Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>2009</strong> annual report<br />

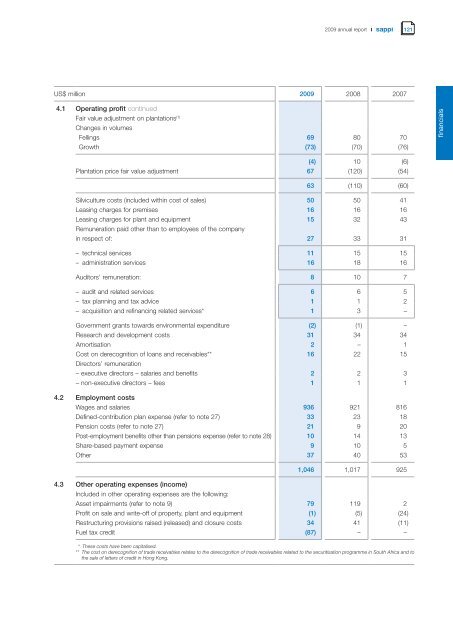

US$ million <strong>2009</strong> 2008 2007<br />

4.1 Operat<strong>in</strong>g profit cont<strong>in</strong>ued<br />

Fair value adjustment on plantations (1)<br />

Changes <strong>in</strong> volumes<br />

Fell<strong>in</strong>gs 69 80 70<br />

Growth (73) (70) (76)<br />

(4) 10 (6)<br />

Plantation price fair value adjustment 67 (120) (54)<br />

63 (110) (60)<br />

Silviculture costs (<strong>in</strong>cluded with<strong>in</strong> cost of sales) 50 50 41<br />

Leas<strong>in</strong>g charges for premises 16 16 16<br />

Leas<strong>in</strong>g charges for plant and equipment 15 32 43<br />

Remuneration paid other than to employees of the company<br />

<strong>in</strong> respect of: 27 33 31<br />

– technical services 11 15 15<br />

– adm<strong>in</strong>istration services 16 18 16<br />

Auditors’ remuneration: 8 10 7<br />

– audit and related services 6 6 5<br />

– tax plann<strong>in</strong>g and tax advice 1 1 2<br />

– acquisition and ref<strong>in</strong>anc<strong>in</strong>g related services* 1 3 –<br />

Government grants towards environmental expenditure (2) (1) –<br />

Research and development costs 31 34 34<br />

Amortisation 2 – 1<br />

Cost on derecognition of loans and receivables** 16 22 15<br />

Directors’ remuneration<br />

– executive directors – salaries and benefits 2 2 3<br />

– non-executive directors – fees 1 1 1<br />

4.2 Employment costs<br />

Wages and salaries 936 921 816<br />

Def<strong>in</strong>ed-contribution plan expense (refer to note 27) 33 23 18<br />

Pension costs (refer to note 27) 21 9 20<br />

Post-employment benefits other than pensions expense (refer to note 28) 10 14 13<br />

Share-based payment expense 9 10 5<br />

Other 37 40 53<br />

4.3 Other operat<strong>in</strong>g expenses (<strong>in</strong>come)<br />

Included <strong>in</strong> other operat<strong>in</strong>g expenses are the follow<strong>in</strong>g:<br />

1,046 1,017 925<br />

Asset impairments (refer to note 9) 79 119 2<br />

Profit on sale and write-off of property, plant and equipment (1) (5) (24)<br />

Restructur<strong>in</strong>g provisions raised (released) and closure costs 34 41 (11)<br />

Fuel tax credit (87) – –<br />

* These costs have been capitalised.<br />

** The cost on derecognition of trade receivables relates to the derecognition of trade receivables related to the securitisation programme <strong>in</strong> South Africa and to<br />

the sale of letters of credit <strong>in</strong> Hong Kong.<br />

121<br />

f<strong>in</strong>ancials