Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

108<br />

Notes to the group annual f<strong>in</strong>ancial statements cont<strong>in</strong>ued<br />

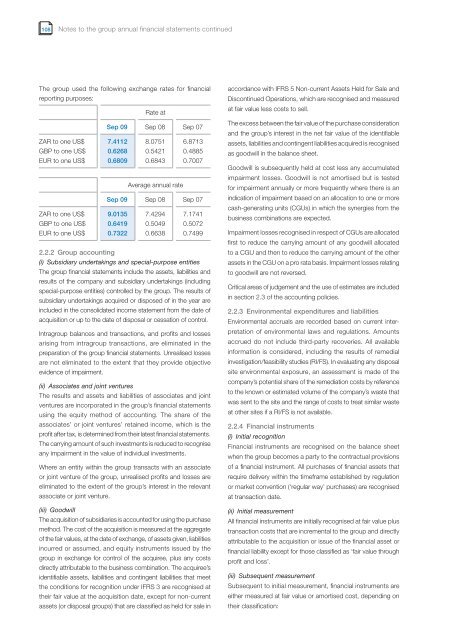

The group used the follow<strong>in</strong>g exchange rates for f<strong>in</strong>ancial<br />

report<strong>in</strong>g purposes:<br />

Rate at<br />

Sep 09 Sep 08 Sep 07<br />

ZAR to one US$ 7.4112 8.0751 6.8713<br />

GBP to one US$ 0.6268 0.5421 0.4885<br />

EUR to one US$ 0.6809 0.6843 0.7007<br />

Average annual rate<br />

Sep 09 Sep 08 Sep 07<br />

ZAR to one US$ 9.0135 7.4294 7.1741<br />

GBP to one US$ 0.6419 0.5049 0.5072<br />

EUR to one US$ 0.7322 0.6638 0.7499<br />

2.2.2 Group account<strong>in</strong>g<br />

(i) Subsidiary undertak<strong>in</strong>gs and special-purpose entities<br />

The group f<strong>in</strong>ancial statements <strong>in</strong>clude the assets, liabilities and<br />

results of the company and subsidiary undertak<strong>in</strong>gs (<strong>in</strong>clud<strong>in</strong>g<br />

special-purpose entities) controlled by the group. The results of<br />

subsidiary undertak<strong>in</strong>gs acquired or disposed of <strong>in</strong> the year are<br />

<strong>in</strong>cluded <strong>in</strong> the consolidated <strong>in</strong>come statement from the date of<br />

acquisition or up to the date of disposal or cessation of control.<br />

Intragroup balances and transactions, and profits and losses<br />

aris<strong>in</strong>g from <strong>in</strong>tragroup transactions, are elim<strong>in</strong>ated <strong>in</strong> the<br />

preparation of the group f<strong>in</strong>ancial statements. Unrealised losses<br />

are not elim<strong>in</strong>ated to the extent that they provide objective<br />

evidence of impairment.<br />

(ii) Associates and jo<strong>in</strong>t ventures<br />

The results and assets and liabilities of associates and jo<strong>in</strong>t<br />

ventures are <strong>in</strong>corporated <strong>in</strong> the group’s f<strong>in</strong>ancial statements<br />

us<strong>in</strong>g the equity method of account<strong>in</strong>g. The share of the<br />

associates’ or jo<strong>in</strong>t ventures’ reta<strong>in</strong>ed <strong>in</strong>come, which is the<br />

profit after tax, is determ<strong>in</strong>ed from their latest f<strong>in</strong>ancial statements.<br />

The carry<strong>in</strong>g amount of such <strong>in</strong>vestments is reduced to recognise<br />

any impairment <strong>in</strong> the value of <strong>in</strong>dividual <strong>in</strong>vestments.<br />

