Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

60 Chief f<strong>in</strong>ancial officer’s report cont<strong>in</strong>ued<br />

pric<strong>in</strong>g and demand <strong>in</strong> the light of an expected soften<strong>in</strong>g economic growth. One of the key<br />

requirements of this rat<strong>in</strong>g was the successful ref<strong>in</strong>anc<strong>in</strong>g of material debt maturities <strong>in</strong> 2010,<br />

well ahead of time. This ref<strong>in</strong>anc<strong>in</strong>g took place <strong>in</strong> August <strong>2009</strong> and S&P subsequently confirmed<br />

the rat<strong>in</strong>g.<br />

In June <strong>2009</strong>, Moody’s revised its rat<strong>in</strong>g from Ba2 to Ba3, with a stable outlook. The ma<strong>in</strong> reasons<br />

for this revision were the difficult market conditions <strong>in</strong> the European paper <strong>in</strong>dustry, and the slower<br />

than expected improvement <strong>in</strong> the key rat<strong>in</strong>g metrics. In September <strong>2009</strong> this rat<strong>in</strong>g and outlook<br />

were confirmed after the successful ref<strong>in</strong>anc<strong>in</strong>g of material 2010 debt maturities.<br />

In November <strong>2009</strong> Fitch revised their <strong>Sappi</strong> Manufactur<strong>in</strong>g local South African rat<strong>in</strong>g from<br />

A+/F1/Negative to A/F1/Negative, ma<strong>in</strong>ly due to the cont<strong>in</strong>u<strong>in</strong>g difficult market and trad<strong>in</strong>g<br />

conditions, and the result<strong>in</strong>g negative impact on the operat<strong>in</strong>g marg<strong>in</strong>s of <strong>Sappi</strong> Manufactur<strong>in</strong>g<br />

when compared to the requirements for the previous rat<strong>in</strong>g.<br />

A security rat<strong>in</strong>g is not a recommendation to buy, sell or hold securities and it may be revised or<br />

withdrawn at any time by the rat<strong>in</strong>g agencies without prior notice to us. Each rat<strong>in</strong>g should be<br />

evaluated <strong>in</strong>dependently of any other rat<strong>in</strong>g.<br />

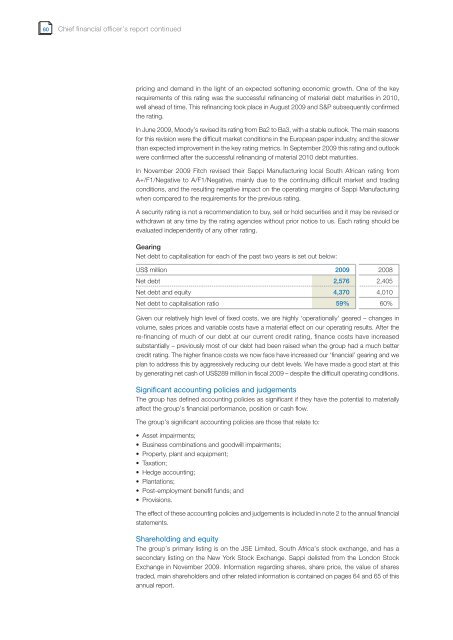

Gear<strong>in</strong>g<br />

Net debt to capitalisation for each of the past two years is set out below:<br />

US$ million <strong>2009</strong> 2008<br />

Net debt 2,576 2,405<br />

Net debt and equity 4,370 4,010<br />

Net debt to capitalisation ratio 59% 60%<br />

Given our relatively high level of fixed costs, we are highly ‘operationally’ geared – changes <strong>in</strong><br />

volume, sales prices and variable costs have a material effect on our operat<strong>in</strong>g results. After the<br />

re-f<strong>in</strong>anc<strong>in</strong>g of much of our debt at our current credit rat<strong>in</strong>g, f<strong>in</strong>ance costs have <strong>in</strong>creased<br />

substantially – previously most of our debt had been raised when the group had a much better<br />

credit rat<strong>in</strong>g. The higher f<strong>in</strong>ance costs we now face have <strong>in</strong>creased our ‘f<strong>in</strong>ancial’ gear<strong>in</strong>g and we<br />

plan to address this by aggressively reduc<strong>in</strong>g our debt levels. We have made a good start at this<br />

by generat<strong>in</strong>g net cash of US$289 million <strong>in</strong> fiscal <strong>2009</strong> – despite the difficult operat<strong>in</strong>g conditions.<br />

Significant account<strong>in</strong>g policies and judgements<br />

The group has def<strong>in</strong>ed account<strong>in</strong>g policies as significant if they have the potential to materially<br />

affect the group’s f<strong>in</strong>ancial <strong>performance</strong>, position or cash flow.<br />

The group’s significant account<strong>in</strong>g policies are those that relate to:<br />

Asset impairments;<br />

Bus<strong>in</strong>ess comb<strong>in</strong>ations and goodwill impairments;<br />

Property, plant and equipment;<br />

Taxation;<br />

Hedge account<strong>in</strong>g;<br />

Plantations;<br />

Post-employment benefit funds; and<br />

Provisions.<br />

The effect of these account<strong>in</strong>g policies and judgements is <strong>in</strong>cluded <strong>in</strong> note 2 to the annual f<strong>in</strong>ancial<br />

statements.<br />

Sharehold<strong>in</strong>g and equity<br />

The group’s primary list<strong>in</strong>g is on the JSE Limited, South Africa’s stock exchange, and has a<br />

secondary list<strong>in</strong>g on the New York Stock Exchange. <strong>Sappi</strong> delisted from the London Stock<br />

Exchange <strong>in</strong> November <strong>2009</strong>. Information regard<strong>in</strong>g shares, share price, the value of shares<br />

traded, ma<strong>in</strong> shareholders and other related <strong>in</strong>formation is conta<strong>in</strong>ed on pages 64 and 65 of this<br />

annual report.