- Page 1 and 2:

Proceedings of the 5th European Con

- Page 3 and 4:

Contents Paper Title Author(s) Page

- Page 5 and 6:

Paper Title Author(s) Page No. Cont

- Page 7 and 8:

Preface The 5th European Conference

- Page 9 and 10:

Dr Jorge Ricardo da Costa Ferreira

- Page 11 and 12:

LSE while working at the British St

- Page 13 and 14:

Minna Isomursu, PhD, is a research

- Page 15 and 16:

Elmarie Papageorgiou is a Senior Le

- Page 17 and 18:

Information and Knowledge Managemen

- Page 19 and 20:

João Agrela et al. So modeling bec

- Page 21 and 22:

João Agrela et al. ETRS 89 project

- Page 23 and 24:

João Agrela et al. (accidents) tha

- Page 25 and 26:

Figure 8: Final model João Agrela

- Page 27 and 28:

João Agrela et al. outputs and res

- Page 29 and 30:

System Integration Model Based on O

- Page 31 and 32:

Kamsuriah Ahmad, Azwan Mohamed and

- Page 33 and 34:

Kamsuriah Ahmad, Azwan Mohamed and

- Page 35 and 36:

Building Virtual Communities on top

- Page 37 and 38:

Cuneyt Gurcan Akcora, Barbara Carmi

- Page 39 and 40:

Cuneyt Gurcan Akcora, Barbara Carmi

- Page 41 and 42:

Cuneyt Gurcan Akcora, Barbara Carmi

- Page 43 and 44:

References Cuneyt Gurcan Akcora, Ba

- Page 45 and 46:

Karen Anderson, Göran Samuelsson a

- Page 47 and 48:

Karen Anderson, Göran Samuelsson a

- Page 49 and 50:

Karen Anderson, Göran Samuelsson a

- Page 51 and 52:

Karen Anderson, Göran Samuelsson a

- Page 53 and 54:

Developing a Model for Assessing IT

- Page 55 and 56:

Mohammad Abooyee Ardakan et al. Fig

- Page 57 and 58:

Mohammad Abooyee Ardakan et al. cor

- Page 59 and 60:

Investigating the Relationship of M

- Page 61 and 62:

Mohammad Abooyee Ardakan, Babak Soh

- Page 63 and 64:

Mohammad Abooyee Ardakan, Babak Soh

- Page 65 and 66:

Mohammad Abooyee Ardakan, Babak Soh

- Page 67 and 68:

Table 3: Goodness of fit indices Mo

- Page 69 and 70:

Evaluation of ICT Investment in Hea

- Page 71 and 72:

Figure 1: Search strategy for syste

- Page 73 and 74:

A. Arviansyah, Egon Berghout and Ch

- Page 75 and 76:

Managerial A. Arviansyah, Egon Berg

- Page 77 and 78:

