Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>2009</strong> annual report<br />

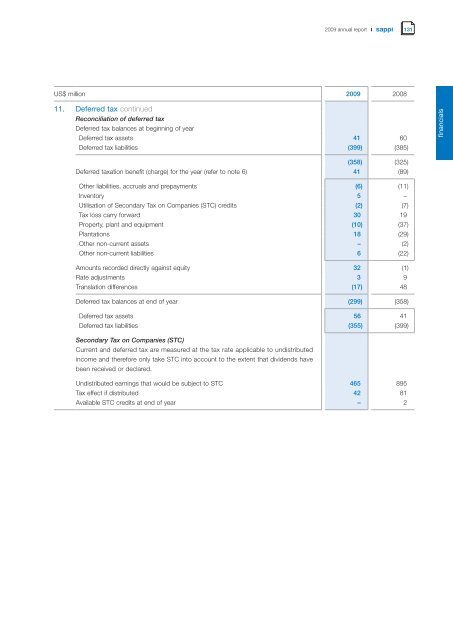

US$ million <strong>2009</strong> 2008<br />

11. Deferred tax cont<strong>in</strong>ued<br />

Reconciliation of deferred tax<br />

Deferred tax balances at beg<strong>in</strong>n<strong>in</strong>g of year<br />

Deferred tax assets 41 60<br />

Deferred tax liabilities (399) (385)<br />

(358) (325)<br />

Deferred taxation benefit (charge) for the year (refer to note 6) 41 (89)<br />

Other liabilities, accruals and prepayments (6) (11)<br />

Inventory 5 –<br />

Utilisation of Secondary Tax on Companies (STC) credits (2) (7)<br />

Tax loss carry forward 30 19<br />

Property, plant and equipment (10) (37)<br />

Plantations 18 (29)<br />

Other non-current assets – (2)<br />

Other non-current liabilities 6 (22)<br />

Amounts recorded directly aga<strong>in</strong>st equity 32 (1)<br />

Rate adjustments 3 9<br />

Translation differences (17) 48<br />

Deferred tax balances at end of year (299) (358)<br />

Deferred tax assets 56 41<br />

Deferred tax liabilities (355) (399)<br />

Secondary Tax on Companies (STC)<br />

Current and deferred tax are measured at the tax rate applicable to undistributed<br />

<strong>in</strong>come and therefore only take STC <strong>in</strong>to account to the extent that dividends have<br />

been received or declared.<br />

Undistributed earn<strong>in</strong>gs that would be subject to STC 465 895<br />

Tax effect if distributed 42 81<br />

Available STC credits at end of year – 2<br />

131<br />

f<strong>in</strong>ancials