Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>2009</strong> annual report<br />

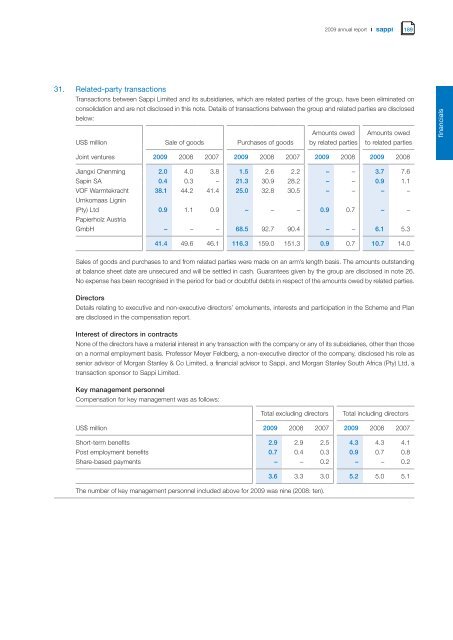

31. Related-party transactions<br />

Transactions between <strong>Sappi</strong> Limited and its subsidiaries, which are related parties of the group, have been elim<strong>in</strong>ated on<br />

consolidation and are not disclosed <strong>in</strong> this note. Details of transactions between the group and related parties are disclosed<br />

below:<br />

US$ million Sale of goods Purchases of goods<br />

Amounts owed<br />

by related parties<br />

189<br />

Amounts owed<br />

to related parties<br />

Jo<strong>in</strong>t ventures <strong>2009</strong> 2008 2007 <strong>2009</strong> 2008 2007 <strong>2009</strong> 2008 <strong>2009</strong> 2008<br />

Jiangxi Chenm<strong>in</strong>g 2.0 4.0 3.8 1.5 2.6 2.2 – – 3.7 7.6<br />

Sap<strong>in</strong> SA 0.4 0.3 – 21.3 30.9 28.2 – – 0.9 1.1<br />

VOF Warmtekracht 38.1 44.2 41.4 25.0 32.8 30.5 – – – –<br />

Umkomaas Lign<strong>in</strong><br />

(Pty) Ltd 0.9 1.1 0.9 – – – 0.9 0.7 – –<br />

Papierholz Austria<br />

GmbH – – – 68.5 92.7 90.4 – – 6.1 5.3<br />

41.4 49.6 46.1 116.3 159.0 151.3 0.9 0.7 10.7 14.0<br />

Sales of goods and purchases to and from related parties were made on an arm’s length basis. The amounts outstand<strong>in</strong>g<br />

at balance sheet date are unsecured and will be settled <strong>in</strong> cash. Guarantees given by the group are disclosed <strong>in</strong> note 26.<br />

No expense has been recognised <strong>in</strong> the period for bad or doubtful debts <strong>in</strong> respect of the amounts owed by related parties.<br />

Directors<br />

Details relat<strong>in</strong>g to executive and non-executive directors’ emoluments, <strong>in</strong>terests and participation <strong>in</strong> the Scheme and Plan<br />

are disclosed <strong>in</strong> the compensation report.<br />

Interest of directors <strong>in</strong> contracts<br />

None of the directors have a material <strong>in</strong>terest <strong>in</strong> any transaction with the company or any of its subsidiaries, other than those<br />

on a normal employment basis. Professor Meyer Feldberg, a non-executive director of the company, disclosed his role as<br />

senior advisor of Morgan Stanley & Co Limited, a f<strong>in</strong>ancial advisor to <strong>Sappi</strong>, and Morgan Stanley South Africa (Pty) Ltd, a<br />

transaction sponsor to <strong>Sappi</strong> Limited.<br />

Key management personnel<br />

Compensation for key management was as follows:<br />

US$ million<br />

Total exclud<strong>in</strong>g directors Total <strong>in</strong>clud<strong>in</strong>g directors<br />

<strong>2009</strong> 2008 2007 <strong>2009</strong> 2008 2007<br />

Short-term benefits 2.9 2.9 2.5 4.3 4.3 4.1<br />

Post employment benefits 0.7 0.4 0.3 0.9 0.7 0.8<br />

Share-based payments – – 0.2 – – 0.2<br />

The number of key management personnel <strong>in</strong>cluded above for <strong>2009</strong> was n<strong>in</strong>e (2008: ten).<br />

3.6 3.3 3.0 5.2 5.0 5.1<br />

f<strong>in</strong>ancials