Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

52 Chief f<strong>in</strong>ancial officer’s report cont<strong>in</strong>ued<br />

Major sensitivities<br />

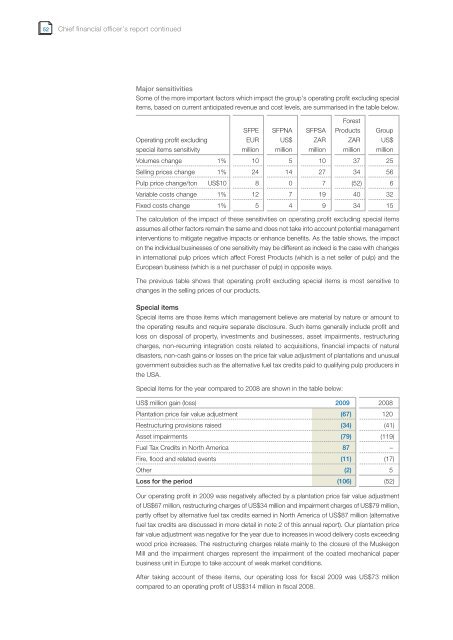

Some of the more important factors which impact the group’s operat<strong>in</strong>g profit exclud<strong>in</strong>g special<br />

items, based on current anticipated revenue and cost levels, are summarised <strong>in</strong> the table below.<br />

SFPE SFPNA SFPSA<br />

Forest<br />

Products Group<br />

Operat<strong>in</strong>g profit exclud<strong>in</strong>g EUR US$ ZAR ZAR US$<br />

special items sensitivity million million million million million<br />

Volumes change 1% 10 5 10 37 25<br />

Sell<strong>in</strong>g prices change 1% 24 14 27 34 56<br />

Pulp price change/ton US$10 8 0 7 (52) 6<br />

Variable costs change 1% 12 7 19 40 32<br />

Fixed costs change 1% 5 4 9 34 15<br />

The calculation of the impact of these sensitivities on operat<strong>in</strong>g profit exclud<strong>in</strong>g special items<br />

assumes all other factors rema<strong>in</strong> the same and does not take <strong>in</strong>to account potential management<br />

<strong>in</strong>terventions to mitigate negative impacts or enhance benefits. As the table shows, the impact<br />

on the <strong>in</strong>dividual bus<strong>in</strong>esses of one sensitivity may be different as <strong>in</strong>deed is the case with changes<br />

<strong>in</strong> <strong>in</strong>ternational pulp prices which affect Forest Products (which is a net seller of pulp) and the<br />

European bus<strong>in</strong>ess (which is a net purchaser of pulp) <strong>in</strong> opposite ways.<br />

The previous table shows that operat<strong>in</strong>g profit exclud<strong>in</strong>g special items is most sensitive to<br />

changes <strong>in</strong> the sell<strong>in</strong>g prices of our products.<br />

Special items<br />

Special items are those items which management believe are material by nature or amount to<br />

the operat<strong>in</strong>g results and require separate disclosure. Such items generally <strong>in</strong>clude profit and<br />

loss on disposal of property, <strong>in</strong>vestments and bus<strong>in</strong>esses, asset impairments, restructur<strong>in</strong>g<br />

charges, non-recurr<strong>in</strong>g <strong>in</strong>tegration costs related to acquisitions, f<strong>in</strong>ancial impacts of natural<br />

disasters, non-cash ga<strong>in</strong>s or losses on the price fair value adjustment of plantations and unusual<br />

government subsidies such as the alternative fuel tax credits paid to qualify<strong>in</strong>g pulp producers <strong>in</strong><br />

the USA.<br />

Special items for the year compared to 2008 are shown <strong>in</strong> the table below:<br />

US$ million ga<strong>in</strong> (loss) <strong>2009</strong> 2008<br />

Plantation price fair value adjustment (67) 120<br />

Restructur<strong>in</strong>g provisions raised (34) (41)<br />

Asset impairments (79) (119)<br />

Fuel Tax Credits <strong>in</strong> North America 87 –<br />

Fire, flood and related events (11) (17)<br />

Other (2) 5<br />

Loss for the period (106) (52)<br />

<strong>Our</strong> operat<strong>in</strong>g profit <strong>in</strong> <strong>2009</strong> was negatively affected by a plantation price fair value adjustment<br />

of US$67 million, restructur<strong>in</strong>g charges of US$34 million and impairment charges of US$79 million,<br />

partly offset by alternative fuel tax credits earned <strong>in</strong> North America of US$87 million (alternative<br />

fuel tax credits are discussed <strong>in</strong> more detail <strong>in</strong> note 2 of this annual report). <strong>Our</strong> plantation price<br />

fair value adjustment was negative for the year due to <strong>in</strong>creases <strong>in</strong> wood delivery costs exceed<strong>in</strong>g<br />

wood price <strong>in</strong>creases. The restructur<strong>in</strong>g charges relate ma<strong>in</strong>ly to the closure of the Muskegon<br />

Mill and the impairment charges represent the impairment of the coated mechanical paper<br />

bus<strong>in</strong>ess unit <strong>in</strong> Europe to take account of weak market conditions.<br />

After tak<strong>in</strong>g account of these items, our operat<strong>in</strong>g loss for fiscal <strong>2009</strong> was US$73 million<br />

compared to an operat<strong>in</strong>g profit of US$314 million <strong>in</strong> fiscal 2008.