PART 1: <strong>2005</strong>-<strong>2006</strong> OVERVIEW Company Home International Total % Home Russian Federation Novogor-Prikamye 1,317,000 0 1,317,000 100% Rosvodokanal 487,000 0 487,000 100% RUS 2,221,000 0 2,221,000 100% Syzran Vodokanal 163000 0 163,000 100% Saudi Arabia Amiantit 0 1,477,000 1,477,000 0% Singapore Asia Environment 0 560,000 560,000 0% Asia <strong>Water</strong> Technology 0 2,150,000 2,150,000 0% Bio-Treat Technology 0 2,110,000 2,110,000 0% Boustead 0 450,000 450,000 0% Darco 0 450,000 450,000 0% Dayen NA 0 NA NA Hyflux 700,000 2,000,000 2,700,000 26% Keppel 100,000 0 100,000 100% Sembcorp NA 0 NA NA Spain Acciona 900,000 0 900,000 100% Agbar [2] 16,000,000 18,900,000 34,900,000 46% Agval [3] 2,040,000 150,000 2,190,000 93% FCC [4] 9,500,000 7,899,000 17,399,000 55% Ferrovial 650,000 0 650,000 100% Gruppo ACS 2,200,000 2,100,000 4,300,000 51% Iberdrola 0 760,000 760,000 0% OHL 750,000 210000 960,000 78% Sacyr Vallehermoso 70,000 1,656,500 1,726,500 4% Tecasva 0 8,470,000 8,470,000 0% Sweden Lackeby <strong>Water</strong> Group 0 250,000 250,000 0% UK AWG 5,792,000 5,240,000 11,032,000 53% Biwater 426,000 2,530,000 2,956,000 14% BOC 0 500,000 500,000 0% Bristol <strong>Water</strong> 1,066,000 0 1,066,000 100% Costain NA 0 NA NA South Downs 665,000 0 665,000 100% Dee Valley 258,000 0 258,000 100% Glas Cymru 3,043,000 0 3,043,000 100% East Surrey 560,000 0 560,000 100% Kelda Group 5,993,000 677,000 6,670,000 90% Nature Technology Solutions NA 0 NA NA Northumbrian <strong>Water</strong> 6,296,000 246,000 6,542,000 96% Pennon Group 1,516,000 0 1,516,000 100% First Aqua 4,170,000 0 4,170,000 100% Severn Trent 8,280,000 6,195,000 14,475,000 57% South East <strong>Water</strong> 1,500,000 0 1,500,000 100% South Staffordshire 1,233,000 0 1,233,000 100% Swan Group 563,000 0 563,000 100% United Utilities 10,323,000 13,505,000 23,828,000 43% USA Alliance <strong>Water</strong> Resources 229,000 0 229,000 100% American States 1,225,000 0 1,225,000 100% Aqua America 2,540,000 0 2,540,000 100% Artesian 265,000 0 265,000 100% BIW 37,000 0 37,000 100% Cadiz NA 0 NA NA 47 <strong>Pinsent</strong> <strong>Masons</strong> <strong>Water</strong> <strong>Yearbook</strong> <strong>2005</strong> – <strong>2006</strong>

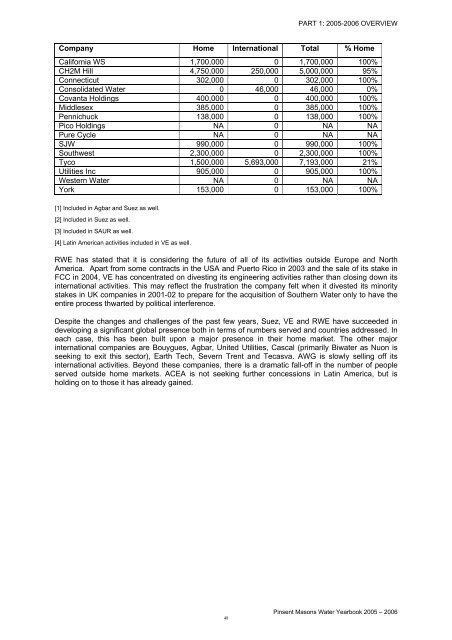

48 PART 1: <strong>2005</strong>-<strong>2006</strong> OVERVIEW Company Home International Total % Home California WS 1,700,000 0 1,700,000 100% CH2M Hill 4,750,000 250,000 5,000,000 95% Connecticut 302,000 0 302,000 100% Consolidated <strong>Water</strong> 0 46,000 46,000 0% Covanta Holdings 400,000 0 400,000 100% Middlesex 385,000 0 385,000 100% Pennichuck 138,000 0 138,000 100% Pico Holdings NA 0 NA NA Pure Cycle NA 0 NA NA SJW 990,000 0 990,000 100% Southwest 2,300,000 0 2,300,000 100% Tyco 1,500,000 5,693,000 7,193,000 21% Utilities Inc 905,000 0 905,000 100% Western <strong>Water</strong> NA 0 NA NA York 153,000 0 153,000 100% [1] Included in Agbar and Suez as well. [2] Included in Suez as well. [3] Included in SAUR as well. [4] Latin American activities included in VE as well. RWE has stated that it is considering the future of all of its activities outside Europe and North America. Apart from some contracts in the USA and Puerto Rico in 2003 and the sale of its stake in FCC in 2004, VE has concentrated on divesting its engineering activities rather than closing down its international activities. This may reflect the frustration the company felt when it divested its minority stakes in UK companies in 2001-02 to prepare for the acquisition of Southern <strong>Water</strong> only to have the entire process thwarted by political interference. Despite the changes and challenges of the past few years, Suez, VE and RWE have succeeded in developing a significant global presence both in terms of numbers served and countries addressed. In each case, this has been built upon a major presence in their home market. The other major international companies are Bouygues, Agbar, United Utilities, Cascal (primarily Biwater as Nuon is seeking to exit this sector), Earth Tech, Severn Trent and Tecasva. AWG is slowly selling off its international activities. Beyond these companies, there is a dramatic fall-off in the number of people served outside home markets. ACEA is not seeking further concessions in Latin America, but is holding on to those it has already gained. <strong>Pinsent</strong> <strong>Masons</strong> <strong>Water</strong> <strong>Yearbook</strong> <strong>2005</strong> – <strong>2006</strong>

- Page 1:

Copyright © Pinsent Masons 2005 Pu

- Page 4 and 5:

£2bn was achieved by increased eff

- Page 6 and 7:

Dr David Lloyd Owen iv DR DAVID OWE

- Page 8 and 9:

PINSENT MASONS WATER SECTOR GROUP F

- Page 10 and 11:

viii CONTENTS DENMARK..............

- Page 12 and 13:

x CONTENTS FRANCE BOUYGUES ........

- Page 14 and 15:

Introduction A new direction for th

- Page 16 and 17:

