Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

58 Chief f<strong>in</strong>ancial officer’s report cont<strong>in</strong>ued<br />

The <strong>2009</strong> notes and our bank facilities conta<strong>in</strong> customary affirmative and negative covenants<br />

restrict<strong>in</strong>g, among other th<strong>in</strong>gs, the grant<strong>in</strong>g of security, <strong>in</strong>currence of <strong>in</strong>debtedness, the provision<br />

of loans and guarantees, mergers and dispositions and certa<strong>in</strong> restricted payments, <strong>in</strong>clud<strong>in</strong>g<br />

the payment of dividends.<br />

Vendor loan notes<br />

As part of the consideration price for the acquisition, <strong>Sappi</strong> Papier Hold<strong>in</strong>g issued to M-real<br />

Corporation the vendor loan notes of r220 million <strong>in</strong> December 2008. The notes carried an<br />

<strong>in</strong>terest rate stepp<strong>in</strong>g up from 9% to 15% over time. The notes had a maturity of up to 48 months<br />

and ranked pari passu with our exist<strong>in</strong>g long-term debt. The vendor loan notes were repaid <strong>in</strong><br />

full on 27 August <strong>2009</strong> at a discount of 13.5% (approximately r30 million/US$41 million), utilis<strong>in</strong>g<br />

proceeds from the issuance of the <strong>2009</strong> notes.<br />

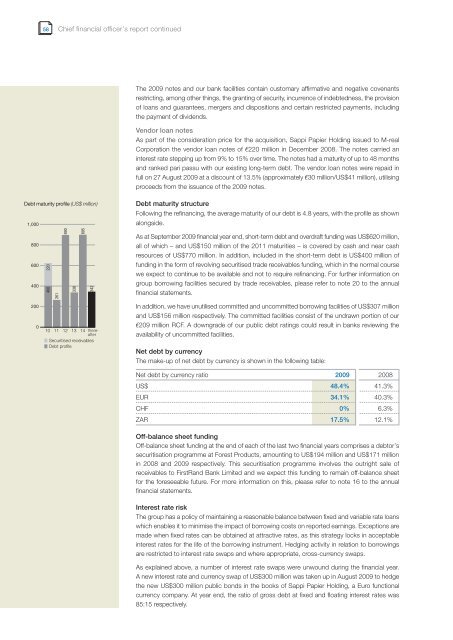

Debt maturity structure<br />

Follow<strong>in</strong>g the ref<strong>in</strong>anc<strong>in</strong>g, the average maturity of our debt is 4.8 years, with the profile as shown<br />

alongside.<br />

As at September <strong>2009</strong> f<strong>in</strong>ancial year end, short-term debt and overdraft fund<strong>in</strong>g was US$620 million,<br />

all of which – and US$150 million of the 2011 maturities – is covered by cash and near cash<br />

resources of US$770 million. In addition, <strong>in</strong>cluded <strong>in</strong> the short-term debt is US$400 million of<br />

fund<strong>in</strong>g <strong>in</strong> the form of revolv<strong>in</strong>g securitised trade receivables fund<strong>in</strong>g, which <strong>in</strong> the normal course<br />

we expect to cont<strong>in</strong>ue to be available and not to require ref<strong>in</strong>anc<strong>in</strong>g. For further <strong>in</strong>formation on<br />

group borrow<strong>in</strong>g facilities secured by trade receivables, please refer to note 20 to the annual<br />

f<strong>in</strong>ancial statements.<br />

In addition, we have unutilised committed and uncommitted borrow<strong>in</strong>g facilities of US$307 million<br />

and US$156 million respectively. The committed facilities consist of the undrawn portion of our<br />

r209 million RCF. A downgrade of our public debt rat<strong>in</strong>gs could result <strong>in</strong> banks review<strong>in</strong>g the<br />

availability of uncommitted facilities.<br />

Net debt by currency<br />

The make-up of net debt by currency is shown <strong>in</strong> the follow<strong>in</strong>g table:<br />

Net debt by currency ratio <strong>2009</strong> 2008<br />

US$ 48.4% 41.3%<br />

EUR 34.1% 40.3%<br />

CHF 0% 6.3%<br />

ZAR 17.5% 12.1%<br />

Off-balance sheet fund<strong>in</strong>g<br />

Off-balance sheet fund<strong>in</strong>g at the end of each of the last two f<strong>in</strong>ancial years comprises a debtor’s<br />

securitisation programme at Forest Products, amount<strong>in</strong>g to US$194 million and US$171 million<br />

<strong>in</strong> 2008 and <strong>2009</strong> respectively. This securitisation programme <strong>in</strong>volves the outright sale of<br />

receivables to FirstRand Bank Limited and we expect this fund<strong>in</strong>g to rema<strong>in</strong> off-balance sheet<br />

for the foreseeable future. For more <strong>in</strong>formation on this, please refer to note 16 to the annual<br />

f<strong>in</strong>ancial statements.<br />

Interest rate risk<br />

The group has a policy of ma<strong>in</strong>ta<strong>in</strong><strong>in</strong>g a reasonable balance between fixed and variable rate loans<br />

which enables it to m<strong>in</strong>imise the impact of borrow<strong>in</strong>g costs on reported earn<strong>in</strong>gs. Exceptions are<br />

made when fixed rates can be obta<strong>in</strong>ed at attractive rates, as this strategy locks <strong>in</strong> acceptable<br />

<strong>in</strong>terest rates for the life of the borrow<strong>in</strong>g <strong>in</strong>strument. Hedg<strong>in</strong>g activity <strong>in</strong> relation to borrow<strong>in</strong>gs<br />

are restricted to <strong>in</strong>terest rate swaps and where appropriate, cross-currency swaps.<br />

As expla<strong>in</strong>ed above, a number of <strong>in</strong>terest rate swaps were unwound dur<strong>in</strong>g the f<strong>in</strong>ancial year.<br />

A new <strong>in</strong>terest rate and currency swap of US$300 million was taken up <strong>in</strong> August <strong>2009</strong> to hedge<br />

the new US$300 million public bonds <strong>in</strong> the books of <strong>Sappi</strong> Papier Hold<strong>in</strong>g, a Euro functional<br />

currency company. At year end, the ratio of gross debt at fixed and float<strong>in</strong>g <strong>in</strong>terest rates was<br />

85:15 respectively.