Where an entity with<strong>in</strong> the group transacts with an associate<br />

or jo<strong>in</strong>t venture of the group, unrealised profits and losses are<br />

elim<strong>in</strong>ated to the extent of the group’s <strong>in</strong>terest <strong>in</strong> the relevant<br />

associate or jo<strong>in</strong>t venture.<br />

(iii) Goodwill<br />

The acquisition of subsidiaries is accounted for us<strong>in</strong>g the purchase<br />

method. The cost of the acquisition is measured at the aggregate<br />

of the fair values, at the date of exchange, of assets given, liabilities<br />

<strong>in</strong>curred or assumed, and equity <strong>in</strong>struments issued by the<br />

group <strong>in</strong> exchange for control of the acquiree, plus any costs<br />

directly attributable to the bus<strong>in</strong>ess comb<strong>in</strong>ation. The acquiree’s<br />

identifiable assets, liabilities and cont<strong>in</strong>gent liabilities that meet<br />

the conditions for recognition under IFRS 3 are recognised at<br />

their fair value at the acquisition date, except for non-current<br />

assets (or disposal groups) that are classified as held for sale <strong>in</strong><br />

accordance with IFRS 5 Non-current Assets Held for Sale and<br />

Discont<strong>in</strong>ued Operations, which are recognised and measured<br />

at fair value less costs to sell.<br />

The excess between the fair value of the purchase consideration<br />

and the group’s <strong>in</strong>terest <strong>in</strong> the net fair value of the identifiable<br />

assets, liabilities and cont<strong>in</strong>gent liabilities acquired is recognised<br />

as goodwill <strong>in</strong> the balance sheet.<br />

Goodwill is subsequently held at cost less any accumulated<br />

impairment losses. Goodwill is not amortised but is tested<br />

for impairment annually or more frequently where there is an<br />

<strong>in</strong>dication of impairment based on an allocation to one or more<br />

cash-generat<strong>in</strong>g units (CGUs) <strong>in</strong> which the synergies from the<br />

bus<strong>in</strong>ess comb<strong>in</strong>ations are expected.<br />

Impairment losses recognised <strong>in</strong> respect of CGUs are allocated<br />

first to reduce the carry<strong>in</strong>g amount of any goodwill allocated<br />

to a CGU and then to reduce the carry<strong>in</strong>g amount of the other<br />

assets <strong>in</strong> the CGU on a pro rata basis. Impairment losses relat<strong>in</strong>g<br />

to goodwill are not reversed.<br />

Critical areas of judgement and the use of estimates are <strong>in</strong>cluded<br />

<strong>in</strong> section 2.3 of the account<strong>in</strong>g policies.<br />

2.2.3 Environmental expenditures and liabilities<br />

Environmental accruals are recorded based on current <strong>in</strong>terpretation<br />

of environmental laws and regulations. Amounts<br />

accrued do not <strong>in</strong>clude third-party recoveries. All available<br />

<strong>in</strong>formation is considered, <strong>in</strong>clud<strong>in</strong>g the results of remedial<br />

<strong>in</strong>vestigation/feasibility studies (RI/FS). In evaluat<strong>in</strong>g any disposal<br />

site environmental exposure, an assessment is made of the<br />

company’s potential share of the remediation costs by reference<br />

to the known or estimated volume of the company’s waste that<br />

was sent to the site and the range of costs to treat similar waste<br />

at other sites if a RI/FS is not available.<br />

2.2.4 F<strong>in</strong>ancial <strong>in</strong>struments<br />

(i) Initial recognition<br />

F<strong>in</strong>ancial <strong>in</strong>struments are recognised on the balance sheet<br />

when the group becomes a party to the contractual provisions<br />

of a f<strong>in</strong>ancial <strong>in</strong>strument. All purchases of f<strong>in</strong>ancial assets that<br />

require delivery with<strong>in</strong> the timeframe established by regulation<br />

or market convention (‘regular way’ purchases) are recognised<br />

at transaction date.<br />

(ii) Initial measurement<br />

All f<strong>in</strong>ancial <strong>in</strong>struments are <strong>in</strong>itially recognised at fair value plus<br />

transaction costs that are <strong>in</strong>cremental to the group and directly<br />

attributable to the acquisition or issue of the f<strong>in</strong>ancial asset or<br />

f<strong>in</strong>ancial liability except for those classified as ‘fair value through<br />

profit and loss’.<br />

(iii) Subsequent measurement<br />

Subsequent to <strong>in</strong>itial measurement, f<strong>in</strong>ancial <strong>in</strong>struments are<br />

either measured at fair value or amortised cost, depend<strong>in</strong>g on<br />

their classification: