Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

154<br />

Notes to the group annual f<strong>in</strong>ancial statements cont<strong>in</strong>ued<br />

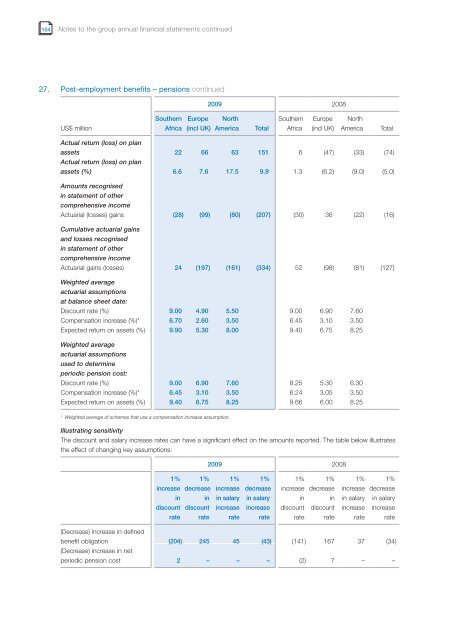

27. Post-employment benefits – pensions cont<strong>in</strong>ued<br />

US$ million<br />

Southern<br />

Africa<br />

Europe<br />

(<strong>in</strong>cl UK)<br />

<strong>2009</strong> 2008<br />

North<br />

America Total<br />

Southern<br />

Africa<br />

Europe<br />

(<strong>in</strong>cl UK)<br />

North<br />

America Total<br />

Actual return (loss) on plan<br />

assets<br />

Actual return (loss) on plan<br />

22 66 63 151 6 (47) (33) (74)<br />

assets (%) 6.6 7.6 17.5 9.9 1.3 (6.2) (9.0) (5.0)<br />

Amounts recognised<br />

<strong>in</strong> statement of other<br />

comprehensive <strong>in</strong>come<br />

Actuarial (losses) ga<strong>in</strong>s (28) (99) (80) (207) (30) 36 (22) (16)<br />

Cumulative actuarial ga<strong>in</strong>s<br />

and losses recognised<br />

<strong>in</strong> statement of other<br />

comprehensive <strong>in</strong>come<br />

Actuarial ga<strong>in</strong>s (losses) 24 (197) (161) (334) 52 (98) (81) (127)<br />

Weighted average<br />

actuarial assumptions<br />

at balance sheet date:<br />

Discount rate (%) 9.00 4.90 5.50 9.00 6.90 7.60<br />

Compensation <strong>in</strong>crease (%)* 6.70 2.60 3.50 6.45 3.10 3.50<br />

Expected return on assets (%) 9.90 5.30 8.00 9.40 6.75 8.25<br />

Weighted average<br />

actuarial assumptions<br />

used to determ<strong>in</strong>e<br />

periodic pension cost:<br />

Discount rate (%) 9.00 6.90 7.60 8.25 5.30 6.30<br />

Compensation <strong>in</strong>crease (%)* 6.45 3.10 3.50 6.24 3.05 3.50<br />

Expected return on assets (%) 9.40 6.75 8.25 9.66 6.00 8.25<br />

* Weighted average of schemes that use a compensation <strong>in</strong>crease assumption.<br />

Illustrat<strong>in</strong>g sensitivity<br />

The discount and salary <strong>in</strong>crease rates can have a significant effect on the amounts reported. The table below illustrates<br />

the effect of chang<strong>in</strong>g key assumptions:<br />

1% 1%<br />

<strong>in</strong>crease decrease<br />

<strong>in</strong> <strong>in</strong><br />

discount discount<br />

rate rate<br />

<strong>2009</strong> 2008<br />

1%<br />

<strong>in</strong>crease<br />

<strong>in</strong> salary<br />

<strong>in</strong>crease<br />

rate<br />

1%<br />

decrease<br />

<strong>in</strong> salary<br />

<strong>in</strong>crease<br />

rate<br />

1% 1%<br />

<strong>in</strong>crease decrease<br />

<strong>in</strong> <strong>in</strong><br />

discount discount<br />

rate rate<br />

1% 1%<br />

<strong>in</strong>crease decrease<br />

<strong>in</strong> salary <strong>in</strong> salary<br />

<strong>in</strong>crease <strong>in</strong>crease<br />

rate rate<br />

(Decrease) <strong>in</strong>crease <strong>in</strong> def<strong>in</strong>ed<br />

benefit obligation<br />

(Decrease) <strong>in</strong>crease <strong>in</strong> net<br />

(204) 245 45 (43) (141) 167 37 (34)<br />

periodic pension cost 2 – – – (2) 7 – –