Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>2009</strong> annual report<br />

30. F<strong>in</strong>ancial <strong>in</strong>struments cont<strong>in</strong>ued<br />

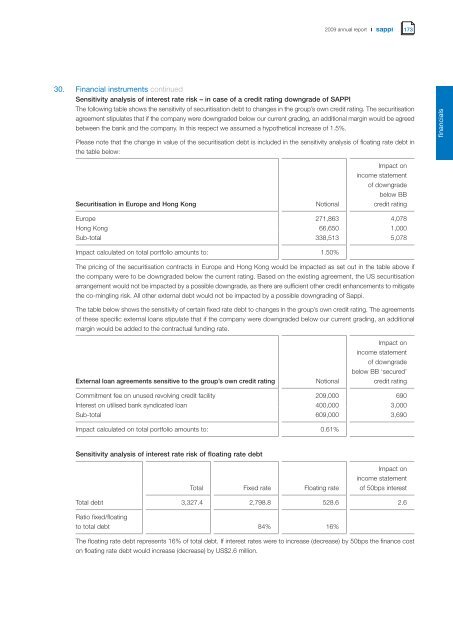

Sensitivity analysis of <strong>in</strong>terest rate risk – <strong>in</strong> case of a credit rat<strong>in</strong>g downgrade of SAPPI<br />

The follow<strong>in</strong>g table shows the sensitivity of securitisation debt to changes <strong>in</strong> the group’s own credit rat<strong>in</strong>g. The securitisation<br />

agreement stipulates that if the company were downgraded below our current grad<strong>in</strong>g, an additional marg<strong>in</strong> would be agreed<br />

between the bank and the company. In this respect we assumed a hypothetical <strong>in</strong>crease of 1.5%.<br />

Please note that the change <strong>in</strong> value of the securitisation debt is <strong>in</strong>cluded <strong>in</strong> the sensitivity analysis of float<strong>in</strong>g rate debt <strong>in</strong><br />

the table below:<br />

Securitisation <strong>in</strong> Europe and Hong Kong Notional<br />

173<br />

Impact on<br />

<strong>in</strong>come statement<br />

of downgrade<br />

below BB<br />

credit rat<strong>in</strong>g<br />

Europe 271,863 4,078<br />

Hong Kong 66,650 1,000<br />

Sub-total 338,513 5,078<br />

Impact calculated on total portfolio amounts to: 1.50%<br />

The pric<strong>in</strong>g of the securitisation contracts <strong>in</strong> Europe and Hong Kong would be impacted as set out <strong>in</strong> the table above if<br />

the company were to be downgraded below the current rat<strong>in</strong>g. Based on the exist<strong>in</strong>g agreement, the US securitisation<br />

arrangement would not be impacted by a possible downgrade, as there are sufficient other credit enhancements to mitigate<br />

the co-m<strong>in</strong>gl<strong>in</strong>g risk. All other external debt would not be impacted by a possible downgrad<strong>in</strong>g of <strong>Sappi</strong>.<br />

The table below shows the sensitivity of certa<strong>in</strong> fixed rate debt to changes <strong>in</strong> the group’s own credit rat<strong>in</strong>g. The agreements<br />

of these specific external loans stipulate that if the company were downgraded below our current grad<strong>in</strong>g, an additional<br />

marg<strong>in</strong> would be added to the contractual fund<strong>in</strong>g rate.<br />

External loan agreements sensitive to the group’s own credit rat<strong>in</strong>g Notional<br />

Impact on<br />

<strong>in</strong>come statement<br />

of downgrade<br />

below BB ‘secured’<br />

credit rat<strong>in</strong>g<br />

Commitment fee on unused revolv<strong>in</strong>g credit facility 209,000 690<br />

Interest on utilised bank syndicated loan 400,000 3,000<br />

Sub-total 609,000 3,690<br />

Impact calculated on total portfolio amounts to: 0.61%<br />

Sensitivity analysis of <strong>in</strong>terest rate risk of float<strong>in</strong>g rate debt<br />

Total debt<br />

Total Fixed rate Float<strong>in</strong>g rate<br />

Impact on<br />

<strong>in</strong>come statement<br />

of 50bps <strong>in</strong>terest<br />

3,327.4 2,798.8 528.6 2.6<br />

Ratio fixed/float<strong>in</strong>g<br />

to total debt 84% 16%<br />

The float<strong>in</strong>g rate debt represents 16% of total debt. If <strong>in</strong>terest rates were to <strong>in</strong>crease (decrease) by 50bps the f<strong>in</strong>ance cost<br />

on float<strong>in</strong>g rate debt would <strong>in</strong>crease (decrease) by US$2.6 million.<br />

f<strong>in</strong>ancials