Issue

- Page 1535 and 1536:

Sales Tax Instructions, 2009 SUBJEC

- Page 1537 and 1538:

Sales Tax Instructions, 2009 in the

- Page 1539 and 1540:

Sales Tax Instructions, 2009 associ

- Page 1541 and 1542:

Sales Tax Instructions, 2009 regist

- Page 1543 and 1544:

Sales Tax Instructions, 2009 SUBJEC

- Page 1545 and 1546:

Sales Tax Instructions, 2009 specif

- Page 1547 and 1548:

Sales Tax Instructions, 2009 cannot

- Page 1549 and 1550:

Sales Tax Instructions, 2009 Commis

- Page 1551 and 1552:

Sales Tax Instructions, 2009 I am d

- Page 1553 and 1554:

Sales Tax Instructions, 2009 it is

- Page 1555 and 1556:

Sales Tax Instructions, 2009 SUBJEC

- Page 1557 and 1558:

Sales Tax Instructions, 2009 SUBJEC

- Page 1559 and 1560:

Sales Tax Instructions, 2009 copy t

- Page 1561 and 1562:

Sales Tax Instructions, 2009 teleco

- Page 1563 and 1564:

Sales Tax Instructions, 2009 invoic

- Page 1565 and 1566:

Sales Tax Instructions, 2009 (vii)

- Page 1567 and 1568:

Sales Tax Instructions, 2009 3. In

- Page 1569 and 1570:

Sales Tax Instructions, 2009 In the

- Page 1571 and 1572:

Sales Tax Instructions, 2009 (vii)

- Page 1573 and 1574:

Sales Tax Instructions, 2009 Act, 1

- Page 1575 and 1576:

Sales Tax Instructions, 2009 2. The

- Page 1577 and 1578:

Sales Tax Instructions, 2009 ******

- Page 1579 and 1580:

Sales Tax Instructions, 2009 ii) ii

- Page 1581 and 1582:

Sales Tax Instructions, 2009 x) Eac

- Page 1583 and 1584:

Sales Tax Instructions, 2009 Servic

- Page 1585 and 1586:

Sales Tax Instructions, 2009 2. The

- Page 1587 and 1588:

Sales Tax Instructions, 2009 I am d

- Page 1589 and 1590:

(iii) Sales Tax Instructions, 2009

- Page 1591 and 1592:

Sales Tax Instructions, 2009 Sales

- Page 1593 and 1594:

Sales Tax Instructions, 2009 (SUB-P

- Page 1595 and 1596:

Sales Tax Instructions, 2009 3. For

- Page 1597 and 1598:

Sales Tax Instructions, 2009 2. The

- Page 1599 and 1600:

prosecution evidence(s) available j

- Page 1601 and 1602:

Sales Tax Instructions, 2009 (vi) (

- Page 1603 and 1604:

Sales Tax Instructions, 2009 for co

- Page 1605 and 1606:

Sales Tax Instructions, 2009 endors

- Page 1607 and 1608:

Sales Tax Instructions, 2009 taxabl

- Page 1609 and 1610:

Sales Tax Instructions, 2009 (d) se

- Page 1611 and 1612:

Sales Tax Instructions, 2009 Custom

- Page 1613 and 1614:

Sales Tax Instructions, 2009 busine

- Page 1615 and 1616:

Sales Tax Instructions, 2009 [Issue

- Page 1617 and 1618:

Sales Tax Instructions, 2009 exclud

- Page 1619 and 1620:

Sales Tax Instructions, 2009 [Issue

- Page 1621 and 1622:

Sales Tax Instructions, 2009 4. As

- Page 1623 and 1624:

Sales Tax Instructions, 2009 (iii)

- Page 1625 and 1626:

Sales Tax Instructions, 2009 987(I)

- Page 1627 and 1628:

Sales Tax Instructions, 2009 ascert

- Page 1629 and 1630:

Sales Tax Instructions, 2009 2. As

- Page 1631 and 1632:

Sales Tax Instructions, 2009 [Issue

- Page 1633 and 1634:

Sales Tax Instructions, 2009 observ

- Page 1635 and 1636:

Sales Tax Instructions, 2009 [Issue

- Page 1637 and 1638:

Sales Tax Instructions, 2009 SUBJEC

- Page 1639 and 1640:

Sales Tax Instructions, 2009 [Issue

- Page 1641 and 1642:

Sales Tax Instructions, 2009 ******

- Page 1643 and 1644:

Sales Tax Instructions, 2009 (iii)

- Page 1645 and 1646:

Sales Tax Instructions, 2009 (ix) I

- Page 1647 and 1648:

Sales Tax Instructions, 2009 manufa

- Page 1649 and 1650:

Sales Tax Instructions, 2009 ******

- Page 1651 and 1652:

Sales Tax Instructions, 2009 [Issue

- Page 1653 and 1654:

Sales Tax Instructions, 2009 [Issue

- Page 1655 and 1656:

Sales Tax Instructions, 2009 enclos

- Page 1657 and 1658:

Sales Tax Instructions, 2009 [Issue

- Page 1659 and 1660:

Sales Tax Instructions, 2009 THE EX

- Page 1661 and 1662:

Sales Tax Instructions, 2009 where

- Page 1663 and 1664:

Sales Tax Instructions, 2009 invoic

- Page 1665 and 1666:

Sales Tax Instructions, 2009 4. The

- Page 1667 and 1668:

Sales Tax Instructions, 2009 Discus

- Page 1669 and 1670:

Sales Tax Instructions, 2009 It not

- Page 1671 and 1672:

Sales Tax Instructions, 2009 SUBJEC

- Page 1673 and 1674:

Sales Tax Instructions, 2009 Please

- Page 1675 and 1676:

Sales Tax Instructions, 2009 condem

- Page 1677 and 1678:

Sales Tax Instructions, 2009 sales

- Page 1679 and 1680:

Sales Tax Instructions, 2009 [Issue

- Page 1681 and 1682:

Sales Tax Instructions, 2009 apply

- Page 1683 and 1684:

Sales Tax Instructions, 2009 (vi) I

- Page 1685 and 1686:

Sales Tax Instructions, 2009 to say

- Page 1687 and 1688:

Sales Tax Instructions, 2009 With r

- Page 1689 and 1690:

Sales Tax Instructions, 2009 (e) (f

- Page 1691 and 1692:

Sales Tax Instructions, 2009 8. MIS

- Page 1693 and 1694:

Sales Tax Instructions, 2009 Explan

- Page 1695 and 1696:

Sales Tax Instructions, 2009 2. Sec

- Page 1697 and 1698:

Sales Tax Instructions, 2009 (viii)

- Page 1699 and 1700:

Sales Tax Instructions, 2009 [Issue

- Page 1701 and 1702:

Sales Tax Instructions, 2009 I am d

- Page 1703 and 1704:

Sales Tax Instructions, 2009 SUBJEC

- Page 1705 and 1706:

Sales Tax Instructions, 2009 SUBJEC

- Page 1707 and 1708:

Sales Tax Instructions, 2009 sectio

- Page 1709 and 1710:

Sales Tax Instructions, 2009 to suc

- Page 1711 and 1712:

Sales Tax Instructions, 2009 [Issue

- Page 1713 and 1714:

Sales Tax Instructions, 2009 C.No.3

- Page 1715 and 1716:

Sales Tax Instructions, 2009 2. You

- Page 1717 and 1718:

Sales Tax Instructions, 2009 printe

- Page 1719 and 1720:

Sales Tax Instructions, 2009 machin

- Page 1721 and 1722:

Sales Tax Instructions, 2009 made a

- Page 1723 and 1724:

Sales Tax Instructions, 2009 I am d

- Page 1725 and 1726:

Sales Tax Instructions, 2009 [Issue

- Page 1727 and 1728:

Sales Tax Instructions, 2009 I am d

- Page 1729 and 1730:

Sales Tax Instructions, 2009 I am d

- Page 1731 and 1732:

Sales Tax Instructions, 2009 ******

- Page 1733 and 1734:

Sales Tax Instructions, 2009 Necess

- Page 1735 and 1736:

Sales Tax Instructions, 2009 In ord

- Page 1737 and 1738:

Sales Tax Instructions, 2009 (xxix)

- Page 1739 and 1740:

Sales Tax Instructions, 2009 3. In

- Page 1741 and 1742:

Sales Tax Instructions, 2009 Export

- Page 1743 and 1744:

Sales Tax Instructions, 2009 leased

- Page 1745 and 1746:

Sales Tax Instructions, 2009 2. It

- Page 1747 and 1748:

Sales Tax Instructions, 2009 theref

- Page 1749 and 1750:

Sales Tax Instructions, 2009 SUBJEC

- Page 1751 and 1752:

Sales Tax Instructions, 2009 iii) i

- Page 1753 and 1754:

Sales Tax Instructions, 2009 xii) C

- Page 1755 and 1756:

Sales Tax Instructions, 2009 [Issue

- Page 1757 and 1758:

Sales Tax Instructions, 2009 sectio

- Page 1759 and 1760:

Sales Tax Instructions, 2009 [Issue

- Page 1761 and 1762:

Sales Tax Instructions, 2009 (vi) (

- Page 1763 and 1764:

Sales Tax Instructions, 2009 even n

- Page 1765 and 1766:

Sales Tax Instructions, 2009 (2) A

- Page 1767 and 1768:

Sales Tax Instructions, 2009 [Issue

- Page 1769 and 1770:

Sales Tax Instructions, 2009 Collec

- Page 1771 and 1772:

prosecution evidence(s) available j

- Page 1773 and 1774:

Sales Tax Instructions, 2009 (xii)

- Page 1775 and 1776:

Sales Tax Instructions, 2009 value-

- Page 1777 and 1778:

Sales Tax Instructions, 2009 endors

- Page 1779 and 1780:

Sales Tax Instructions, 2009 I am d

- Page 1781 and 1782:

Sales Tax Instructions, 2009 (d) se

- Page 1783 and 1784:

Sales Tax Instructions, 2009 Custom

- Page 1785 and 1786:

Sales Tax Instructions, 2009 2. It

- Page 1787 and 1788:

Sales Tax Instructions, 2009 [Issue

- Page 1789 and 1790:

Sales Tax Instructions, 2009 a regi

- Page 1791 and 1792:

Sales Tax Instructions, 2009 [Issue

- Page 1793 and 1794:

Sales Tax Instructions, 2009 4. As

- Page 1795 and 1796:

Sales Tax Instructions, 2009 (iii)

- Page 1797 and 1798:

Sales Tax Instructions, 2009 987(I)

- Page 1799 and 1800:

Sales Tax Instructions, 2009 conver

- Page 1801 and 1802:

Sales Tax Instructions, 2009 2. As

- Page 1803 and 1804:

Sales Tax Instructions, 2009 C.No.2

- Page 1805 and 1806:

Sales Tax Instructions, 2009 review

- Page 1807 and 1808:

Sales Tax Instructions, 2009 SUBJEC

- Page 1809 and 1810:

Sales Tax Instructions, 2009 dated

- Page 1811 and 1812:

Sales Tax Instructions, 2009 SUBJEC

- Page 1813 and 1814:

Sales Tax Instructions, 2009 I am d

- Page 1815 and 1816:

Sales Tax Instructions, 2009 same p

- Page 1817 and 1818:

Sales Tax Instructions, 2009 tenant

- Page 1819 and 1820:

Sales Tax Instructions, 2009 [Issue

- Page 1821 and 1822:

Sales Tax Instructions, 2009 C. NO.

- Page 1823 and 1824:

Sales Tax Instructions, 2009 C.No.3

- Page 1825 and 1826:

Sales Tax Instructions, 2009 SALES

- Page 1827 and 1828:

Sales Tax Instructions, 2009 cases

- Page 1829 and 1830:

Sales Tax Instructions, 2009 [Issue

- Page 1831 and 1832:

Sales Tax Instructions, 2009 ******

- Page 1833 and 1834:

Sales Tax Instructions, 2009 I am d

- Page 1835 and 1836:

Sales Tax Instructions, 2009 I am d

- Page 1837 and 1838:

Sales Tax Instructions, 2009 (b) (c

- Page 1839 and 1840:

Sales Tax Instructions, 2009 I am d

- Page 1841 and 1842:

Sales Tax Instructions, 2009 accoun

- Page 1843 and 1844:

Sales Tax Instructions, 2009 ******

- Page 1845 and 1846:

Sales Tax Instructions, 2009 are

- Page 1847 and 1848:

Sales Tax Instructions, 2009 Mohamm

- Page 1849 and 1850:

Sales Tax Instructions, 2009 C.No.

- Page 1851 and 1852:

Sales Tax Instructions, 2009 SUBJEC

- Page 1853 and 1854:

Sales Tax Instructions, 2009 SALES

- Page 1855 and 1856:

Sales Tax Instructions, 2009 circul

- Page 1857 and 1858:

Sales Tax Instructions, 2009 I am d

- Page 1859 and 1860:

Sales Tax Instructions, 2009 C.No.4

- Page 1861 and 1862:

Sales Tax Instructions, 2009 C.No.3

- Page 1863 and 1864:

Sales Tax Instructions, 2009 i) pha

- Page 1865 and 1866:

Sales Tax Instructions, 2009 ______

- Page 1867 and 1868:

Sales Tax Instructions, 2009 1. Hav

- Page 1869 and 1870:

Sales Tax Instructions, 2009 bills

- Page 1871 and 1872:

Sales Tax Instructions, 2009 [Issue

- Page 1873 and 1874:

Sales Tax Instructions, 2009 ENCLOS

- Page 1875 and 1876:

Sales Tax Instructions, 2009 Person

- Page 1877 and 1878:

(x) (xi) Sales Tax Instructions, 20

- Page 1879 and 1880:

Sales Tax Instructions, 2009 Develo

- Page 1881 and 1882:

Sales Tax Instructions, 2009 SALES

- Page 1883 and 1884:

Sales Tax Instructions, 2009 C.No.1

- Page 1885 and 1886:

Sales Tax Instructions, 2009 SUBJEC

- Page 1887 and 1888:

Sales Tax Instructions, 2009 For th

- Page 1889 and 1890:

(c) (d) (e) (f) Sales Tax Instructi

- Page 1891 and 1892:

Sales Tax Instructions, 2009 afores

- Page 1893 and 1894:

Sales Tax Instructions, 2009 The Ce

- Page 1895 and 1896:

Sales Tax Instructions, 2009 (1) (2

- Page 1897 and 1898:

Sales Tax Instructions, 2009 iii) I

- Page 1899 and 1900:

Sales Tax Instructions, 2009 and sh

- Page 1901 and 1902:

Sales Tax Instructions, 2009 discon

- Page 1903 and 1904:

Sales Tax Instructions, 2009 ******

- Page 1905 and 1906:

Sales Tax Instructions, 2009 [Issue

- Page 1907 and 1908:

Sales Tax Instructions, 2009 the pr

- Page 1909 and 1910:

Sales Tax Instructions, 2009 2. In

- Page 1911 and 1912:

Sales Tax Instructions, 2009 C.NO.

- Page 1913 and 1914:

Sales Tax Instructions, 2009 2. The

- Page 1915 and 1916:

Sales Tax Instructions, 2009 I am d

- Page 1917 and 1918:

Sales Tax Instructions, 2009 [Issue

- Page 1919 and 1920:

Sales Tax Instructions, 2009 SUBJEC

- Page 1921 and 1922:

Sales Tax Instructions, 2009 WASTAG

- Page 1923 and 1924:

Sales Tax Instructions, 2009 (D) To

- Page 1925 and 1926:

Sales Tax Instructions, 2009 servic

- Page 1927 and 1928:

Sales Tax Instructions, 2009 ******

- Page 1929 and 1930:

Sales Tax Instructions, 2009 2. It

- Page 1931 and 1932:

Sales Tax Instructions, 2009 [Issue

- Page 1933 and 1934:

Sales Tax Instructions, 2009 C.NO.

- Page 1935 and 1936:

Sales Tax Instructions, 2009 For an

- Page 1937 and 1938:

Sales Tax Instructions, 2009 such r

- Page 1939 and 1940:

Sales Tax Instructions, 2009 allowe

- Page 1941 and 1942:

Sales Tax Instructions, 2009 C. NO.

- Page 1943 and 1944:

Sales Tax Instructions, 2009 basis

- Page 1945 and 1946:

Sales Tax Instructions, 2009 It is

- Page 1947 and 1948:

Sales Tax Instructions, 2009 SALES

- Page 1949 and 1950:

Sales Tax Instructions, 2009 [Issue

- Page 1951 and 1952:

Sales Tax Instructions, 2009 23.07.

- Page 1953 and 1954:

Sales Tax Instructions, 2009 are in

- Page 1955 and 1956:

Sales Tax Instructions, 2009 SRO-50

- Page 1957 and 1958:

Sales Tax Instructions, 2009 respec

- Page 1959 and 1960:

(xvi) Sales Tax Instructions, 2009

- Page 1961 and 1962:

Sales Tax Instructions, 2009 SALES

- Page 1963 and 1964:

Sales Tax Instructions, 2009 SUBJEC

- Page 1965 and 1966:

Sales Tax Instructions, 2009 budget

- Page 1967 and 1968:

Sales Tax Instructions, 2009 paymen

- Page 1969 and 1970:

Sales Tax Instructions, 2009 SUBJEC

- Page 1971 and 1972:

Sales Tax Instructions, 2009 I am d

- Page 1973 and 1974:

Sales Tax Instructions, 2009 (iv) (

- Page 1975 and 1976:

Sales Tax Instructions, 2009 Any o

- Page 1977 and 1978:

Sales Tax Instructions, 2009 3. Adj

- Page 1979 and 1980:

Sales Tax Instructions, 2009 1. Exa

- Page 1981 and 1982:

Sales Tax Instructions, 2009 b) Amo

- Page 1983 and 1984:

Sales Tax Instructions, 2009 implem

- Page 1985 and 1986:

Sales Tax Instructions, 2009 throug

- Page 1987 and 1988:

Sales Tax Instructions, 2009 SUBJEC

- Page 1989 and 1990:

Sales Tax Instructions, 2009 For su

- Page 1991 and 1992:

Sales Tax Instructions, 2009 nature

- Page 1993 and 1994:

Sales Tax Instructions, 2009 [Issue

- Page 1995 and 1996:

Sales Tax Instructions, 2009 AREAS.

- Page 1997 and 1998:

Sales Tax Instructions, 2009 GOVERN

- Page 1999 and 2000:

Sales Tax Instructions, 2009 Please

- Page 2001 and 2002: