2005 - 2006 - Pinsent Masons Water Yearbook 2012

2005 - 2006 - Pinsent Masons Water Yearbook 2012

2005 - 2006 - Pinsent Masons Water Yearbook 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

UNITED KINGDOM PART 3 (ii): COMPANY ANALYSIS: LOCAL/REGIONAL PLAYERS<br />

Glas Cymru (Dŵr Cymru Welsh <strong>Water</strong>)<br />

The evolution of Glas Cymru came as a response to extraordinary circumstances. Hyder Plc was the<br />

holding company for Dŵr Cymru Welsh <strong>Water</strong> (DCWW, water and sewerage in Wales), Swalec<br />

(electricity and gas distribution in South Wales) and a number of related infrastructure service and<br />

investment activities. Despite its name (Hyder means ‘confidence’ in Welsh), the multi utility strategy<br />

came at a high price in terms of gearing, with debt rather than equity being used. As a result, by April<br />

2000, the company expected gearing to rise above the levels stipulated in its debt covenants by the<br />

end of 2001. Crucially, there was inadequate investor support for a rights issue at the time.<br />

In April 2000, St David’s Capital, a company formed by Nomura International made an agreed bid for<br />

Hyder at 260p per share. The bid was designed to take the company private and to securitise its cash<br />

flows while ending dividend payments and selling off surplus assets. In June, WPD, a US utility JV,<br />

made a hostile 300p per share bid based upon breaking Hyder up and having Dŵr Cymru divested or<br />

its services operated by United Utilities. During August 2000, there were revised bids by Nomura at<br />

320p, WPD at 340p and Nomura at 360p. The Stock Exchange ended the process by calling for<br />

sealed bids. WPD won with a 365p bid while Nomura retained their previous bid. On September 7 th<br />

2000 it was announced that WPD had gained a majority of Hyder’s shares. The bid was completed on<br />

October 25 th 2000, when the Hyder name was withdrawn in favour of Dŵr Cymru.<br />

Glas Cymru’s management developed the concept of a bond financed company in 1999, and made<br />

formal offers with the support of Barclays Capital to buy DCWW from Hyder in 1999 and 2000. From<br />

the outset, the non-shareholder model was designed to significantly lower DCWW’s cost of capital<br />

through a single-purpose company designed to produce the highest quality debt rating. Glas Cymru<br />

was formally incorporated in April 2000 and became WPD’s preferred bidder for DCWW in November<br />

2000. Ofwat cleared the acquisition in January 2001 and the acquisition was finalised in May 2001.<br />

Glas Cymru is restricted to running DCWW. DCWW was acquired for £1.85 billion against a<br />

Regulatory Asset Value of £2 billion, and Glas Cymru has raised £1.91 billion in debt finance. During<br />

the past year, Glas Cymru has concentrated upon developing conditions that would ease the cost of<br />

financing DCWW’s debt burden. The bond covenants were structured specifically to optimise the debt<br />

ratings, by minimising the risk attached to each bond issue.<br />

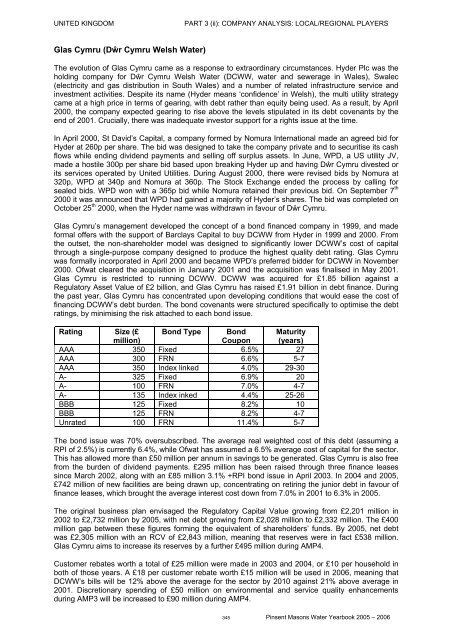

Rating Size (£ Bond Type Bond Maturity<br />

million)<br />

Coupon (years)<br />

AAA 350 Fixed 6.5% 27<br />

AAA 300 FRN 6.6% 5-7<br />

AAA 350 Index linked 4.0% 29-30<br />

A- 325 Fixed 6.9% 20<br />

A- 100 FRN 7.0% 4-7<br />

A- 135 Index inked 4.4% 25-26<br />

BBB 125 Fixed 8.2% 10<br />

BBB 125 FRN 8.2% 4-7<br />

Unrated 100 FRN 11.4% 5-7<br />

The bond issue was 70% oversubscribed. The average real weighted cost of this debt (assuming a<br />

RPI of 2.5%) is currently 6.4%, while Ofwat has assumed a 6.5% average cost of capital for the sector.<br />

This has allowed more than £50 million per annum in savings to be generated. Glas Cymru is also free<br />

from the burden of dividend payments. £295 million has been raised through three finance leases<br />

since March 2002, along with an £85 million 3.1% +RPI bond issue in April 2003. In 2004 and <strong>2005</strong>,<br />

£742 million of new facilities are being drawn up, concentrating on retiring the junior debt in favour of<br />

finance leases, which brought the average interest cost down from 7.0% in 2001 to 6.3% in <strong>2005</strong>.<br />

The original business plan envisaged the Regulatory Capital Value growing from £2,201 million in<br />

2002 to £2,732 million by <strong>2005</strong>, with net debt growing from £2,028 million to £2,332 million. The £400<br />

million gap between these figures forming the equivalent of shareholders’ funds. By <strong>2005</strong>, net debt<br />

was £2,305 million with an RCV of £2,843 million, meaning that reserves were in fact £538 million.<br />

Glas Cymru aims to increase its reserves by a further £495 million during AMP4.<br />

Customer rebates worth a total of £25 million were made in 2003 and 2004, or £10 per household in<br />

both of those years. A £18 per customer rebate worth £15 million will be used in <strong>2006</strong>, meaning that<br />

DCWW’s bills will be 12% above the average for the sector by 2010 against 21% above average in<br />

2001. Discretionary spending of £50 million on environmental and service quality enhancements<br />

during AMP3 will be increased to £90 million during AMP4.<br />

345 <strong>Pinsent</strong> <strong>Masons</strong> <strong>Water</strong> <strong>Yearbook</strong> <strong>2005</strong> – <strong>2006</strong>