Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

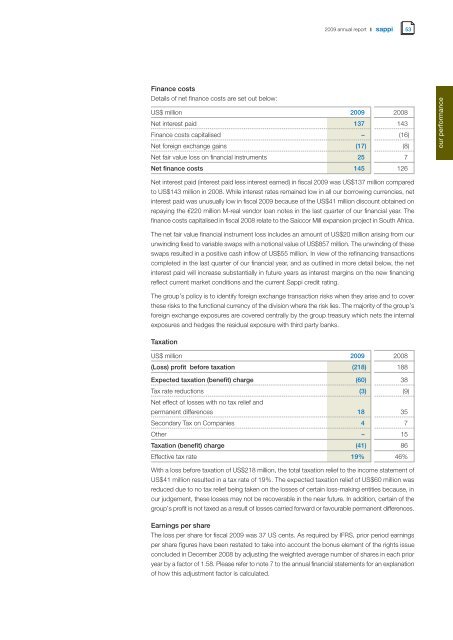

F<strong>in</strong>ance costs<br />

Details of net f<strong>in</strong>ance costs are set out below:<br />

Net <strong>in</strong>terest paid (<strong>in</strong>terest paid less <strong>in</strong>terest earned) <strong>in</strong> fiscal <strong>2009</strong> was US$137 million compared<br />

to US$143 million <strong>in</strong> 2008. While <strong>in</strong>terest rates rema<strong>in</strong>ed low <strong>in</strong> all our borrow<strong>in</strong>g currencies, net<br />

<strong>in</strong>terest paid was unusually low <strong>in</strong> fiscal <strong>2009</strong> because of the US$41 million discount obta<strong>in</strong>ed on<br />

repay<strong>in</strong>g the r220 million M-real vendor loan notes <strong>in</strong> the last quarter of our f<strong>in</strong>ancial year. The<br />

f<strong>in</strong>ance costs capitalised <strong>in</strong> fiscal 2008 relate to the Saiccor Mill expansion project <strong>in</strong> South Africa.<br />

The net fair value f<strong>in</strong>ancial <strong>in</strong>strument loss <strong>in</strong>cludes an amount of US$20 million aris<strong>in</strong>g from our<br />

unw<strong>in</strong>d<strong>in</strong>g fixed to variable swaps with a notional value of US$857 million. The unw<strong>in</strong>d<strong>in</strong>g of these<br />

swaps resulted <strong>in</strong> a positive cash <strong>in</strong>flow of US$55 million. In view of the ref<strong>in</strong>anc<strong>in</strong>g transactions<br />

completed <strong>in</strong> the last quarter of our f<strong>in</strong>ancial year, and as outl<strong>in</strong>ed <strong>in</strong> more detail below, the net<br />

<strong>in</strong>terest paid will <strong>in</strong>crease substantially <strong>in</strong> future years as <strong>in</strong>terest marg<strong>in</strong>s on the new f<strong>in</strong>anc<strong>in</strong>g<br />

reflect current market conditions and the current <strong>Sappi</strong> credit rat<strong>in</strong>g.<br />

The group’s policy is to identify foreign exchange transaction risks when they arise and to cover<br />

these risks to the functional currency of the division where the risk lies. The majority of the group’s<br />

foreign exchange exposures are covered centrally by the group treasury which nets the <strong>in</strong>ternal<br />

exposures and hedges the residual exposure with third party banks.<br />

Taxation<br />

<strong>2009</strong> annual report 53<br />

US$ million <strong>2009</strong> 2008<br />

Net <strong>in</strong>terest paid 137 143<br />

F<strong>in</strong>ance costs capitalised – (16)<br />

Net foreign exchange ga<strong>in</strong>s (17) (8)<br />

Net fair value loss on f<strong>in</strong>ancial <strong>in</strong>struments 25 7<br />

Net f<strong>in</strong>ance costs 145 126<br />

US$ million <strong>2009</strong> 2008<br />

(Loss) profit before taxation (218) 188<br />

Expected taxation (benefit) charge (60) 38<br />

Tax rate reductions<br />

Net effect of losses with no tax relief and<br />

(3) (9)<br />

permanent differences 18 35<br />

Secondary Tax on Companies 4 7<br />

Other – 15<br />

Taxation (benefit) charge (41) 86<br />

Effective tax rate 19% 46%<br />

With a loss before taxation of US$218 million, the total taxation relief to the <strong>in</strong>come statement of<br />

US$41 million resulted <strong>in</strong> a tax rate of 19%. The expected taxation relief of US$60 million was<br />

reduced due to no tax relief be<strong>in</strong>g taken on the losses of certa<strong>in</strong> loss-mak<strong>in</strong>g entities because, <strong>in</strong><br />

our judgement, these losses may not be recoverable <strong>in</strong> the near future. In addition, certa<strong>in</strong> of the<br />

group’s profit is not taxed as a result of losses carried forward or favourable permanent differences.<br />

Earn<strong>in</strong>gs per share<br />

The loss per share for fiscal <strong>2009</strong> was 37 US cents. As required by IFRS, prior period earn<strong>in</strong>gs<br />

per share figures have been restated to take <strong>in</strong>to account the bonus element of the rights issue<br />

concluded <strong>in</strong> December 2008 by adjust<strong>in</strong>g the weighted average number of shares <strong>in</strong> each prior<br />

year by a factor of 1.58. Please refer to note 7 to the annual f<strong>in</strong>ancial statements for an explanation<br />

of how this adjustment factor is calculated.<br />

our <strong>performance</strong>