Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>2009</strong> annual report<br />

<strong>2009</strong> 2008<br />

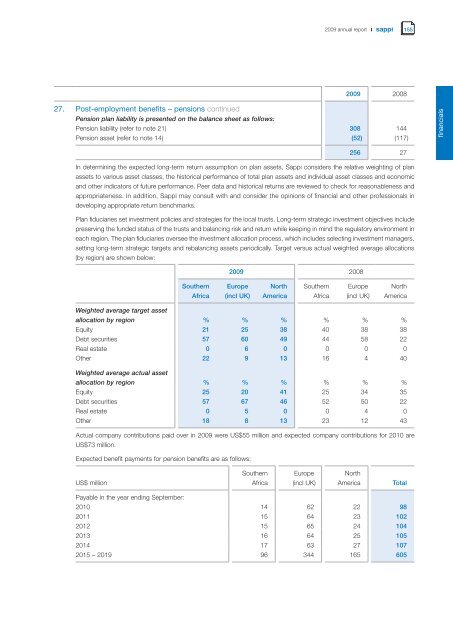

27. Post-employment benefits – pensions cont<strong>in</strong>ued<br />

Pension plan liability is presented on the balance sheet as follows:<br />

Pension liability (refer to note 21) 308 144<br />

Pension asset (refer to note 14) (52) (117)<br />

256 27<br />

In determ<strong>in</strong><strong>in</strong>g the expected long-term return assumption on plan assets, <strong>Sappi</strong> considers the relative weight<strong>in</strong>g of plan<br />

assets to various asset classes, the historical <strong>performance</strong> of total plan assets and <strong>in</strong>dividual asset classes and economic<br />

and other <strong>in</strong>dicators of future <strong>performance</strong>. Peer data and historical returns are reviewed to check for reasonableness and<br />

appropriateness. In addition, <strong>Sappi</strong> may consult with and consider the op<strong>in</strong>ions of f<strong>in</strong>ancial and other professionals <strong>in</strong><br />

develop<strong>in</strong>g appropriate return benchmarks.<br />

Plan fiduciaries set <strong>in</strong>vestment policies and strategies for the local trusts. Long-term strategic <strong>in</strong>vestment objectives <strong>in</strong>clude<br />

preserv<strong>in</strong>g the funded status of the trusts and balanc<strong>in</strong>g risk and return while keep<strong>in</strong>g <strong>in</strong> m<strong>in</strong>d the regulatory environment <strong>in</strong><br />

each region. The plan fiduciaries oversee the <strong>in</strong>vestment allocation process, which <strong>in</strong>cludes select<strong>in</strong>g <strong>in</strong>vestment managers,<br />

sett<strong>in</strong>g long-term strategic targets and rebalanc<strong>in</strong>g assets periodically. Target versus actual weighted average allocations<br />

(by region) are shown below:<br />

Southern<br />

Africa<br />

<strong>2009</strong> 2008<br />

Europe<br />

(<strong>in</strong>cl UK)<br />

North<br />

America<br />

Southern<br />

Africa<br />

Europe<br />

(<strong>in</strong>cl UK)<br />

155<br />

North<br />

America<br />

Weighted average target asset<br />

allocation by region % % % % % %<br />

Equity 21 25 38 40 38 38<br />

Debt securities 57 60 49 44 58 22<br />

Real estate 0 6 0 0 0 0<br />

Other 22 9 13 16 4 40<br />

Weighted average actual asset<br />

allocation by region % % % % % %<br />

Equity 25 20 41 25 34 35<br />

Debt securities 57 67 46 52 50 22<br />

Real estate 0 5 0 0 4 0<br />

Other 18 8 13 23 12 43<br />

Actual company contributions paid over <strong>in</strong> <strong>2009</strong> were US$55 million and expected company contributions for 2010 are<br />

US$73 million.<br />

Expected benefit payments for pension benefits are as follows:<br />

US$ million<br />

Southern<br />

Africa<br />

Europe<br />

(<strong>in</strong>cl UK)<br />

North<br />

America Total<br />

Payable <strong>in</strong> the year end<strong>in</strong>g September:<br />

2010 14 62 22 98<br />

2011 15 64 23 102<br />

2012 15 65 24 104<br />

2013 16 64 25 105<br />

2014 17 63 27 107<br />

2015 – 2019 96 344 165 605<br />

f<strong>in</strong>ancials