Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

100<br />

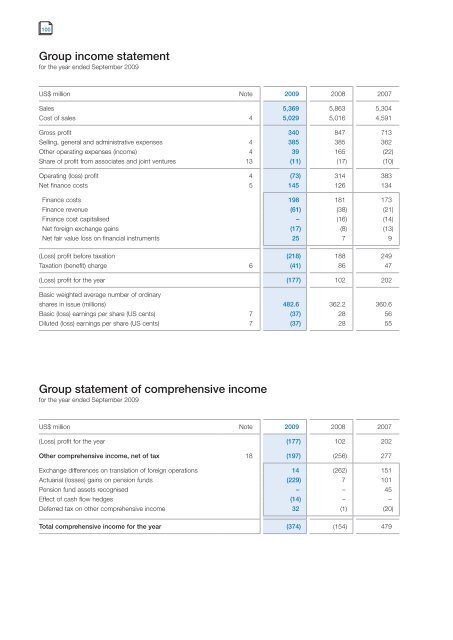

Group <strong>in</strong>come statement<br />

for the year ended September <strong>2009</strong><br />

US$ million Note <strong>2009</strong> 2008 2007<br />

Sales 5,369 5,863 5,304<br />

Cost of sales 4 5,029 5,016 4,591<br />

Gross profit 340 847 713<br />

Sell<strong>in</strong>g, general and adm<strong>in</strong>istrative expenses 4 385 385 362<br />

Other operat<strong>in</strong>g expenses (<strong>in</strong>come) 4 39 165 (22)<br />

Share of profit from associates and jo<strong>in</strong>t ventures 13 (11) (17) (10)<br />

Operat<strong>in</strong>g (loss) profit 4 (73) 314 383<br />

Net f<strong>in</strong>ance costs 5 145 126 134<br />

F<strong>in</strong>ance costs 198 181 173<br />

F<strong>in</strong>ance revenue (61) (38) (21)<br />

F<strong>in</strong>ance cost capitalised – (16) (14)<br />

Net foreign exchange ga<strong>in</strong>s (17) (8) (13)<br />

Net fair value loss on f<strong>in</strong>ancial <strong>in</strong>struments 25 7 9<br />

(Loss) profit before taxation (218) 188 249<br />

Taxation (benefit) charge 6 (41) 86 47<br />

(Loss) profit for the year (177) 102 202<br />

Basic weighted average number of ord<strong>in</strong>ary<br />

shares <strong>in</strong> issue (millions) 482.6 362.2 360.6<br />

Basic (loss) earn<strong>in</strong>gs per share (US cents) 7 (37) 28 56<br />

Diluted (loss) earn<strong>in</strong>gs per share (US cents) 7 (37) 28 55<br />

Group statement of comprehensive <strong>in</strong>come<br />

for the year ended September <strong>2009</strong><br />

US$ million Note <strong>2009</strong> 2008 2007<br />

(Loss) profit for the year (177) 102 202<br />

Other comprehensive <strong>in</strong>come, net of tax 18 (197) (256) 277<br />

Exchange differences on translation of foreign operations 14 (262) 151<br />

Actuarial (losses) ga<strong>in</strong>s on pension funds (229) 7 101<br />

Pension fund assets recognised – – 45<br />

Effect of cash flow hedges (14) – –<br />

Deferred tax on other comprehensive <strong>in</strong>come 32 (1) (20)<br />

Total comprehensive <strong>in</strong>come for the year (374) (154) 479