Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>2009</strong> annual report<br />

US$ million <strong>2009</strong> 2008<br />

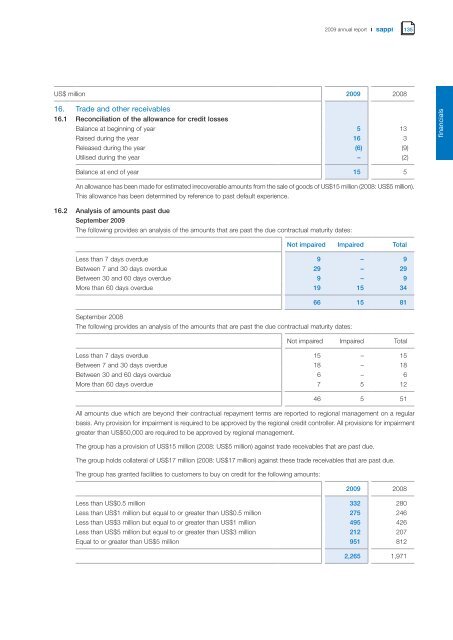

16. Trade and other receivables<br />

16.1 Reconciliation of the allowance for credit losses<br />

Balance at beg<strong>in</strong>n<strong>in</strong>g of year 5 13<br />

Raised dur<strong>in</strong>g the year 16 3<br />

Released dur<strong>in</strong>g the year (6) (9)<br />

Utilised dur<strong>in</strong>g the year – (2)<br />

Balance at end of year 15 5<br />

An allowance has been made for estimated irrecoverable amounts from the sale of goods of US$15 million (2008: US$5 million).<br />

This allowance has been determ<strong>in</strong>ed by reference to past default experience.<br />

16.2 Analysis of amounts past due<br />

September <strong>2009</strong><br />

The follow<strong>in</strong>g provides an analysis of the amounts that are past the due contractual maturity dates:<br />

Not impaired Impaired Total<br />

Less than 7 days overdue 9 – 9<br />

Between 7 and 30 days overdue 29 – 29<br />

Between 30 and 60 days overdue 9 – 9<br />

More than 60 days overdue 19 15 34<br />

September 2008<br />

The follow<strong>in</strong>g provides an analysis of the amounts that are past the due contractual maturity dates:<br />

66 15 81<br />

Not impaired Impaired Total<br />

Less than 7 days overdue 15 – 15<br />

Between 7 and 30 days overdue 18 – 18<br />

Between 30 and 60 days overdue 6 – 6<br />

More than 60 days overdue 7 5 12<br />

46 5 51<br />

All amounts due which are beyond their contractual repayment terms are reported to regional management on a regular<br />

basis. Any provision for impairment is required to be approved by the regional credit controller. All provisions for impairment<br />

greater than US$50,000 are required to be approved by regional management.<br />

The group has a provision of US$15 million (2008: US$5 million) aga<strong>in</strong>st trade receivables that are past due.<br />

The group holds collateral of US$17 million (2008: US$17 million) aga<strong>in</strong>st these trade receivables that are past due.<br />

The group has granted facilities to customers to buy on credit for the follow<strong>in</strong>g amounts:<br />

<strong>2009</strong> 2008<br />

Less than US$0.5 million 332 280<br />

Less than US$1 million but equal to or greater than US$0.5 million 275 246<br />

Less than US$3 million but equal to or greater than US$1 million 495 426<br />

Less than US$5 million but equal to or greater than US$3 million 212 207<br />

Equal to or greater than US$5 million 951 812<br />

135<br />

2,265 1,971<br />

f<strong>in</strong>ancials