Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

174<br />

Notes to the group annual f<strong>in</strong>ancial statements cont<strong>in</strong>ued<br />

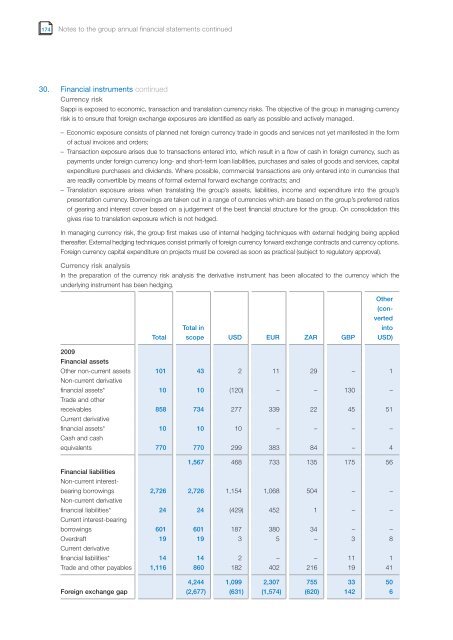

30. F<strong>in</strong>ancial <strong>in</strong>struments cont<strong>in</strong>ued<br />

Currency risk<br />

<strong>Sappi</strong> is exposed to economic, transaction and translation currency risks. The objective of the group <strong>in</strong> manag<strong>in</strong>g currency<br />

risk is to ensure that foreign exchange exposures are identified as early as possible and actively managed.<br />

– Economic exposure consists of planned net foreign currency trade <strong>in</strong> goods and services not yet manifested <strong>in</strong> the form<br />

of actual <strong>in</strong>voices and orders;<br />

– Transaction exposure arises due to transactions entered <strong>in</strong>to, which result <strong>in</strong> a flow of cash <strong>in</strong> foreign currency, such as<br />

payments under foreign currency long- and short-term loan liabilities, purchases and sales of goods and services, capital<br />

expenditure purchases and dividends. Where possible, commercial transactions are only entered <strong>in</strong>to <strong>in</strong> currencies that<br />

are readily convertible by means of formal external forward exchange contracts; and<br />

– Translation exposure arises when translat<strong>in</strong>g the group’s assets, liabilities, <strong>in</strong>come and expenditure <strong>in</strong>to the group’s<br />

presentation currency. Borrow<strong>in</strong>gs are taken out <strong>in</strong> a range of currencies which are based on the group’s preferred ratios<br />

of gear<strong>in</strong>g and <strong>in</strong>terest cover based on a judgement of the best f<strong>in</strong>ancial structure for the group. On consolidation this<br />

gives rise to translation exposure which is not hedged.<br />

In manag<strong>in</strong>g currency risk, the group first makes use of <strong>in</strong>ternal hedg<strong>in</strong>g techniques with external hedg<strong>in</strong>g be<strong>in</strong>g applied<br />

thereafter. External hedg<strong>in</strong>g techniques consist primarily of foreign currency forward exchange contracts and currency options.<br />

Foreign currency capital expenditure on projects must be covered as soon as practical (subject to regulatory approval).<br />

Currency risk analysis<br />

In the preparation of the currency risk analysis the derivative <strong>in</strong>strument has been allocated to the currency which the<br />

underly<strong>in</strong>g <strong>in</strong>strument has been hedg<strong>in</strong>g.<br />

Total<br />

Total <strong>in</strong><br />

scope USD EUR ZAR GBP<br />

Other<br />

(converted<br />

<strong>in</strong>to<br />

USD)<br />

<strong>2009</strong><br />

F<strong>in</strong>ancial assets<br />

Other non-current assets<br />

Non-current derivative<br />

101 43 2 11 29 – 1<br />

f<strong>in</strong>ancial assets*<br />

Trade and other<br />

10 10 (120) – – 130 –<br />

receivables<br />

Current derivative<br />

858 734 277 339 22 45 51<br />

f<strong>in</strong>ancial assets*<br />

Cash and cash<br />

10 10 10 – – – –<br />

equivalents 770 770 299 383 84 – 4<br />

1,567 468 733 135 175 56<br />

F<strong>in</strong>ancial liabilities<br />

Non-current <strong>in</strong>terestbear<strong>in</strong>g<br />

borrow<strong>in</strong>gs<br />

Non-current derivative<br />

2,726 2,726 1,154 1,068 504 – –<br />

f<strong>in</strong>ancial liabilities*<br />

Current <strong>in</strong>terest-bear<strong>in</strong>g<br />

24 24 (429) 452 1 – –<br />

borrow<strong>in</strong>gs 601 601 187 380 34 – –<br />

Overdraft<br />

Current derivative<br />

19 19 3 5 – 3 8<br />

f<strong>in</strong>ancial liabilities* 14 14 2 – – 11 1<br />

Trade and other payables 1,116 860 182 402 216 19 41<br />

4,244 1,099 2,307 755 33 50<br />

Foreign exchange gap (2,677) (631) (1,574) (620) 142 6