Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

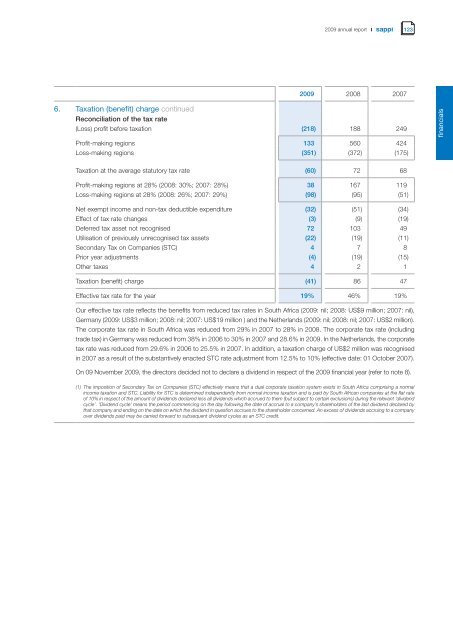

6. Taxation (benefit) charge cont<strong>in</strong>ued<br />

Reconciliation of the tax rate<br />

<strong>2009</strong> annual report<br />

<strong>2009</strong> 2008 2007<br />

(Loss) profit before taxation (218) 188 249<br />

Profit-mak<strong>in</strong>g regions 133 560 424<br />

Loss-mak<strong>in</strong>g regions (351) (372) (175)<br />

Taxation at the average statutory tax rate (60) 72 68<br />

Profit-mak<strong>in</strong>g regions at 28% (2008: 30%; 2007: 28%) 38 167 119<br />

Loss-mak<strong>in</strong>g regions at 28% (2008: 26%; 2007: 29%) (98) (95) (51)<br />

Net exempt <strong>in</strong>come and non-tax deductible expenditure (32) (51) (34)<br />

Effect of tax rate changes (3) (9) (19)<br />

Deferred tax asset not recognised 72 103 49<br />

Utilisation of previously unrecognised tax assets (22) (19) (11)<br />

Secondary Tax on Companies (STC) 4 7 8<br />

Prior year adjustments (4) (19) (15)<br />

Other taxes 4 2 1<br />

Taxation (benefit) charge (41) 86 47<br />

Effective tax rate for the year 19% 46% 19%<br />

<strong>Our</strong> effective tax rate reflects the benefits from reduced tax rates <strong>in</strong> South Africa (<strong>2009</strong>: nil; 2008: US$9 million; 2007: nil),<br />

Germany (<strong>2009</strong>: US$3 million; 2008: nil; 2007: US$19 million ) and the Netherlands (<strong>2009</strong>: nil; 2008: nil; 2007: US$2 million).<br />

The corporate tax rate <strong>in</strong> South Africa was reduced from 29% <strong>in</strong> 2007 to 28% <strong>in</strong> 2008. The corporate tax rate (<strong>in</strong>clud<strong>in</strong>g<br />

trade tax) <strong>in</strong> Germany was reduced from 38% <strong>in</strong> 2006 to 30% <strong>in</strong> 2007 and 28.6% <strong>in</strong> <strong>2009</strong>. In the Netherlands, the corporate<br />

tax rate was reduced from 29.6% <strong>in</strong> 2006 to 25.5% <strong>in</strong> 2007. In addition, a taxation charge of US$2 million was recognised<br />

<strong>in</strong> 2007 as a result of the substantively enacted STC rate adjustment from 12.5% to 10% (effective date: 01 October 2007).<br />

On 09 November <strong>2009</strong>, the directors decided not to declare a dividend <strong>in</strong> respect of the <strong>2009</strong> f<strong>in</strong>ancial year (refer to note 8).<br />

(1) The imposition of Secondary Tax on Companies (STC) effectively means that a dual corporate taxation system exists <strong>in</strong> South Africa compris<strong>in</strong>g a normal<br />

<strong>in</strong>come taxation and STC. Liability for STC is determ<strong>in</strong>ed <strong>in</strong>dependently from normal <strong>in</strong>come taxation and is paid by South African companies at the flat rate<br />

of 10% <strong>in</strong> respect of the amount of dividends declared less all dividends which accrued to them (but subject to certa<strong>in</strong> exclusions) dur<strong>in</strong>g the relevant ‘dividend<br />

cycle’. ‘Dividend cycle’ means the period commenc<strong>in</strong>g on the day follow<strong>in</strong>g the date of accrual to a company’s shareholders of the last dividend declared by<br />

that company and end<strong>in</strong>g on the date on which the dividend <strong>in</strong> question accrues to the shareholder concerned. An excess of dividends accru<strong>in</strong>g to a company<br />

over dividends paid may be carried forward to subsequent dividend cycles as an STC credit.<br />

123<br />

f<strong>in</strong>ancials