…while the real cost of conflict

- Page 18 and 19: How to use this book xv HOW TO USE

- Page 20 and 21: Russian Utility Systems (Russia) Re

- Page 23 and 24: Whither Africa? 2 PART 1: 2005-2006

- Page 25 and 26: Framework for Action Annual Investm

- Page 27 and 28: 6 PART 1: 2005-2006 OVERVIEW most b

- Page 29 and 30: PART 1: 2005-2006 OVERVIEW and find

- Page 31 and 32: Responding to these challenges 10 P

- Page 33 and 34: Identified private sector projects,

- Page 35 and 36: Three new companies noted 14 PART 1

- Page 37 and 38: Indicative estimates of the size of

- Page 39 and 40: Desalination 18 PART 1: 2005-2006 O

- Page 41 and 42: PART 1: 2005-2006 OVERVIEW apprecia

- Page 43 and 44: 22 PART 1: 2005-2006 OVERVIEW Water

- Page 45 and 46: [2] Casablanca - block tariffs and

- Page 47 and 48: [4] Argentina: Serving the Salta Pr

- Page 49 and 50: [6] Connecting a squatter settlemen

- Page 51 and 52: Companies Active In, Entering and L

- Page 53 and 54: Number of People Served by Country

- Page 55 and 56: How Many People are Served by the P

- Page 57 and 58: PART 1: 2005-2006 OVERVIEW Company

- Page 59 and 60: PART 1: 2005-2006 OVERVIEW privatis

- Page 61 and 62: Country Market Development, Prospec

- Page 63 and 64: 42 PART 1: 2005-2006 OVERVIEW The A

- Page 65 and 66: National and International Players

- Page 67: PART 1: 2005-2006 OVERVIEW Company

- Page 73 and 74: ALBANIA PART 2: COUNTRY ANALYSIS Al

- Page 75 and 76: ALGERIA PART 2: COUNTRY ANALYSIS Al

- Page 77 and 78: ARMENIA PART 2: COUNTRY ANALYSIS Ar

- Page 79 and 80: AUSTRIA PART 2: COUNTRY ANALYSIS Th

- Page 81 and 82: AZERBAIJAN PART 2: COUNTRY ANALYSIS

- Page 83 and 84: BELGIUM PART 2: COUNTRY ANALYSIS Be

- Page 85 and 86: BELGIUM PART 2: COUNTRY ANALYSIS Fo

- Page 87 and 88: BULGARIA PART 2: COUNTRY ANALYSIS t

- Page 89 and 90: BURKINA FASO PART 2: COUNTRY ANALYS

- Page 91 and 92: CAMEROON PART 2: COUNTRY ANALYSIS M

- Page 93 and 94: CHAD PART 2: COUNTRY ANALYSIS Chad

- Page 95 and 96: REPUBLIC OF CONGO PART 2: COUNTRY A

- Page 97 and 98: COTE D'IVOIRE PART 2: COUNTRY ANALY

- Page 99 and 100: CROATIA PART 2: COUNTRY ANALYSIS Ur

- Page 101 and 102: CZECH REPUBLIC PART 2: COUNTRY ANAL

- Page 103 and 104: CZECH REPUBLIC PART 2: COUNTRY ANAL

- Page 105 and 106: EGYPT PART 2: COUNTRY ANALYSIS Egyp

- Page 107 and 108: EGYPT PART 2: COUNTRY ANALYSIS Fres

- Page 109 and 110: ESTONIA PART 2: COUNTRY ANALYSIS Es

- Page 111 and 112: ETHIOPIA PART 2: COUNTRY ANALYSIS E

- Page 113 and 114: FRANCE PART 2: COUNTRY ANALYSIS Fra

- Page 115 and 116: FRANCE PART 2: COUNTRY ANALYSIS Sin

- Page 117 and 118: GABON PART 2: COUNTRY ANALYSIS Gabo

- Page 119 and 120:

GERMANY PART 2: COUNTRY ANALYSIS Ge

- Page 121 and 122:

GERMANY PART 2: COUNTRY ANALYSIS In

- Page 123 and 124:

GERMANY PART 2: COUNTRY ANALYSIS Pr

- Page 125 and 126:

GREECE PART 2: COUNTRY ANALYSIS Gre

- Page 127 and 128:

GREECE PART 2: COUNTRY ANALYSIS Flo

- Page 129 and 130:

GUINEA PART 2: COUNTRY ANALYSIS Fre

- Page 131 and 132:

HUNGARY PART 2: COUNTRY ANALYSIS Hu

- Page 133 and 134:

HUNGARY PART 2: COUNTRY ANALYSIS Pr

- Page 135 and 136:

IRAQ PART 2: COUNTRY ANALYSIS Iraq

- Page 137 and 138:

IRELAND PART 2: COUNTRY ANALYSIS Ir

- Page 139 and 140:

IRELAND PART 2: COUNTRY ANALYSIS Gr

- Page 141 and 142:

ISRAEL - PALESTINE PART 2: COUNTRY

- Page 143 and 144:

ISRAEL - PALESTINE PART 2: COUNTRY

- Page 145 and 146:

ITALY PART 2: COUNTRY ANALYSIS and

- Page 147 and 148:

ITALY PART 2: COUNTRY ANALYSIS Priv

- Page 149 and 150:

JORDAN PART 2: COUNTRY ANALYSIS Jor

- Page 151 and 152:

KENYA PART 2: COUNTRY ANALYSIS Keny

- Page 153 and 154:

KENYA PART 2: COUNTRY ANALYSIS Oper

- Page 155 and 156:

KUWAIT PART 2: COUNTRY ANALYSIS MAJ

- Page 157 and 158:

LEBANON PART 2: COUNTRY ANALYSIS Le

- Page 159 and 160:

