Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

152<br />

Notes to the group annual f<strong>in</strong>ancial statements cont<strong>in</strong>ued<br />

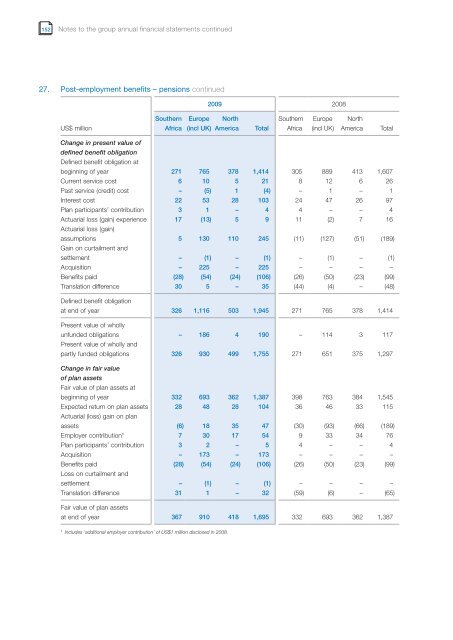

27. Post-employment benefits – pensions cont<strong>in</strong>ued<br />

US$ million<br />

Southern<br />

Africa<br />

Europe<br />

(<strong>in</strong>cl UK)<br />

<strong>2009</strong> 2008<br />

North<br />

America Total<br />

Southern<br />

Africa<br />

Europe<br />

(<strong>in</strong>cl UK)<br />

North<br />

America Total<br />

Change <strong>in</strong> present value of<br />

def<strong>in</strong>ed benefit obligation<br />

Def<strong>in</strong>ed benefit obligation at<br />

beg<strong>in</strong>n<strong>in</strong>g of year 271 765 378 1,414 305 889 413 1,607<br />

Current service cost 6 10 5 21 8 12 6 26<br />

Past service (credit) cost – (5) 1 (4) – 1 – 1<br />

Interest cost 22 53 28 103 24 47 26 97<br />

Plan participants’ contribution 3 1 – 4 4 – – 4<br />

Actuarial loss (ga<strong>in</strong>) experience<br />

Actuarial loss (ga<strong>in</strong>)<br />

17 (13) 5 9 11 (2) 7 16<br />

assumptions<br />

Ga<strong>in</strong> on curtailment and<br />

5 130 110 245 (11) (127) (51) (189)<br />

settlement – (1) – (1) – (1) – (1)<br />

Acquisition – 225 – 225 – – – –<br />

Benefits paid (28) (54) (24) (106) (26) (50) (23) (99)<br />

Translation difference 30 5 – 35 (44) (4) – (48)<br />

Def<strong>in</strong>ed benefit obligation<br />

at end of year 326 1,116 503 1,945 271 765 378 1,414<br />

Present value of wholly<br />

unfunded obligations<br />

Present value of wholly and<br />

– 186 4 190 – 114 3 117<br />

partly funded obligations 326 930 499 1,755 271 651 375 1,297<br />

Change <strong>in</strong> fair value<br />

of plan assets<br />

Fair value of plan assets at<br />

beg<strong>in</strong>n<strong>in</strong>g of year 332 693 362 1,387 398 763 384 1,545<br />

Expected return on plan assets<br />

Actuarial (loss) ga<strong>in</strong> on plan<br />

28 48 28 104 36 46 33 115<br />

assets (6) 18 35 47 (30) (93) (66) (189)<br />

Employer contribution* 7 30 17 54 9 33 34 76<br />

Plan participants’ contribution 3 2 – 5 4 – – 4<br />

Acquisition – 173 – 173 – – – –<br />

Benefits paid<br />

Loss on curtailment and<br />

(28) (54) (24) (106) (26) (50) (23) (99)<br />

settlement – (1) – (1) – – – –<br />

Translation difference 31 1 – 32 (59) (6) – (65)<br />

Fair value of plan assets<br />

at end of year 367 910 418 1,695 332 693 362 1,387<br />

* Includes ‘additional employer contribution’ of US$1 million disclosed <strong>in</strong> 2008.