2005 - 2006 - Pinsent Masons Water Yearbook 2012

2005 - 2006 - Pinsent Masons Water Yearbook 2012

2005 - 2006 - Pinsent Masons Water Yearbook 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

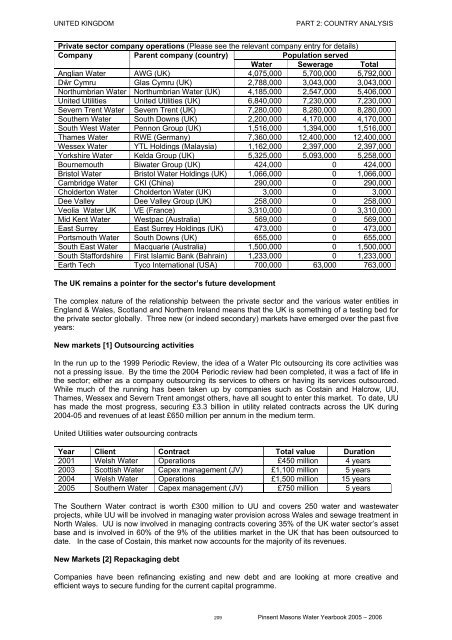

UNITED KINGDOM PART 2: COUNTRY ANALYSIS<br />

Private sector company operations (Please see the relevant company entry for details)<br />

Company Parent company (country)<br />

Population served<br />

<strong>Water</strong> Sewerage Total<br />

Anglian <strong>Water</strong> AWG (UK) 4,075,000 5,700,000 5,792,000<br />

Dŵr Cymru Glas Cymru (UK) 2,788,000 3,043,000 3,043,000<br />

Northumbrian <strong>Water</strong> Northumbrian <strong>Water</strong> (UK) 4,185,000 2,547,000 5,406,000<br />

United Utilities United Utilities (UK) 6,840,000 7,230,000 7,230,000<br />

Severn Trent <strong>Water</strong> Severn Trent (UK) 7,280,000 8,280,000 8,280,000<br />

Southern <strong>Water</strong> South Downs (UK) 2,200,000 4,170,000 4,170,000<br />

South West <strong>Water</strong> Pennon Group (UK) 1,516,000 1,394,000 1,516,000<br />

Thames <strong>Water</strong> RWE (Germany) 7,360,000 12,400,000 12,400,000<br />

Wessex <strong>Water</strong> YTL Holdings (Malaysia) 1,162,000 2,397,000 2,397,000<br />

Yorkshire <strong>Water</strong> Kelda Group (UK) 5,325,000 5,093,000 5,258,000<br />

Bournemouth Biwater Group (UK) 424,000 0 424,000<br />

Bristol <strong>Water</strong> Bristol <strong>Water</strong> Holdings (UK) 1,066,000 0 1,066,000<br />

Cambridge <strong>Water</strong> CKI (China) 290,000 0 290,000<br />

Cholderton <strong>Water</strong> Cholderton <strong>Water</strong> (UK) 3,000 0 3,000<br />

Dee Valley Dee Valley Group (UK) 258,000 0 258,000<br />

Veolia <strong>Water</strong> UK VE (France) 3,310,000 0 3,310,000<br />

Mid Kent <strong>Water</strong> Westpac (Australia) 569,000 0 569,000<br />

East Surrey East Surrey Holdings (UK) 473,000 0 473,000<br />

Portsmouth <strong>Water</strong> South Downs (UK) 655,000 0 655,000<br />

South East <strong>Water</strong> Macquarie (Australia) 1,500,000 0 1,500,000<br />

South Staffordshire First Islamic Bank (Bahrain) 1,233,000 0 1,233,000<br />

Earth Tech Tyco International (USA) 700,000 63,000 763,000<br />

The UK remains a pointer for the sector’s future development<br />

The complex nature of the relationship between the private sector and the various water entities in<br />

England & Wales, Scotland and Northern Ireland means that the UK is something of a testing bed for<br />

the private sector globally. Three new (or indeed secondary) markets have emerged over the past five<br />

years:<br />

New markets [1] Outsourcing activities<br />

In the run up to the 1999 Periodic Review, the idea of a <strong>Water</strong> Plc outsourcing its core activities was<br />

not a pressing issue. By the time the 2004 Periodic review had been completed, it was a fact of life in<br />

the sector; either as a company outsourcing its services to others or having its services outsourced.<br />

While much of the running has been taken up by companies such as Costain and Halcrow, UU,<br />

Thames, Wessex and Severn Trent amongst others, have all sought to enter this market. To date, UU<br />

has made the most progress, securing £3.3 billion in utility related contracts across the UK during<br />

2004-05 and revenues of at least £650 million per annum in the medium term.<br />

United Utilities water outsourcing contracts<br />

Year Client Contract Total value Duration<br />

2001 Welsh <strong>Water</strong> Operations £450 million 4 years<br />

2003 Scottish <strong>Water</strong> Capex management (JV) £1,100 million 5 years<br />

2004 Welsh <strong>Water</strong> Operations £1,500 million 15 years<br />

<strong>2005</strong> Southern <strong>Water</strong> Capex management (JV) £750 million 5 years<br />

The Southern <strong>Water</strong> contract is worth £300 million to UU and covers 250 water and wastewater<br />

projects, while UU will be involved in managing water provision across Wales and sewage treatment in<br />

North Wales. UU is now involved in managing contracts covering 35% of the UK water sector’s asset<br />

base and is involved in 60% of the 9% of the utilities market in the UK that has been outsourced to<br />

date. In the case of Costain, this market now accounts for the majority of its revenues.<br />

New Markets [2] Repackaging debt<br />

Companies have been refinancing existing and new debt and are looking at more creative and<br />

efficient ways to secure funding for the current capital programme.<br />

209 <strong>Pinsent</strong> <strong>Masons</strong> <strong>Water</strong> <strong>Yearbook</strong> <strong>2005</strong> – <strong>2006</strong>