LESOTHO PART 2: COUNTRY ANALYSIS wa

- Page 161 and 162:

LITHUANIA PART 2: COUNTRY ANALYSIS

- Page 163 and 164:

MALI PART 2: COUNTRY ANALYSIS Mali

- Page 165 and 166:

MOROCCO PART 2: COUNTRY ANALYSIS Fr

- Page 167 and 168:

MOZAMBIQUE PART 2: COUNTRY ANALYSIS

- Page 169 and 170:

MOZAMBIQUE PART 2: COUNTRY ANALYSIS

- Page 171 and 172:

THE NETHERLANDS PART 2: COUNTRY ANA

- Page 173 and 174:

THE NETHERLANDS PART 2: COUNTRY ANA

- Page 175 and 176:

NIGERIA PART 2: COUNTRY ANALYSIS Ni

- Page 177 and 178:

NIGERIA PART 2: COUNTRY ANALYSIS (L

- Page 179 and 180:

NORWAY PART 2: COUNTRY ANALYSIS spa

- Page 181 and 182:

POLAND PART 2: COUNTRY ANALYSIS Pol

- Page 183 and 184:

POLAND PART 2: COUNTRY ANALYSIS Pri

- Page 185 and 186:

PORTUGAL PART 2: COUNTRY ANALYSIS P

- Page 187 and 188:

PORTUGAL PART 2: COUNTRY ANALYSIS G

- Page 189 and 190:

ROMANIA PART 2: COUNTRY ANALYSIS Ro

- Page 191 and 192:

ROMANIA PART 2: COUNTRY ANALYSIS Pr

- Page 193 and 194:

THE RUSSIAN FEDERATION PART 2: COUN

- Page 195 and 196:

THE RUSSIAN FEDERATION PART 2: COUN

- Page 197 and 198:

SAUDI ARABIA PART 2: COUNTRY ANALYS

- Page 199 and 200:

SENEGAL PART 2: COUNTRY ANALYSIS Se

- Page 201 and 202:

SLOVAKIA PART 2: COUNTRY ANALYSIS S

- Page 203 and 204:

SLOVENIA PART 2: COUNTRY ANALYSIS S

- Page 205 and 206:

SOUTH AFRICA PART 2: COUNTRY ANALYS

- Page 207 and 208:

SOUTH AFRICA PART 2: COUNTRY ANALYS

- Page 209 and 210:

SPAIN PART 2: COUNTRY ANALYSIS Spai

- Page 211 and 212:

SPAIN PART 2: COUNTRY ANALYSIS Fres

- Page 213 and 214:

SWEDEN PART 2: COUNTRY ANALYSIS Swe

- Page 215 and 216:

SWITZERLAND PART 2: COUNTRY ANALYSI

- Page 217 and 218:

TANZANIA PART 2: COUNTRY ANALYSIS R

- Page 219 and 220:

TUNISIA PART 2: COUNTRY ANALYSIS Pr

- Page 221 and 222:

TURKEY PART 2: COUNTRY ANALYSIS Izm

- Page 223 and 224:

UGANDA PART 2: COUNTRY ANALYSIS Ref

- Page 225 and 226:

UKRAINE PART 2: COUNTRY ANALYSIS Uk

- Page 227 and 228:

UNITED ARAB EMIRATES PART 2: COUNTR

- Page 229 and 230:

UNITED KINGDOM PART 2: COUNTRY ANAL

- Page 231 and 232:

UNITED KINGDOM PART 2: COUNTRY ANAL

- Page 233 and 234:

UNITED KINGDOM PART 2: COUNTRY ANAL

- Page 235:

ZAMBIA PART 2: COUNTRY ANALYSIS Zam

- Page 239 and 240:

FRANCE PART 3 (i): COMPANY ANALYSIS

- Page 241 and 242:

FRANCE PART 3 (i): COMPANY ANALYSIS

- Page 243 and 244:

FRANCE PART 3 (i): COMPANY ANALYSIS

- Page 245 and 246:

FRANCE PART 3 (i): COMPANY ANALYSIS

- Page 247 and 248:

FRANCE PART 3 (i): COMPANY ANALYSIS

- Page 249 and 250:

FRANCE PART 3 (i): COMPANY ANALYSIS

- Page 251 and 252:

