Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

56 Chief f<strong>in</strong>ancial officer’s report cont<strong>in</strong>ued<br />

Debt<br />

Debt is a major source of fund<strong>in</strong>g for the group. In the management of debt we focus on net<br />

debt, which is the sum of current and non-current <strong>in</strong>terest-bear<strong>in</strong>g borrow<strong>in</strong>gs and bank overdraft,<br />

net of cash, cash equivalents and short-term deposits.<br />

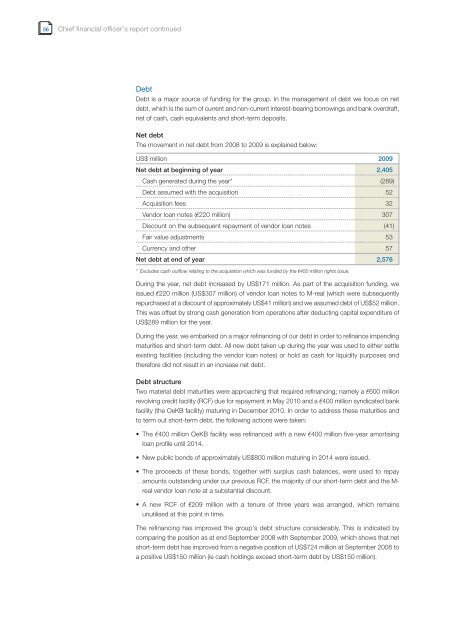

Net debt<br />

The movement <strong>in</strong> net debt from 2008 to <strong>2009</strong> is expla<strong>in</strong>ed below:<br />

US$ million <strong>2009</strong><br />

Net debt at beg<strong>in</strong>n<strong>in</strong>g of year 2,405<br />

Cash generated dur<strong>in</strong>g the year* (289)<br />

Debt assumed with the acquisition 52<br />

Acquisition fees 32<br />

Vendor loan notes (r220 million) 307<br />

Discount on the subsequent repayment of vendor loan notes (41)<br />

Fair value adjustments 53<br />

Currency and other 57<br />

Net debt at end of year 2,576<br />

* Excludes cash outflow relat<strong>in</strong>g to the acquisition which was funded by the r450 million rights issue.<br />

Dur<strong>in</strong>g the year, net debt <strong>in</strong>creased by US$171 million. As part of the acquisition fund<strong>in</strong>g, we<br />

issued r220 million (US$307 million) of vendor loan notes to M-real (which were subsequently<br />

repurchased at a discount of approximately US$41 million) and we assumed debt of US$52 million.<br />

This was offset by strong cash generation from operations after deduct<strong>in</strong>g capital expenditure of<br />

US$289 million for the year.<br />

Dur<strong>in</strong>g the year, we embarked on a major ref<strong>in</strong>anc<strong>in</strong>g of our debt <strong>in</strong> order to ref<strong>in</strong>ance impend<strong>in</strong>g<br />

maturities and short-term debt. All new debt taken up dur<strong>in</strong>g the year was used to either settle<br />

exist<strong>in</strong>g facilities (<strong>in</strong>clud<strong>in</strong>g the vendor loan notes) or hold as cash for liquidity purposes and<br />

therefore did not result <strong>in</strong> an <strong>in</strong>crease net debt.<br />

Debt structure<br />

Two material debt maturities were approach<strong>in</strong>g that required ref<strong>in</strong>anc<strong>in</strong>g; namely a r600 million<br />

revolv<strong>in</strong>g credit facility (RCF) due for repayment <strong>in</strong> May 2010 and a r400 million syndicated bank<br />

facility (the OeKB facility) matur<strong>in</strong>g <strong>in</strong> December 2010. In order to address these maturities and<br />

to term out short-term debt, the follow<strong>in</strong>g actions were taken:<br />

The r400 million OeKB facility was ref<strong>in</strong>anced with a new r400 million five-year amortis<strong>in</strong>g<br />

loan profile until 2014.<br />

New public bonds of approximately US$800 million matur<strong>in</strong>g <strong>in</strong> 2014 were issued.<br />

The proceeds of these bonds, together with surplus cash balances, were used to repay<br />

amounts outstand<strong>in</strong>g under our previous RCF, the majority of our short-term debt and the Mreal<br />

vendor loan note at a substantial discount.<br />

A new RCF of r209 million with a tenure of three years was arranged, which rema<strong>in</strong>s<br />

unutilised at this po<strong>in</strong>t <strong>in</strong> time.<br />

The ref<strong>in</strong>anc<strong>in</strong>g has improved the group’s debt structure considerably. This is <strong>in</strong>dicated by<br />

compar<strong>in</strong>g the position as at end September 2008 with September <strong>2009</strong>, which shows that net<br />

short-term debt has improved from a negative position of US$724 million at September 2008 to<br />

a positive US$150 million (ie cash hold<strong>in</strong>gs exceed short-term debt by US$150 million).