A. Arviansyah, Egon Berghout and Ch

- Page 79 and 80: A. Arviansyah, Egon Berghout and Ch

- Page 81 and 82: The Uses of Business Outcomes for I

- Page 83 and 84: Dawit Asmelash Measurability of th

- Page 85 and 86: Dawit Asmelash affected business pr

- Page 87 and 88: Business Units HR Sales Step 2 Iden

- Page 89 and 90: Dawit Asmelash In this case, at thi

- Page 91 and 92: Data Governance in Practice: The SM

- Page 93 and 94: Carolyn Begg and Tom Caira Our rese

- Page 95 and 96: Carolyn Begg and Tom Caira In the f

- Page 97 and 98: Carolyn Begg and Tom Caira Decision

- Page 99 and 100: Carolyn Begg and Tom Caira SMEs nee

- Page 101 and 102: Fergal Carton et al. The language u

- Page 103 and 104: Fergal Carton et al. 2008) to abstr

- Page 105 and 106: Payment integration (payment produc

- Page 107 and 108: Fergal Carton et al. Kim,C., Mirsob

- Page 109 and 110: Walter Castelnovo devised for, have

- Page 111 and 112: Walter Castelnovo the potential ris

- Page 113 and 114: Walter Castelnovo allow the informa

- Page 115 and 116: Walter Castelnovo Risk assessment,

- Page 117 and 118: Embedding Human Values Into Informa

- Page 119 and 120: Sunil Choenni, Peter van Waart and

- Page 121 and 122: Sunil Choenni, Peter van Waart and

- Page 123 and 124: Sunil Choenni, Peter van Waart and

- Page 125 and 126: Evaluating the Role and Potential o

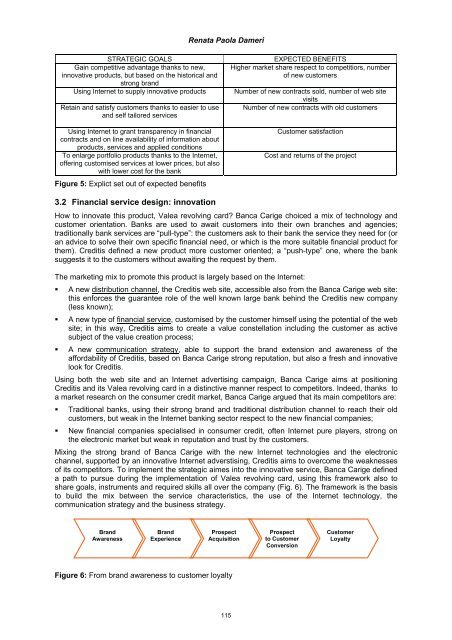

- Page 127 and 128: Renata Paola Dameri For these reaso

- Page 129: Final assessment and evaluation. Re

- Page 133 and 134: Renata Paola Dameri To clearly com

- Page 135 and 136: ICT and PA: A Marriage Made in Heav

- Page 137 and 138: Maria Concetta De Vivo, Alberto Pol

- Page 139 and 140: Maria Concetta De Vivo, Alberto Pol

- Page 141 and 142: Maria Concetta De Vivo, Alberto Pol

- Page 143 and 144: Jan Devos, Hendrik Van Landeghem an

- Page 145 and 146: Jan Devos, Hendrik Van Landeghem an

- Page 147 and 148: Jan Devos, Hendrik Van Landeghem an

- Page 149 and 150: References Jan Devos, Hendrik Van L

- Page 151 and 152: Luciana Duranti and Adam Jansen Dig

- Page 153 and 154: Luciana Duranti and Adam Jansen A

- Page 155 and 156: References Luciana Duranti and Adam

- Page 157 and 158: Kate Dymoke-Bradshaw and Ann Brown

- Page 159 and 160: Kate Dymoke-Bradshaw and Ann Brown

- Page 161 and 162: Kate Dymoke-Bradshaw and Ann Brown

- Page 163 and 164: Kate Dymoke-Bradshaw and Ann Brown

- Page 165 and 166: Graham Fletcher and Marie Cahillane

- Page 167 and 168: Graham Fletcher and Marie Cahillane

- Page 169 and 170: Graham Fletcher and Marie Cahillane

- Page 171 and 172: Graham Fletcher and Marie Cahillane

- Page 173 and 174: How Open Source Software Products:

- Page 175 and 176: Chiara Friso, Valentina Lenarduzzi,

- Page 177 and 178: Chiara Friso, Valentina Lenarduzzi,

- Page 179 and 180: Il giornale elettronico (Trivella,

- Page 181 and 182:

Chiara Friso, Valentina Lenarduzzi,

- Page 183 and 184:

Yuwanuch Gulatee and Barbara Combes

- Page 185 and 186:

Table 1: Wholly online participants

- Page 187 and 188:

Yuwanuch Gulatee and Barbara Combes

- Page 189 and 190:

Yuwanuch Gulatee and Barbara Combes

- Page 191 and 192:

Florian Hamel, Thomas Ph. Herz, Fal

- Page 193 and 194:

Florian Hamel, Thomas Ph. Herz, Fal

- Page 195 and 196:

Florian Hamel, Thomas Ph. Herz, Fal

- Page 197 and 198:

Florian Hamel, Thomas Ph. Herz, Fal

- Page 199 and 200:

Martin Hill, John Salt and Graham F

- Page 201 and 202:

Martin Hill, John Salt and Graham F

- Page 203 and 204:

Martin Hill, John Salt and Graham F

- Page 205 and 206:

Transforming Information to Knowled

- Page 207 and 208:

Vered Holzmann and Ben Holzmann Tot

- Page 209 and 210:

Vered Holzmann and Ben Holzmann kno

- Page 211 and 212:

Vered Holzmann and Ben Holzmann Prz

- Page 213 and 214:

Grant Howard and Sam Lubbe High-lev

- Page 215 and 216:

3. Theoretical discussion 3.1 Green

- Page 217 and 218:

Grant Howard and Sam Lubbe 3.6 Envi

- Page 219 and 220:

Grant Howard and Sam Lubbe Easterbr

- Page 221 and 222:

Evaluating ICT Based Services for O

- Page 223 and 224:

Minna Isomursu and Marja Harjumaa t

- Page 225 and 226:

4.2 Challenges with research method

- Page 227 and 228:

Minna Isomursu and Marja Harjumaa b

- Page 229 and 230:

The Geography of Criminality - Info

- Page 231 and 232:

Intelligence Paulo João, Jorge Fer

- Page 233 and 234:

4.1 Crime hot-spots Paulo João, Jo

- Page 235 and 236:

Paulo João, Jorge Ferreira and Jos

- Page 237 and 238:

Paulo João, Jorge Ferreira and Jos

- Page 239 and 240:

Paulo João, Jorge Ferreira and Jos

- Page 241 and 242:

Mobile Virtual Network Operator Inf

- Page 243 and 244:

Hallur Leivsgarð Joensen and Torbe

- Page 245 and 246:

Hallur Leivsgarð Joensen and Torbe

- Page 247 and 248:

Hallur Leivsgarð Joensen and Torbe

- Page 249 and 250:

Hallur Leivsgarð Joensen and Torbe

- Page 251 and 252:

Björn Johansson and Linda Bergkvis

- Page 253 and 254:

Björn Johansson and Linda Bergkvis

- Page 255 and 256:

Björn Johansson and Linda Bergkvis

- Page 257 and 258:

Björn Johansson and Linda Bergkvis

- Page 259 and 260:

A Fair Partnership Model by Sharing

- Page 261 and 262:

Ghassan Kbar 2. Partnership and VC

- Page 263 and 264:

Ghassan Kbar Entering state of the

- Page 265 and 266:

Ghassan Kbar Saudi-chamber, (2011)

- Page 267 and 268:

Ghassan Kbar and Abdul Aziz AlDusar

- Page 269 and 270:

Ghassan Kbar and Abdul Aziz AlDusar

- Page 271 and 272:

Ghassan Kbar and Abdul Aziz AlDusar

- Page 273 and 274:

Ghassan Kbar and Abdul Aziz AlDusar

- Page 275 and 276:

Dong-Hyun Kim and Hyun-Joo Kim We i

- Page 277 and 278:

Dong-Hyun Kim and Hyun-Joo Kim As a

- Page 279 and 280:

Dong-Hyun Kim and Hyun-Joo Kim We m

- Page 281 and 282:

Erdem Kirkbesoglu and Gizem Ogutcu

- Page 283 and 284:

Erdem Kirkbesoglu and Gizem Ogutcu

- Page 285 and 286:

Erdem Kirkbesoglu and Gizem Ogutcu

- Page 287 and 288:

Portfolio Management in Non-Profit

- Page 289 and 290:

Bert Kleersnijder and Egon Berghout

- Page 291 and 292:

Bert Kleersnijder and Egon Berghout

- Page 293 and 294:

Bert Kleersnijder and Egon Berghout

- Page 295 and 296:

Why is an IS Project Late? - A Case

- Page 297 and 298:

2. The project 2.1 Background and r

- Page 299 and 300:

Juha Kontio Phase In stallation Ope

- Page 301 and 302:

Table 2: Identified reason of the p

- Page 303 and 304:

Juha Kontio There are also reasons

- Page 305 and 306:

2. Performance review model for NDP

- Page 307 and 308:

