Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

158<br />

Notes to the group annual f<strong>in</strong>ancial statements cont<strong>in</strong>ued<br />

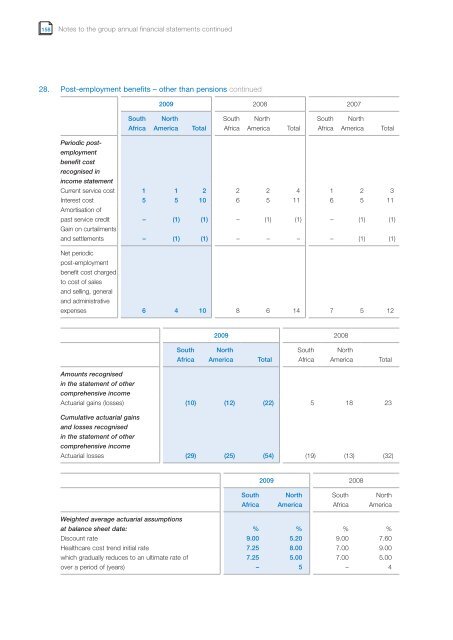

28. Post-employment benefits – other than pensions cont<strong>in</strong>ued<br />

South<br />

Africa<br />

<strong>2009</strong> 2008 2007<br />

North<br />

America Total<br />

South<br />

Africa<br />

North<br />

America Total<br />

South<br />

Africa<br />

North<br />

America Total<br />

Periodic postemployment<br />

benefit cost<br />

recognised <strong>in</strong><br />

<strong>in</strong>come statement<br />

Current service cost 1 1 2 2 2 4 1 2 3<br />

Interest cost<br />

Amortisation of<br />

5 5 10 6 5 11 6 5 11<br />

past service credit<br />

Ga<strong>in</strong> on curtailments<br />

– (1) (1) – (1) (1) – (1) (1)<br />

and settlements – (1) (1) – – – – (1) (1)<br />

Net periodic<br />

post-employment<br />

benefit cost charged<br />

to cost of sales<br />

and sell<strong>in</strong>g, general<br />

and adm<strong>in</strong>istrative<br />

expenses 6 4 10 8 6 14 7 5 12<br />

South<br />

Africa<br />

<strong>2009</strong> 2008<br />

North<br />

America Total<br />

South<br />

Africa<br />

North<br />

America Total<br />

Amounts recognised<br />

<strong>in</strong> the statement of other<br />

comprehensive <strong>in</strong>come<br />

Actuarial ga<strong>in</strong>s (losses) (10) (12) (22) 5 18 23<br />

Cumulative actuarial ga<strong>in</strong>s<br />

and losses recognised<br />

<strong>in</strong> the statement of other<br />

comprehensive <strong>in</strong>come<br />

Actuarial losses (29) (25) (54) (19) (13) (32)<br />

South<br />

Africa<br />

<strong>2009</strong> 2008<br />

North<br />

America<br />

South<br />

Africa<br />

North<br />

America<br />

Weighted average actuarial assumptions<br />

at balance sheet date: % % % %<br />

Discount rate 9.00 5.20 9.00 7.60<br />

Healthcare cost trend <strong>in</strong>itial rate 7.25 8.00 7.00 9.00<br />

which gradually reduces to an ultimate rate of 7.25 5.00 7.00 5.00<br />

over a period of (years) – 5 – 4