Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>2009</strong> annual report<br />

20. Interest-bear<strong>in</strong>g borrow<strong>in</strong>gs cont<strong>in</strong>ued<br />

<strong>Sappi</strong> F<strong>in</strong>e Paper Europe and <strong>Sappi</strong> Trad<strong>in</strong>g<br />

Under a comb<strong>in</strong>ed securitisation arrangement for <strong>Sappi</strong> F<strong>in</strong>e Paper Europe and <strong>Sappi</strong> Trad<strong>in</strong>g, <strong>Sappi</strong> sells receivables to<br />

Galleon Capital LLC on a non-recourse basis. Credit enhancement is calculated by deduct<strong>in</strong>g a deferred purchase price of<br />

14%. <strong>Sappi</strong> is responsible for the collection of all amounts that are due from the customer. The rate of discount<strong>in</strong>g that is<br />

charged on the receivables is LIBOR (London Interbank Offered Rate) plus a marg<strong>in</strong> for receivables to customers located <strong>in</strong><br />

OECD countries plus a further marg<strong>in</strong> for receivables to customers located <strong>in</strong> non-OECD countries.<br />

Non-utilised facilities<br />

The group monitors its availabilty to funds on a weekly basis. The group treasury committee determ<strong>in</strong>es the amount of<br />

unutilised facilities to determ<strong>in</strong>e the headroom which it currently operates <strong>in</strong>. The net cash balances <strong>in</strong>cluded <strong>in</strong> current<br />

assets and current liabilities are <strong>in</strong>cluded <strong>in</strong> the determ<strong>in</strong>ation of the headroom available.<br />

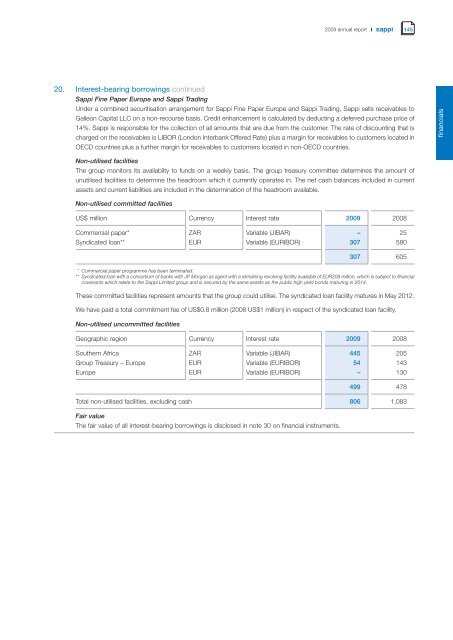

Non-utilised committed facilities<br />

US$ million Currency Interest rate <strong>2009</strong> 2008<br />

Commercial paper* ZAR Variable (JIBAR) – 25<br />

Syndicated loan** EUR Variable (EURIBOR) 307 580<br />

307 605<br />

** Commercial paper programme has been term<strong>in</strong>ated.<br />

** Syndicated loan with a consortium of banks with JP Morgan as agent with a rema<strong>in</strong><strong>in</strong>g revolv<strong>in</strong>g facility available of EUR209 million, which is subject to f<strong>in</strong>ancial<br />

covenants which relate to the <strong>Sappi</strong> Limited group and is secured by the same assets as the public high yield bonds matur<strong>in</strong>g <strong>in</strong> 2014.<br />

These committed facilities represent amounts that the group could utilise. The syndicated loan facility matures <strong>in</strong> May 2012.<br />

We have paid a total commitment fee of US$0.8 million (2008 US$1 million) <strong>in</strong> respect of the syndicated loan facility.<br />

Non-utilised uncommitted facilities<br />

Geographic region Currency Interest rate <strong>2009</strong> 2008<br />

Southern Africa ZAR Variable (JIBAR) 445 205<br />

Group Treasury – Europe EUR Variable (EURIBOR) 54 143<br />

Europe EUR Variable (EURIBOR) – 130<br />

499 478<br />

Total non-utilised facilities, exclud<strong>in</strong>g cash 806 1,083<br />

Fair value<br />

The fair value of all <strong>in</strong>terest-bear<strong>in</strong>g borrow<strong>in</strong>gs is disclosed <strong>in</strong> note 30 on f<strong>in</strong>ancial <strong>in</strong>struments.<br />

145<br />

f<strong>in</strong>ancials