Misoo Kwon Among the review indicat

- Page 309 and 310:

Type Average time saved Misoo Kwon

- Page 311 and 312:

Luigi Lavazza In conclusion, when a

- Page 313 and 314:

Luigi Lavazza The former can be de

- Page 315 and 316:

Luigi Lavazza For each process, we

- Page 317 and 318:

6. Conclusions Luigi Lavazza When e

- Page 319 and 320:

eBusiness Model Design and Evaluati

- Page 321 and 322:

Monika Magnusson categories of busi

- Page 323 and 324:

Monika Magnusson Business Model Ele

- Page 325 and 326:

5.2 Guiding questions Monika Magnus

- Page 327 and 328:

Monika Magnusson Hay, M. and Kamsha

- Page 329 and 330:

Monika Magnusson and Marie-Therese

- Page 331 and 332:

Monika Magnusson and Marie-Therese

- Page 333 and 334:

4.3 Goals at the project level Moni

- Page 335 and 336:

Monika Magnusson and Marie-Therese

- Page 337 and 338:

Alignment in Enterprise Architectur

- Page 339 and 340:

Thanos Magoulas, Aida Hadzic, Ted S

- Page 341 and 342:

Thanos Magoulas, Aida Hadzic, Ted S

- Page 343 and 344:

3.4 Infological alignment Thanos Ma

- Page 345 and 346:

Thanos Magoulas, Aida Hadzic, Ted S

- Page 347 and 348:

Thanos Magoulas, Aida Hadzic, Ted S

- Page 349 and 350:

Panagiotis Manolitzas et al. to Gov

- Page 351 and 352:

Panagiotis Manolitzas et al. Anothe

- Page 353 and 354:

Table 1: Criteria weights and satis

- Page 355 and 356:

Panagiotis Manolitzas et al. Satisf

- Page 357 and 358:

Understanding the Impact of Knowled

- Page 359 and 360:

Magdeline Mashilo and Tiko Iyamu Ac

- Page 361 and 362:

Magdeline Mashilo and Tiko Iyamu Cu

- Page 363 and 364:

Magdeline Mashilo and Tiko Iyamu Th

- Page 365 and 366:

Magdeline Mashilo and Tiko Iyamu Ho

- Page 367 and 368:

2. Literature review 2.1 The Batik

- Page 369 and 370:

Nor Laila Md Noor and Ariza Nordin

- Page 371 and 372:

Nor Laila Md Noor and Ariza Nordin

- Page 373 and 374:

Isolated Strategies Nor Laila Md No

- Page 375 and 376:

HOT-fit Evaluation Framework: Valid

- Page 377 and 378:

Maryati Mohd Yusof In order to vali

- Page 379 and 380:

Maryati Mohd Yusof Further framewor

- Page 381 and 382:

Maryati Mohd Yusof Kaplan, B., and

- Page 383 and 384:

Gunilla Myreteg social context (Orl

- Page 385 and 386:

Gunilla Myreteg needed routine. Ano

- Page 387 and 388:

Gunilla Myreteg used, which in turn

- Page 389 and 390:

Environmental Scanning Practice of

- Page 391 and 392:

Roslina Othman and Siti Rohimi Hame

- Page 393 and 394:

Roslina Othman and Siti Rohimi Hame

- Page 395 and 396:

Roslina Othman and Siti Rohimi Hame

- Page 397 and 398:

5. Conclusion Roslina Othman and Si

- Page 399 and 400:

Understanding Financial and non-Fin

- Page 401 and 402:

Elmarie Papageorgiou and Herman de

- Page 403 and 404:

Elmarie Papageorgiou and Herman de

- Page 405 and 406:

Elmarie Papageorgiou and Herman de

- Page 407 and 408:

Type of non-financial information a

- Page 409 and 410:

Elmarie Papageorgiou and Herman de

- Page 411 and 412:

Shabnam Pasandide, Abbas Toloie Esh

- Page 413 and 414:

Shabnam Pasandide, Abbas Toloie Esh

- Page 415 and 416:

Shabnam Pasandide, Abbas Toloie Esh

- Page 417 and 418:

Shabnam Pasandide, Abbas Toloie Esh

- Page 419 and 420:

Can eGovernment Systems Bridge the

- Page 421 and 422:

Higher quality of services Elias Pi

- Page 423 and 424:

Elias Pimenidis, Lazaros Iliadis, a

- Page 425 and 426:

Elias Pimenidis, Lazaros Iliadis, a

- Page 427 and 428:

Contributions to the Measurement an

- Page 429 and 430:

Rui Alexandre Pires and Maria do C

- Page 431 and 432:

Rui Alexandre Pires and Maria do C

- Page 433 and 434:

assessment Rui Alexandre Pires and

- Page 435 and 436:

Rui Alexandre Pires and Maria do C

- Page 437 and 438:

Rozilawati Razali and Mahamsiatus K

- Page 439 and 440:

Figure 1: Research design 3.2 Phase

- Page 441 and 442:

Rozilawati Razali and Mahamsiatus K

- Page 443 and 444:

Rozilawati Razali and Mahamsiatus K

- Page 445 and 446:

David Sammon, Tadhg Nagle and John

- Page 447 and 448:

David Sammon, Tadhg Nagle and John

- Page 449 and 450:

David Sammon, Tadhg Nagle and John

- Page 451 and 452:

David Sammon, Tadhg Nagle and John

- Page 453 and 454:

Teresa Santos, Ségio Freire and Jo

- Page 455 and 456:

Teresa Santos, Ségio Freire and Jo

- Page 457 and 458:

Teresa Santos, Ségio Freire and Jo

- Page 459 and 460:

Reflections on the Role of the Lect

- Page 461 and 462:

3. Reflective practice Elsje Scott,

- Page 463 and 464:

Elsje Scott, Peter Weimann and Nata

- Page 465 and 466:

Elsje Scott, Peter Weimann and Nata

- Page 467 and 468:

Elsje Scott, Peter Weimann and Nata

- Page 469 and 470:

Elena Serova traditional ERP manage

- Page 471 and 472:

Elena Serova Increase in percentag

- Page 473 and 474:

9. Conclusion Elena Serova At prese

- Page 475 and 476:

Sharina Tajul Urus, Alemayehu Molla

- Page 477 and 478:

4.2 Description of feral systems Sh

- Page 479 and 480:

Sharina Tajul Urus, Alemayehu Molla

- Page 481 and 482:

Type Sharina Tajul Urus, Alemayehu

- Page 483 and 484:

Open Source Disease Control Softwar

- Page 485 and 486:

Jose Teixeira and Reima Suomi do no

- Page 487 and 488:

Jose Teixeira and Reima Suomi from

- Page 489 and 490:

Jose Teixeira and Reima Suomi Futur

- Page 491 and 492:

Value of Knowledge Management Syste

- Page 493 and 494:

Nelly Todorova Human capital repres

- Page 495 and 496:

Nelly Todorova IT value from pure f

- Page 497 and 498:

Nelly Todorova unique and inimitabl

- Page 499 and 500:

Accountability and the Reconstructi

- Page 501 and 502:

Geert-Jan van Bussel cluding the pr

- Page 503 and 504:

Geert-Jan van Bussel (e.g., Wijnhov

- Page 505 and 506:

Geert-Jan van Bussel complementary,

- Page 507 and 508:

The Question of Selecting Appropria

- Page 509 and 510:

Bartosz Wachnik We can discern two

- Page 511 and 512:

Bartosz Wachnik Table 1: Criteria o

- Page 513 and 514:

Tasks in an ERP implementation proj

- Page 515 and 516:

Bartosz Wachnik Tests’ recapitul

- Page 517 and 518:

PhD Research Papers 501

- Page 519 and 520:

Information Systems for Production

- Page 521 and 522:

Denisa Ferenčíková 3. Correctly

- Page 523 and 524:

Denisa Ferenčíková method requir

- Page 525 and 526:

Denisa Ferenčíková mentioned typ

- Page 527 and 528:

1.2 Service oriented architecture A

- Page 529 and 530:

Antonio Hidalgo Landa, Ian Owens an

- Page 531 and 532:

