Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

16. Trade and other receivables cont<strong>in</strong>ued<br />

16.5 Off balance sheet structures cont<strong>in</strong>ued<br />

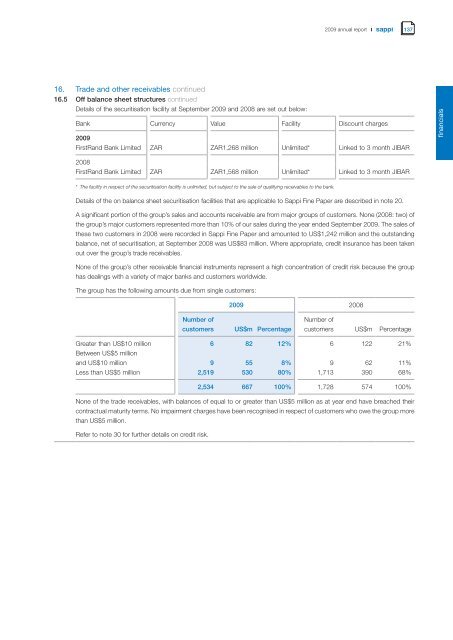

Details of the securitisation facility at September <strong>2009</strong> and 2008 are set out below:<br />

<strong>2009</strong> annual report<br />

Bank Currency Value Facility Discount charges<br />

<strong>2009</strong><br />

FirstRand Bank Limited ZAR ZAR1,268 million Unlimited* L<strong>in</strong>ked to 3 month JIBAR<br />

2008<br />

FirstRand Bank Limited ZAR ZAR1,568 million Unlimited* L<strong>in</strong>ked to 3 month JIBAR<br />

* The facility <strong>in</strong> respect of the securitisation facility is unlimited, but subject to the sale of qualify<strong>in</strong>g receivables to the bank.<br />

Details of the on balance sheet securitisation facilities that are applicable to <strong>Sappi</strong> F<strong>in</strong>e Paper are described <strong>in</strong> note 20.<br />

A significant portion of the group’s sales and accounts receivable are from major groups of customers. None (2008: two) of<br />

the group’s major customers represented more than 10% of our sales dur<strong>in</strong>g the year ended September <strong>2009</strong>. The sales of<br />

these two customers <strong>in</strong> 2008 were recorded <strong>in</strong> <strong>Sappi</strong> F<strong>in</strong>e Paper and amounted to US$1,242 million and the outstand<strong>in</strong>g<br />

balance, net of securitisation, at September 2008 was US$83 million. Where appropriate, credit <strong>in</strong>surance has been taken<br />

out over the group’s trade receivables.<br />

None of the group’s other receivable f<strong>in</strong>ancial <strong>in</strong>struments represent a high concentration of credit risk because the group<br />

has deal<strong>in</strong>gs with a variety of major banks and customers worldwide.<br />

The group has the follow<strong>in</strong>g amounts due from s<strong>in</strong>gle customers:<br />

<strong>2009</strong> 2008<br />

Number of<br />

customers US$m Percentage<br />

137<br />

Number of<br />

customers US$m Percentage<br />

Greater than US$10 million<br />

Between US$5 million<br />

6 82 12% 6 122 21%<br />

and US$10 million 9 55 8% 9 62 11%<br />

Less than US$5 million 2,519 530 80% 1,713 390 68%<br />

2,534 667 100% 1,728 574 100%<br />

None of the trade receivables, with balances of equal to or greater than US$5 million as at year end have breached their<br />

contractual maturity terms. No impairment charges have been recognised <strong>in</strong> respect of customers who owe the group more<br />

than US$5 million.<br />

Refer to note 30 for further details on credit risk.<br />

f<strong>in</strong>ancials