Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

62<br />

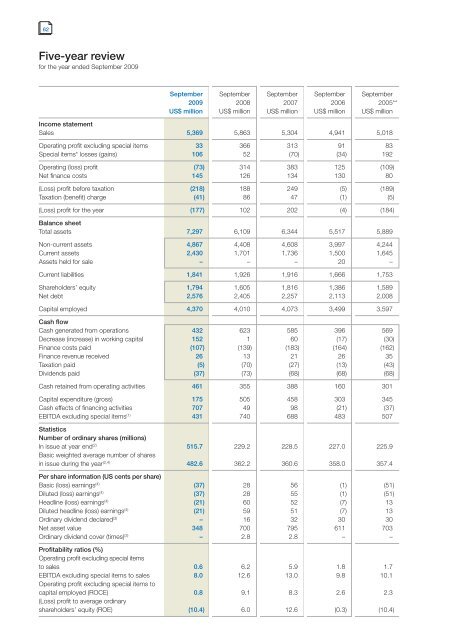

Five-year review<br />

for the year ended September <strong>2009</strong><br />

September September September September September<br />

<strong>2009</strong> 2008 2007 2006 2005**<br />

US$ million US$ million US$ million US$ million US$ million<br />

Income statement<br />

Sales 5,369 5,863 5,304 4,941 5,018<br />

Operat<strong>in</strong>g profit exclud<strong>in</strong>g special items 33 366 313 91 83<br />

Special items* losses (ga<strong>in</strong>s) 106 52 (70) (34) 192<br />

Operat<strong>in</strong>g (loss) profit (73) 314 383 125 (109)<br />

Net f<strong>in</strong>ance costs 145 126 134 130 80<br />

(Loss) profit before taxation (218) 188 249 (5) (189)<br />

Taxation (benefit) charge (41) 86 47 (1) (5)<br />

(Loss) profit for the year (177) 102 202 (4) (184)<br />

Balance sheet<br />

Total assets 7,297 6,109 6,344 5,517 5,889<br />

Non-current assets 4,867 4,408 4,608 3,997 4,244<br />

Current assets 2,430 1,701 1,736 1,500 1,645<br />

Assets held for sale – – – 20 –<br />

Current liabilities 1,841 1,926 1,916 1,666 1,753<br />

Shareholders’ equity 1,794 1,605 1,816 1,386 1,589<br />

Net debt 2,576 2,405 2,257 2,113 2,008<br />

Capital employed 4,370 4,010 4,073 3,499 3,597<br />

Cash flow<br />

Cash generated from operations 432 623 585 396 569<br />

Decrease (<strong>in</strong>crease) <strong>in</strong> work<strong>in</strong>g capital 152 1 60 (17) (30)<br />

F<strong>in</strong>ance costs paid (107) (139) (183) (164) (162)<br />

F<strong>in</strong>ance revenue received 26 13 21 26 35<br />

Taxation paid (5) (70) (27) (13) (43)<br />

Dividends paid (37) (73) (68) (68) (68)<br />

Cash reta<strong>in</strong>ed from operat<strong>in</strong>g activities 461 355 388 160 301<br />

Capital expenditure (gross) 175 505 458 303 345<br />

Cash effects of f<strong>in</strong>anc<strong>in</strong>g activities 707 49 98 (21) (37)<br />

EBITDA exclud<strong>in</strong>g special items (1) 431 740 688 483 507<br />

Statistics<br />

Number of ord<strong>in</strong>ary shares (millions)<br />

In issue at year end (2) 515.7 229.2 228.5 227.0 225.9<br />

Basic weighted average number of shares<br />

<strong>in</strong> issue dur<strong>in</strong>g the year (2,4) 482.6 362.2 360.6 358.0 357.4<br />

Per share <strong>in</strong>formation (US cents per share)<br />

Basic (loss) earn<strong>in</strong>gs (4) (37) 28 56 (1) (51)<br />

Diluted (loss) earn<strong>in</strong>gs (4) (37) 28 55 (1) (51)<br />

Headl<strong>in</strong>e (loss) earn<strong>in</strong>gs (4) (21) 60 52 (7) 13<br />

Diluted headl<strong>in</strong>e (loss) earn<strong>in</strong>gs (4) (21) 59 51 (7) 13<br />

Ord<strong>in</strong>ary dividend declared (3) – 16 32 30 30<br />

Net asset value 348 700 795 611 703<br />

Ord<strong>in</strong>ary dividend cover (times) (3) – 2.8 2.8 – –<br />

Profitability ratios (%)<br />

Operat<strong>in</strong>g profit exclud<strong>in</strong>g special items<br />

to sales 0.6 6.2 5.9 1.8 1.7<br />

EBITDA exclud<strong>in</strong>g special items to sales 8.0 12.6 13.0 9.8 10.1<br />

Operat<strong>in</strong>g profit exclud<strong>in</strong>g special items to<br />

capital employed (ROCE) 0.8 9.1 8.3 2.6 2.3<br />

(Loss) profit to average ord<strong>in</strong>ary<br />

shareholders’ equity (ROE) (10.4) 6.0 12.6 (0.3) (10.4)