Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Covenants<br />

F<strong>in</strong>ancial covenants apply to approximately US$588 million of our non-South African long-term<br />

debt and our unutilised r209 million revolv<strong>in</strong>g credit facility. This debt is supported by a <strong>Sappi</strong><br />

Limited guarantee. For this reason the first two of the three covenants mentioned below are<br />

measured on a consolidated group level. The covenants also differ from measurement period to<br />

period, as they are set <strong>in</strong> l<strong>in</strong>e with the long-term forecast of group results.<br />

<strong>Sappi</strong> Papier Hold<strong>in</strong>g f<strong>in</strong>ancial covenants require that:<br />

<strong>2009</strong> annual report 59<br />

(i) At the end of each quarter the mean average of the ratios of EBITDA to consolidated net<br />

<strong>in</strong>terest expense for that quarter and each of the three preced<strong>in</strong>g quarters be not less than<br />

2:1 (<strong>in</strong>creas<strong>in</strong>g over the term of the facility to 2.5 <strong>in</strong> July 2012);<br />

(ii) The ratio of net debt to EBITDA be not greater than 6:1 (reduc<strong>in</strong>g over the term of the facility<br />

to 4:1 <strong>in</strong> September 2012); and<br />

(iii) With regard to <strong>Sappi</strong> Manufactur<strong>in</strong>g (Pty) Limited (the hold<strong>in</strong>g company for South African<br />

agents) and its subsidiaries only, the ratio of net debt to equity be not, at the end of any<br />

quarter, greater than 0.65:1, and at the end of the full-year, the ratio of EBITDA (as def<strong>in</strong>ed)<br />

to consolidated net <strong>in</strong>terest paid for that period be not less than 2:1, for the period ended<br />

September <strong>2009</strong>.<br />

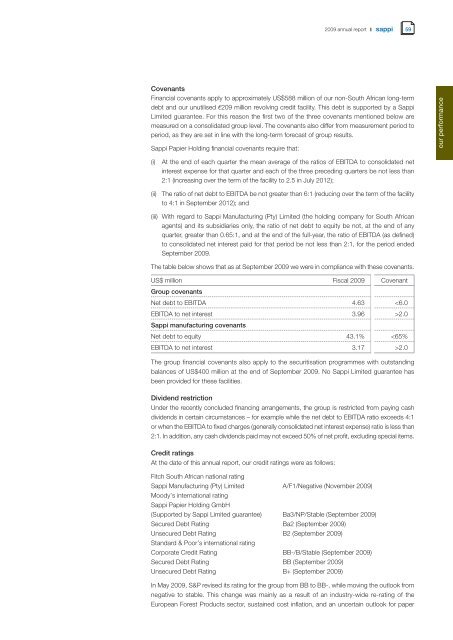

The table below shows that as at September <strong>2009</strong> we were <strong>in</strong> compliance with these covenants.<br />

US$ million Fiscal <strong>2009</strong> Covenant<br />

Group covenants<br />

Net debt to EBITDA 4.63 2.0<br />

<strong>Sappi</strong> manufactur<strong>in</strong>g covenants<br />

Net debt to equity 43.1% 2.0<br />

The group f<strong>in</strong>ancial covenants also apply to the securitisation programmes with outstand<strong>in</strong>g<br />

balances of US$400 million at the end of September <strong>2009</strong>. No <strong>Sappi</strong> Limited guarantee has<br />

been provided for these facilities.<br />

Dividend restriction<br />

Under the recently concluded f<strong>in</strong>anc<strong>in</strong>g arrangements, the group is restricted from pay<strong>in</strong>g cash<br />

dividends <strong>in</strong> certa<strong>in</strong> circumstances – for example while the net debt to EBITDA ratio exceeds 4:1<br />

or when the EBITDA to fixed charges (generally consolidated net <strong>in</strong>terest expense) ratio is less than<br />

2:1. In addition, any cash dividends paid may not exceed 50% of net profit, exclud<strong>in</strong>g special items.<br />

Credit rat<strong>in</strong>gs<br />

At the date of this annual report, our credit rat<strong>in</strong>gs were as follows:<br />

Fitch South African national rat<strong>in</strong>g<br />

<strong>Sappi</strong> Manufactur<strong>in</strong>g (Pty) Limited<br />

Moody’s <strong>in</strong>ternational rat<strong>in</strong>g<br />

<strong>Sappi</strong> Papier Hold<strong>in</strong>g GmbH<br />

A/F1/Negative (November <strong>2009</strong>)<br />

(Supported by <strong>Sappi</strong> Limited guarantee) Ba3/NP/Stable (September <strong>2009</strong>)<br />

Secured Debt Rat<strong>in</strong>g Ba2 (September <strong>2009</strong>)<br />

Unsecured Debt Rat<strong>in</strong>g<br />

Standard & Poor’s <strong>in</strong>ternational rat<strong>in</strong>g<br />

B2 (September <strong>2009</strong>)<br />

Corporate Credit Rat<strong>in</strong>g BB-/B/Stable (September <strong>2009</strong>)<br />

Secured Debt Rat<strong>in</strong>g BB (September <strong>2009</strong>)<br />

Unsecured Debt Rat<strong>in</strong>g B+ (September <strong>2009</strong>)<br />

In May <strong>2009</strong>, S&P revised its rat<strong>in</strong>g for the group from BB to BB-, while mov<strong>in</strong>g the outlook from<br />

negative to stable. This change was ma<strong>in</strong>ly as a result of an <strong>in</strong>dustry-wide re-rat<strong>in</strong>g of the<br />

European Forest Products sector, susta<strong>in</strong>ed cost <strong>in</strong>flation, and an uncerta<strong>in</strong> outlook for paper<br />

our <strong>performance</strong>