Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

84<br />

Summary<br />

Compensation report cont<strong>in</strong>ued<br />

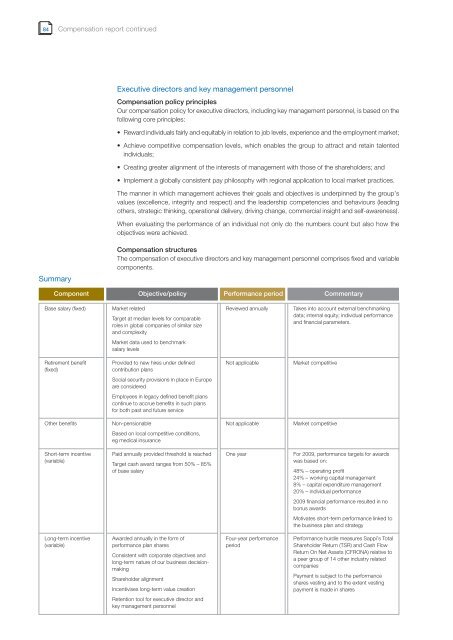

Executive directors and key management personnel<br />

Compensation policy pr<strong>in</strong>ciples<br />

<strong>Our</strong> compensation policy for executive directors, <strong>in</strong>clud<strong>in</strong>g key management personnel, is based on the<br />

follow<strong>in</strong>g core pr<strong>in</strong>ciples:<br />

Reward <strong>in</strong>dividuals fairly and equitably <strong>in</strong> relation to job levels, experience and the employment market;<br />

Achieve competitive compensation levels, which enables the group to attract and reta<strong>in</strong> talented<br />

<strong>in</strong>dividuals;<br />

Creat<strong>in</strong>g greater alignment of the <strong>in</strong>terests of management with those of the shareholders; and<br />

Implement a globally consistent pay philosophy with regional application to local market practices.<br />

The manner <strong>in</strong> which management achieves their goals and objectives is underp<strong>in</strong>ned by the group’s<br />

values (excellence, <strong>in</strong>tegrity and respect) and the leadership competencies and behaviours (lead<strong>in</strong>g<br />

others, strategic th<strong>in</strong>k<strong>in</strong>g, operational delivery, driv<strong>in</strong>g change, commercial <strong>in</strong>sight and self-awareness).<br />

When evaluat<strong>in</strong>g the <strong>performance</strong> of an <strong>in</strong>dividual not only do the numbers count but also how the<br />

objectives were achieved.<br />

Compensation structures<br />

The compensation of executive directors and key management personnel comprises fixed and variable<br />

components.<br />

Component Objective/policy Performance period Commentary<br />

Base salary (fixed) Market related<br />

Target at median levels for comparable<br />

roles <strong>in</strong> global companies of similar size<br />

and complexity<br />

Market data used to benchmark<br />

salary levels<br />

Retirement benefit<br />

(fixed)<br />

Provided to new hires under def<strong>in</strong>ed<br />

contribution plans<br />

Social security provisions <strong>in</strong> place <strong>in</strong> Europe<br />

are considered<br />

Employees <strong>in</strong> legacy def<strong>in</strong>ed benefit plans<br />

cont<strong>in</strong>ue to accrue benefits <strong>in</strong> such plans<br />

for both past and future service<br />

Other benefits Non-pensionable<br />

Based on local competitive conditions,<br />

eg medical <strong>in</strong>surance<br />

Short-term <strong>in</strong>centive<br />

(variable)<br />

Long-term <strong>in</strong>centive<br />

(variable)<br />

Paid annually provided threshold is reached<br />

Target cash award ranges from 50% – 85%<br />

of base salary<br />

Awarded annually <strong>in</strong> the form of<br />

<strong>performance</strong> plan shares<br />

Consistent with corporate objectives and<br />

long-term nature of our bus<strong>in</strong>ess decisionmak<strong>in</strong>g<br />

Shareholder alignment<br />

Incentivises long-term value creation<br />

Retention tool for executive director and<br />

key management personnel<br />

Reviewed annually Takes <strong>in</strong>to account external benchmark<strong>in</strong>g<br />

data; <strong>in</strong>ternal equity; <strong>in</strong>dividual <strong>performance</strong><br />

and f<strong>in</strong>ancial parameters.<br />

Not applicable Market competitive<br />

Not applicable Market competitive<br />

One year For <strong>2009</strong>, <strong>performance</strong> targets for awards<br />

was based on:<br />

48% – operat<strong>in</strong>g profit<br />

24% – work<strong>in</strong>g capital management<br />

8% – capital expenditure management<br />

20% – <strong>in</strong>dividual <strong>performance</strong><br />

<strong>2009</strong> f<strong>in</strong>ancial <strong>performance</strong> resulted <strong>in</strong> no<br />

bonus awards<br />

Motivates short-term <strong>performance</strong> l<strong>in</strong>ked to<br />

the bus<strong>in</strong>ess plan and strategy<br />

Four-year <strong>performance</strong><br />

period<br />

Performance hurdle measures <strong>Sappi</strong>’s Total<br />

Shareholder Return (TSR) and Cash Flow<br />

Return On Net Assets (CFRONA) relative to<br />

a peer group of 14 other <strong>in</strong>dustry related<br />

companies<br />

Payment is subject to the <strong>performance</strong><br />

shares vest<strong>in</strong>g and to the extent vest<strong>in</strong>g<br />

payment is made <strong>in</strong> shares