FRANCE PART 3 (i): COMPANY ANALYSIS

- Page 253 and 254:

FRANCE PART 3 (i): COMPANY ANALYSIS

- Page 255 and 256:

FRANCE PART 3 (i): COMPANY ANALYSIS

- Page 257 and 258:

FRANCE PART 3 (i): COMPANY ANALYSIS

- Page 259 and 260:

FRANCE PART 3 (i): COMPANY ANALYSIS

- Page 261 and 262:

FRANCE PART 3 (i): COMPANY ANALYSIS

- Page 263 and 264:

FRANCE PART 3 (i): COMPANY ANALYSIS

- Page 265 and 266:

FRANCE PART 3 (i): COMPANY ANALYSIS

- Page 267 and 268:

FRANCE PART 3 (i): COMPANY ANALYSIS

- Page 269 and 270:

FRANCE PART 3 (i): COMPANY ANALYSIS

- Page 271 and 272:

FRANCE PART 3 (i): COMPANY ANALYSIS

- Page 273 and 274:

FRANCE PART 3 (i): COMPANY ANALYSIS

- Page 275 and 276:

FRANCE PART 3 (i): COMPANY ANALYSIS

- Page 277 and 278:

FRANCE PART 3 (i): COMPANY ANALYSIS

- Page 279 and 280:

FRANCE PART 3 (i): COMPANY ANALYSIS

- Page 281 and 282:

GERMANY PART 3 (i): COMPANY ANALYSI

- Page 283 and 284:

GERMANY PART 3 (i): COMPANY ANALYSI

- Page 285 and 286:

GERMANY PART 3 (i): COMPANY ANALYSI

- Page 287 and 288:

GERMANY PART 3 (i): COMPANY ANALYSI

- Page 289 and 290:

GERMANY PART 3 (i): COMPANY ANALYSI

- Page 291 and 292:

GERMANY PART 3 (i): COMPANY ANALYSI

- Page 293 and 294:

ITALY PART 3 (i): COMPANY AN/ALYSIS

- Page 295 and 296:

ITALY PART 3 (i): COMPANY AN/ALYSIS

- Page 297 and 298:

SPAIN PART 3 (i): COMPANY ANALYSIS:

- Page 299 and 300:

SPAIN PART 3 (i): COMPANY ANALYSIS:

- Page 301 and 302:

THE NETHERLANDS PART 3 (i): COMPANY

- Page 303 and 304:

UNITED KINGDOM PART 3 (i): COMPANY

- Page 305 and 306:

UNITED KINGDOM PART 3 (i): COMPANY

- Page 307 and 308:

UNITED KINGDOM PART 3 (i): COMPANY

- Page 309 and 310:

UNITED KINGDOM PART 3 (i): COMPANY

- Page 311:

UNITED KINGDOM PART 3 (i): COMPANY

- Page 315 and 316:

AUSTRIA PART 3 (ii): COMPANY ANALYS

- Page 317 and 318:

AUSTRIA PART 3 (ii): COMPANY ANALYS

- Page 319 and 320:

AUSTRIA PART 3 (ii): COMPANY ANALYS

- Page 321 and 322:

BELGIUM PART 3 (ii): COMPANY ANALYS

- Page 323 and 324:

ESTONIA PART 3 (ii): COMPANY ANALYS

- Page 325 and 326:

FRANCE PART 3 (ii): COMPANY ANALYSI

- Page 327 and 328:

GERMANY PART 3 (ii): COMPANY ANALYS

- Page 329 and 330:

GERMANY PART 3 (ii): COMPANY ANALYS

- Page 331 and 332:

GERMANY PART 3 (ii): COMPANY ANALYS

- Page 333 and 334:

GREECE PART 3 (ii): COMPANY ANALYSI

- Page 335 and 336:

ITALY PART 3 (ii): COMPANY ANALYSIS

- Page 337 and 338:

ITALY PART 3 (ii): COMPANY ANALYSIS

- Page 339 and 340:

ITALY PART 3 (ii): COMPANY ANALYSIS

- Page 341 and 342:

ITALY PART 3 (ii): COMPANY ANALYSIS

- Page 343 and 344:

SAUDI ARABIA PART 3 (ii): COMPANY A

- Page 345 and 346:

