Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

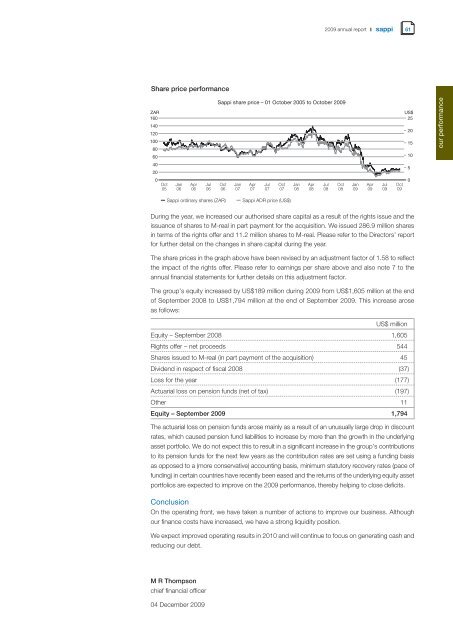

Share price <strong>performance</strong><br />

<strong>2009</strong> annual report 61<br />

Dur<strong>in</strong>g the year, we <strong>in</strong>creased our authorised share capital as a result of the rights issue and the<br />

issuance of shares to M-real <strong>in</strong> part payment for the acquisition. We issued 286.9 million shares<br />

<strong>in</strong> terms of the rights offer and 11.2 million shares to M-real. Please refer to the Directors’ report<br />

for further detail on the changes <strong>in</strong> share capital dur<strong>in</strong>g the year.<br />

The share prices <strong>in</strong> the graph above have been revised by an adjustment factor of 1.58 to reflect<br />

the impact of the rights offer. Please refer to earn<strong>in</strong>gs per share above and also note 7 to the<br />

annual f<strong>in</strong>ancial statements for further details on this adjustment factor.<br />

The group’s equity <strong>in</strong>creased by US$189 million dur<strong>in</strong>g <strong>2009</strong> from US$1,605 million at the end<br />

of September 2008 to US$1,794 million at the end of September <strong>2009</strong>. This <strong>in</strong>crease arose<br />

as follows:<br />

Equity – September 2008<br />

US$ million<br />

1,605<br />

Rights offer – net proceeds 544<br />

Shares issued to M-real (<strong>in</strong> part payment of the acquisition) 45<br />

Dividend <strong>in</strong> respect of fiscal 2008 (37)<br />

Loss for the year (177)<br />

Actuarial loss on pension funds (net of tax) (197)<br />

Other 11<br />

Equity – September <strong>2009</strong> 1,794<br />

The actuarial loss on pension funds arose ma<strong>in</strong>ly as a result of an unusually large drop <strong>in</strong> discount<br />

rates, which caused pension fund liabilities to <strong>in</strong>crease by more than the growth <strong>in</strong> the underly<strong>in</strong>g<br />

asset portfolio. We do not expect this to result <strong>in</strong> a significant <strong>in</strong>crease <strong>in</strong> the group’s contributions<br />

to its pension funds for the next few years as the contribution rates are set us<strong>in</strong>g a fund<strong>in</strong>g basis<br />

as opposed to a (more conservative) account<strong>in</strong>g basis, m<strong>in</strong>imum statutory recovery rates (pace of<br />

fund<strong>in</strong>g) <strong>in</strong> certa<strong>in</strong> countries have recently been eased and the returns of the underly<strong>in</strong>g equity asset<br />

portfolios are expected to improve on the <strong>2009</strong> <strong>performance</strong>, thereby help<strong>in</strong>g to close deficits.<br />

Conclusion<br />

On the operat<strong>in</strong>g front, we have taken a number of actions to improve our bus<strong>in</strong>ess. Although<br />

our f<strong>in</strong>ance costs have <strong>in</strong>creased, we have a strong liquidity position.<br />

We expect improved operat<strong>in</strong>g results <strong>in</strong> 2010 and will cont<strong>in</strong>ue to focus on generat<strong>in</strong>g cash and<br />

reduc<strong>in</strong>g our debt.<br />

M R Thompson<br />

chief f<strong>in</strong>ancial officer<br />

04 December <strong>2009</strong><br />

our <strong>performance</strong>