Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

124<br />

Notes to the group annual f<strong>in</strong>ancial statements cont<strong>in</strong>ued<br />

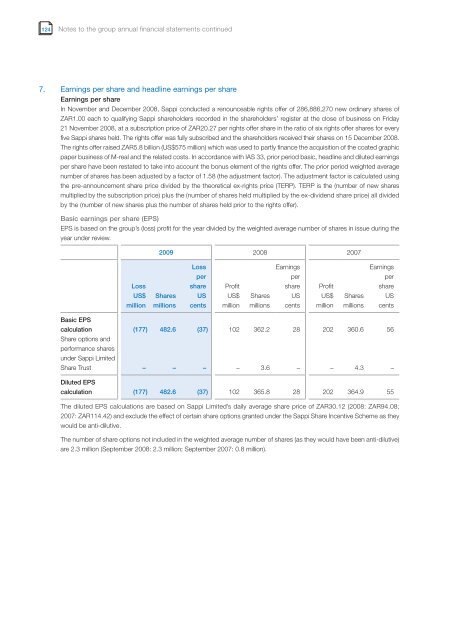

7. Earn<strong>in</strong>gs per share and headl<strong>in</strong>e earn<strong>in</strong>gs per share<br />

Earn<strong>in</strong>gs per share<br />

In November and December 2008, <strong>Sappi</strong> conducted a renounceable rights offer of 286,886,270 new ord<strong>in</strong>ary shares of<br />

ZAR1.00 each to qualify<strong>in</strong>g <strong>Sappi</strong> shareholders recorded <strong>in</strong> the shareholders’ register at the close of bus<strong>in</strong>ess on Friday<br />

21 November 2008, at a subscription price of ZAR20.27 per rights offer share <strong>in</strong> the ratio of six rights offer shares for every<br />

five <strong>Sappi</strong> shares held. The rights offer was fully subscribed and the shareholders received their shares on 15 December 2008.<br />

The rights offer raised ZAR5.8 billion (US$575 million) which was used to partly f<strong>in</strong>ance the acquisition of the coated graphic<br />

paper bus<strong>in</strong>ess of M-real and the related costs. In accordance with IAS 33, prior period basic, headl<strong>in</strong>e and diluted earn<strong>in</strong>gs<br />

per share have been restated to take <strong>in</strong>to account the bonus element of the rights offer. The prior period weighted average<br />

number of shares has been adjusted by a factor of 1.58 (the adjustment factor). The adjustment factor is calculated us<strong>in</strong>g<br />

the pre-announcement share price divided by the theoretical ex-rights price (TERP). TERP is the (number of new shares<br />

multiplied by the subscription price) plus the (number of shares held multiplied by the ex-dividend share price) all divided<br />

by the (number of new shares plus the number of shares held prior to the rights offer).<br />

Basic earn<strong>in</strong>gs per share (EPS)<br />

EPS is based on the group’s (loss) profit for the year divided by the weighted average number of shares <strong>in</strong> issue dur<strong>in</strong>g the<br />

year under review.<br />

Basic EPS<br />

Loss<br />

US$<br />

million<br />

<strong>2009</strong> 2008 2007<br />

Shares<br />

millions<br />

Loss<br />

per<br />

share<br />

US<br />

cents<br />

Profit<br />

US$<br />

million<br />

Shares<br />

millions<br />

Earn<strong>in</strong>gs<br />

per<br />

share<br />

US<br />

cents<br />

Profit<br />

US$<br />

million<br />

Shares<br />

millions<br />

Earn<strong>in</strong>gs<br />

calculation (177) 482.6 (37) 102 362.2 28 202 360.6 56<br />

Share options and<br />

<strong>performance</strong> shares<br />

under <strong>Sappi</strong> Limited<br />

Share Trust – – – – 3.6 – – 4.3 –<br />

Diluted EPS<br />

calculation (177) 482.6 (37) 102 365.8 28 202 364.9 55<br />

The diluted EPS calculations are based on <strong>Sappi</strong> Limited’s daily average share price of ZAR30.12 (2008: ZAR94.08;<br />

2007: ZAR114.42) and exclude the effect of certa<strong>in</strong> share options granted under the <strong>Sappi</strong> Share Incentive Scheme as they<br />

would be anti-dilutive.<br />

The number of share options not <strong>in</strong>cluded <strong>in</strong> the weighted average number of shares (as they would have been anti-dilutive)<br />

are 2.3 million (September 2008: 2.3 million; September 2007: 0.8 million).<br />

per<br />

share<br />

US<br />

cents