Antonio Hidalgo Landa, Ian Owens an

- Page 533 and 534:

Antonio Hidalgo Landa, Ian Owens an

- Page 535 and 536:

Antonio Hidalgo Landa, Ian Owens an

- Page 537 and 538:

Hesbon Nyagowa, Dennis Ocholla and

- Page 539 and 540:

Hesbon Nyagowa, Dennis Ocholla and

- Page 541 and 542:

Hesbon Nyagowa, Dennis Ocholla and

- Page 543 and 544:

Hesbon Nyagowa, Dennis Ocholla and

- Page 545 and 546:

Hesbon Nyagowa, Dennis Ocholla and

- Page 547 and 548:

The Specification of Competency Que

- Page 549 and 550:

Yadary Ortega-González et al. Figu

- Page 551 and 552:

Yadary Ortega-González et al. merg

- Page 553 and 554:

Yadary Ortega-González et al. Comp

- Page 555 and 556:

Yadary Ortega-González et al. Lysa

- Page 557 and 558:

Michal Pivnička to (Collis 2008),

- Page 559 and 560:

Figure 2: List of scorecards window

- Page 561 and 562:

Michal Pivnička A Custom view (fig

- Page 563 and 564:

Michal Pivnička necessary calculat

- Page 565 and 566:

Michal Pivnička combines two or mo

- Page 567 and 568:

Michal Pivnička When any informati

- Page 569 and 570:

Challenges in Business Case Develop

- Page 571 and 572:

Bart-Jan van Putten, Franziska Brec

- Page 573 and 574:

Bart-Jan van Putten, Franziska Brec

- Page 575 and 576:

Bart-Jan van Putten, Franziska Brec

- Page 577 and 578:

Bart-Jan van Putten, Franziska Brec

- Page 579 and 580:

Bart-Jan van Putten and Markus Schi

- Page 581 and 582:

Bart-Jan van Putten and Markus Schi

- Page 583 and 584:

Bart-Jan van Putten and Markus Schi

- Page 585 and 586:

Bart-Jan van Putten and Markus Schi

- Page 587 and 588:

Mohamad Norzamani Sahroni and Marya

- Page 589 and 590:

Table 1: Type of medical error Moha

- Page 591 and 592:

Mohamad Norzamani Sahroni and Marya

- Page 593 and 594:

Non Academic Papers 577

- Page 595 and 596:

Management of Waiting List for Surg

- Page 597 and 598:

Rita Cristóvão and Pedro Gomes In

- Page 599 and 600:

Figure 4: Circuit of the patient in

- Page 601 and 602:

Rita Cristóvão and Pedro Gomes Fi

- Page 603 and 604:

Rita Cristóvão and Pedro Gomes ne

- Page 605 and 606:

Rita Cristóvão and Pedro Gomes Fi

- Page 607 and 608:

Rita Cristóvão and Pedro Gomes T

- Page 609 and 610:

Work in Progress Papers with Poster

- Page 611 and 612:

Information Management Enabling Col

- Page 613 and 614:

Maria Bergenstjerna Data will be co

- Page 615 and 616:

2. Methodology Giovanni Camponovo R

- Page 617 and 618:

Giovanni Camponovo separate concept

- Page 619 and 620:

Giovanni Camponovo A graphical summ

- Page 621 and 622:

Giovanni Camponovo 3.5 Motivations

- Page 623 and 624:

Giovanni Camponovo Butler, B., Spro

- Page 625 and 626:

An Enterprise Ontology Approach for

- Page 627 and 628:

Bernardo Gomes, André Vasconcelos

- Page 629 and 630:

Bernardo Gomes, André Vasconcelos

- Page 631 and 632:

Bernardo Gomes, André Vasconcelos

- Page 633 and 634:

Soudabeh Khodambashi and Maryati Mo

- Page 635 and 636:

National ICT Strategy and its Imple

- Page 637 and 638:

Ermelinda Kordha and As. Kozeta Sev

- Page 639 and 640:

João Soares, José Tribolet and An

- Page 641:

João Soares, José Tribolet and An