Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

170<br />

Notes to the group annual f<strong>in</strong>ancial statements cont<strong>in</strong>ued<br />

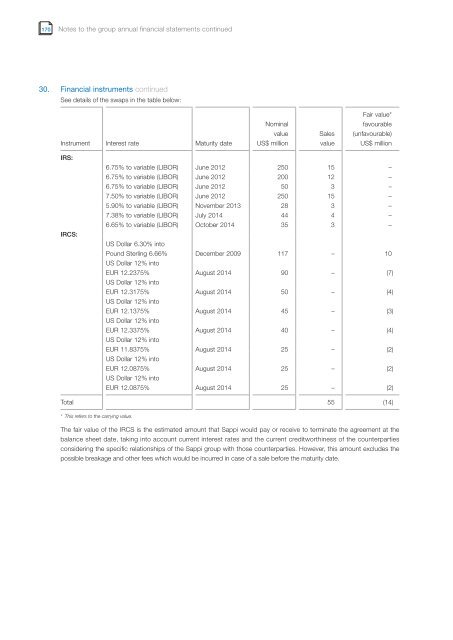

30. F<strong>in</strong>ancial <strong>in</strong>struments cont<strong>in</strong>ued<br />

See details of the swaps <strong>in</strong> the table below:<br />

Instrument Interest rate Maturity date<br />

IRS:<br />

IRCS:<br />

Nom<strong>in</strong>al<br />

value<br />

US$ million<br />

Sales<br />

value<br />

Fair value*<br />

favourable<br />

(unfavourable)<br />

US$ million<br />

6.75% to variable (LIBOR) June 2012 250 15 –<br />

6.75% to variable (LIBOR) June 2012 200 12 –<br />

6.75% to variable (LIBOR) June 2012 50 3 –<br />

7.50% to variable (LIBOR) June 2012 250 15 –<br />

5.90% to variable (LIBOR) November 2013 28 3 –<br />

7.38% to variable (LIBOR) July 2014 44 4 –<br />

6.65% to variable (LIBOR) October 2014 35 3 –<br />

US Dollar 6.30% <strong>in</strong>to<br />

Pound Sterl<strong>in</strong>g 6.66% December <strong>2009</strong> 117 – 10<br />

US Dollar 12% <strong>in</strong>to<br />

EUR 12.2375% August 2014 90 – (7)<br />

US Dollar 12% <strong>in</strong>to<br />

EUR 12.3175% August 2014 50 – (4)<br />

US Dollar 12% <strong>in</strong>to<br />

EUR 12.1375% August 2014 45 – (3)<br />

US Dollar 12% <strong>in</strong>to<br />

EUR 12.3375% August 2014 40 – (4)<br />

US Dollar 12% <strong>in</strong>to<br />

EUR 11.8375% August 2014 25 – (2)<br />

US Dollar 12% <strong>in</strong>to<br />

EUR 12.0875% August 2014 25 – (2)<br />

US Dollar 12% <strong>in</strong>to<br />

EUR 12.0875% August 2014 25 – (2)<br />

Total 55 (14)<br />

* This refers to the carry<strong>in</strong>g value.<br />

The fair value of the IRCS is the estimated amount that <strong>Sappi</strong> would pay or receive to term<strong>in</strong>ate the agreement at the<br />

balance sheet date, tak<strong>in</strong>g <strong>in</strong>to account current <strong>in</strong>terest rates and the current creditworth<strong>in</strong>ess of the counterparties<br />

consider<strong>in</strong>g the specific relationships of the <strong>Sappi</strong> group with those counterparties. However, this amount excludes the<br />

possible breakage and other fees which would be <strong>in</strong>curred <strong>in</strong> case of a sale before the maturity date.