SAUDI ARABIA PART 3 (ii): COMPANY A

- Page 347 and 348:

SPAIN PART 3 (ii): COMPANY ANALYSIS

- Page 349 and 350:

SPAIN PART 3 (ii): COMPANY ANALYSIS

- Page 351 and 352:

SPAIN PART 3 (ii): COMPANY ANALYSIS

- Page 353 and 354:

SPAIN PART 3 (ii): COMPANY ANALYSIS

- Page 355 and 356:

SPAIN PART 3 (ii): COMPANY ANALYSIS

- Page 357 and 358:

SPAIN PART 3 (ii): COMPANY ANALYSIS

- Page 359 and 360:

SPAIN PART 3 (ii): COMPANY ANALYSIS

- Page 361 and 362:

UNITED KINGDOM PART 3 (ii): COMPANY

- Page 363 and 364:

UNITED KINGDOM PART 3 (ii): COMPANY

- Page 365 and 366:

UNITED KINGDOM PART 3 (ii): COMPANY

- Page 367 and 368:

UNITED KINGDOM PART 3 (ii): COMPANY

- Page 369 and 370:

UNITED KINGDOM PART 3 (ii): COMPANY

- Page 371 and 372:

UNITED KINGDOM PART 3 (ii): COMPANY

- Page 373 and 374:

UNITED KINGDOM PART 3 (ii): COMPANY

- Page 375 and 376:

UNITED KINGDOM PART 3 (ii): COMPANY

- Page 377 and 378:

UNITED KINGDOM PART 3 (ii): COMPANY

- Page 379 and 380:

UNITED KINGDOM PART 3 (ii): COMPANY

- Page 381 and 382:

UNITED KINGDOM PART 3 (ii): COMPANY

- Page 383 and 384:

UNITED KINGDOM PART 3 (ii): COMPANY

- Page 385 and 386:

UNITED KINGDOM PART 3 (ii): COMPANY

- Page 387:

UNITED KINGDOM PART 3 (ii): COMPANY

- Page 391 and 392:

PHILIPPINES PART 3 (iii): COMPANY A

- Page 393:

Part 4: Appendix 1 The water cycle

- Page 396 and 397:

PART 4: APPENDIX 1: THE WATER CYCLE

- Page 398 and 399:

PART 4: APPENDIX 1: THE WATER CYCLE

- Page 400 and 401:

370 Pinsent Masons Water Yearbook 2

- Page 402 and 403:

372 Pinsent Masons Water Yearbook 2

- Page 405 and 406:

Private Sector Participation Types

- Page 407 and 408:

PART 4: APPENDIX 2: PRIVATE SECTOR

- Page 409 and 410:

PART 4: APPENDIX 2: PRIVATE SECTOR

- Page 411 and 412:

Water and power contracts compared

- Page 413 and 414:

The private sector’s role PART 4:

- Page 415 and 416:

PART 4: APPENDIX 2: PRIVATE SECTOR

- Page 417 and 418:

PART 4: APPENDIX 2: PRIVATE SECTOR

- Page 419:

Part 4: Appendix 3 The Private Sect

- Page 422 and 423:

PART 4: APPENDIX 3: THE PRIVATE SEC

- Page 424 and 425:

PART 4: APPENDIX 3: THE PRIVATE SEC

- Page 427:

Part 4: Appendix 4 Glossary Of Wate

- Page 430 and 431:

PART 4: APPENDIX 4: GLOSSARY OF WAT

- Page 432 and 433:

PART 4: APPENDIX 4: GLOSSARY OF WAT

- Page 434 and 435:

PART 4: APPENDIX 4: GLOSSARY OF WAT

- Page 436 and 437:

PART 4: APPENDIX 4: GLOSSARY OF WAT

- Page 438 and 439:

PART 4: APPENDIX 4: GLOSSARY OF WAT

- Page 441 and 442:

References And Further Reading PART

- Page 443 and 444:

PART 4: APPENDIX 5: REFERENCES AND

- Page 445 and 446:

PART 4: APPENDIX 5: REFERENCES AND

- Page 447 and 448:

PART 4: APPENDIX 5: REFERENCES AND

- Page 449:

PART 4: APPENDIX 5: REFERENCES AND