Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>2009</strong> annual report<br />

US$ million <strong>2009</strong> 2008<br />

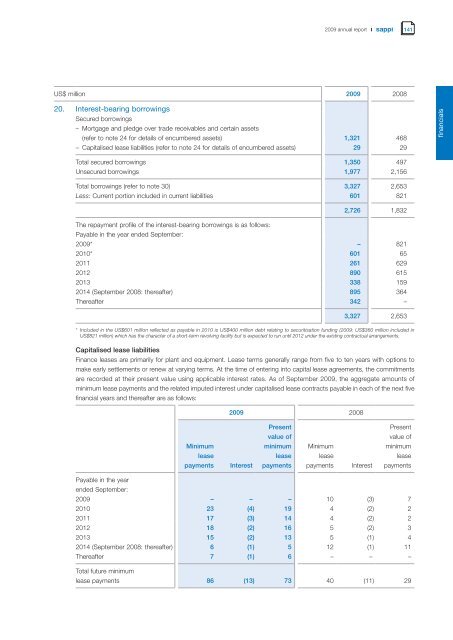

20. Interest-bear<strong>in</strong>g borrow<strong>in</strong>gs<br />

Secured borrow<strong>in</strong>gs<br />

– Mortgage and pledge over trade receivables and certa<strong>in</strong> assets<br />

(refer to note 24 for details of encumbered assets) 1,321 468<br />

– Capitalised lease liabilities (refer to note 24 for details of encumbered assets) 29 29<br />

Total secured borrow<strong>in</strong>gs 1,350 497<br />

Unsecured borrow<strong>in</strong>gs 1,977 2,156<br />

Total borrow<strong>in</strong>gs (refer to note 30) 3,327 2,653<br />

Less: Current portion <strong>in</strong>cluded <strong>in</strong> current liabilities 601 821<br />

The repayment profile of the <strong>in</strong>terest-bear<strong>in</strong>g borrow<strong>in</strong>gs is as follows:<br />

Payable <strong>in</strong> the year ended September:<br />

2,726 1,832<br />

<strong>2009</strong>* – 821<br />

2010* 601 65<br />

2011 261 629<br />

2012 890 615<br />

2013 338 159<br />

2014 (September 2008: thereafter) 895 364<br />

Thereafter 342 –<br />

3,327 2,653<br />

* Included <strong>in</strong> the US$601 million reflected as payable <strong>in</strong> 2010 is US$400 million debt relat<strong>in</strong>g to securitisation fund<strong>in</strong>g (<strong>2009</strong>: US$360 million <strong>in</strong>cluded <strong>in</strong><br />

US$821 million) which has the character of a short-term revolv<strong>in</strong>g facility but is expected to run until 2012 under the exist<strong>in</strong>g contractual arrangements.<br />

Capitalised lease liabilities<br />

F<strong>in</strong>ance leases are primarily for plant and equipment. Lease terms generally range from five to ten years with options to<br />

make early settlements or renew at vary<strong>in</strong>g terms. At the time of enter<strong>in</strong>g <strong>in</strong>to capital lease agreements, the commitments<br />

are recorded at their present value us<strong>in</strong>g applicable <strong>in</strong>terest rates. As of September <strong>2009</strong>, the aggregate amounts of<br />

m<strong>in</strong>imum lease payments and the related imputed <strong>in</strong>terest under capitalised lease contracts payable <strong>in</strong> each of the next five<br />

f<strong>in</strong>ancial years and thereafter are as follows:<br />

Payable <strong>in</strong> the year<br />

ended September:<br />

M<strong>in</strong>imum<br />

lease<br />

payments Interest<br />

<strong>2009</strong> 2008<br />

Present<br />

value of<br />

m<strong>in</strong>imum<br />

lease<br />

payments<br />

M<strong>in</strong>imum<br />

lease<br />

payments Interest<br />

141<br />

Present<br />

value of<br />

m<strong>in</strong>imum<br />

lease<br />

payments<br />

<strong>2009</strong> – – – 10 (3) 7<br />

2010 23 (4) 19 4 (2) 2<br />

2011 17 (3) 14 4 (2) 2<br />

2012 18 (2) 16 5 (2) 3<br />

2013 15 (2) 13 5 (1) 4<br />

2014 (September 2008: thereafter) 6 (1) 5 12 (1) 11<br />

Thereafter 7 (1) 6 – – –<br />

Total future m<strong>in</strong>imum<br />

lease payments 86 (13) 73 40 (11) 29<br />

f<strong>in</strong>ancials