Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

54 Chief f<strong>in</strong>ancial officer’s report cont<strong>in</strong>ued<br />

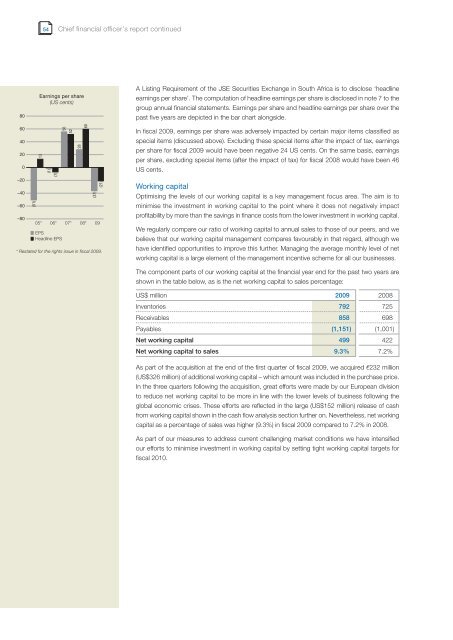

A List<strong>in</strong>g Requirement of the JSE Securities Exchange <strong>in</strong> South Africa is to disclose ‘headl<strong>in</strong>e<br />

earn<strong>in</strong>gs per share’. The computation of headl<strong>in</strong>e earn<strong>in</strong>gs per share is disclosed <strong>in</strong> note 7 to the<br />

group annual f<strong>in</strong>ancial statements. Earn<strong>in</strong>gs per share and headl<strong>in</strong>e earn<strong>in</strong>gs per share over the<br />

past five years are depicted <strong>in</strong> the bar chart alongside.<br />

In fiscal <strong>2009</strong>, earn<strong>in</strong>gs per share was adversely impacted by certa<strong>in</strong> major items classified as<br />

special items (discussed above). Exclud<strong>in</strong>g these special items after the impact of tax, earn<strong>in</strong>gs<br />

per share for fiscal <strong>2009</strong> would have been negative 24 US cents. On the same basis, earn<strong>in</strong>gs<br />

per share, exclud<strong>in</strong>g special items (after the impact of tax) for fiscal 2008 would have been 46<br />

US cents.<br />

Work<strong>in</strong>g capital<br />

Optimis<strong>in</strong>g the levels of our work<strong>in</strong>g capital is a key management focus area. The aim is to<br />

m<strong>in</strong>imise the <strong>in</strong>vestment <strong>in</strong> work<strong>in</strong>g capital to the po<strong>in</strong>t where it does not negatively impact<br />

profitability by more than the sav<strong>in</strong>gs <strong>in</strong> f<strong>in</strong>ance costs from the lower <strong>in</strong>vestment <strong>in</strong> work<strong>in</strong>g capital.<br />

We regularly compare our ratio of work<strong>in</strong>g capital to annual sales to those of our peers, and we<br />

believe that our work<strong>in</strong>g capital management compares favourably <strong>in</strong> that regard, although we<br />

have identified opportunities to improve this further. Manag<strong>in</strong>g the average monthly level of net<br />

work<strong>in</strong>g capital is a large element of the management <strong>in</strong>centive scheme for all our bus<strong>in</strong>esses.<br />

The component parts of our work<strong>in</strong>g capital at the f<strong>in</strong>ancial year end for the past two years are<br />

shown <strong>in</strong> the table below, as is the net work<strong>in</strong>g capital to sales percentage:<br />

US$ million <strong>2009</strong> 2008<br />

Inventories 792 725<br />

Receivables 858 698<br />

Payables (1,151) (1,001)<br />

Net work<strong>in</strong>g capital 499 422<br />

Net work<strong>in</strong>g capital to sales 9.3% 7.2%<br />

As part of the acquisition at the end of the first quarter of fiscal <strong>2009</strong>, we acquired r232 million<br />

(US$326 million) of additional work<strong>in</strong>g capital – which amount was <strong>in</strong>cluded <strong>in</strong> the purchase price.<br />

In the three quarters follow<strong>in</strong>g the acquisition, great efforts were made by our European division<br />

to reduce net work<strong>in</strong>g capital to be more <strong>in</strong> l<strong>in</strong>e with the lower levels of bus<strong>in</strong>ess follow<strong>in</strong>g the<br />

global economic crises. These efforts are reflected <strong>in</strong> the large (US$152 million) release of cash<br />

from work<strong>in</strong>g capital shown <strong>in</strong> the cash flow analysis section further on. Nevertheless, net work<strong>in</strong>g<br />

capital as a percentage of sales was higher (9.3%) <strong>in</strong> fiscal <strong>2009</strong> compared to 7.2% <strong>in</strong> 2008.<br />

As part of our measures to address current challeng<strong>in</strong>g market conditions we have <strong>in</strong>tensified<br />

our efforts to m<strong>in</strong>imise <strong>in</strong>vestment <strong>in</strong> work<strong>in</strong>g capital by sett<strong>in</strong>g tight work<strong>in</strong>g capital targets for<br />

fiscal 2010.