Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

160<br />

Notes to the group annual f<strong>in</strong>ancial statements cont<strong>in</strong>ued<br />

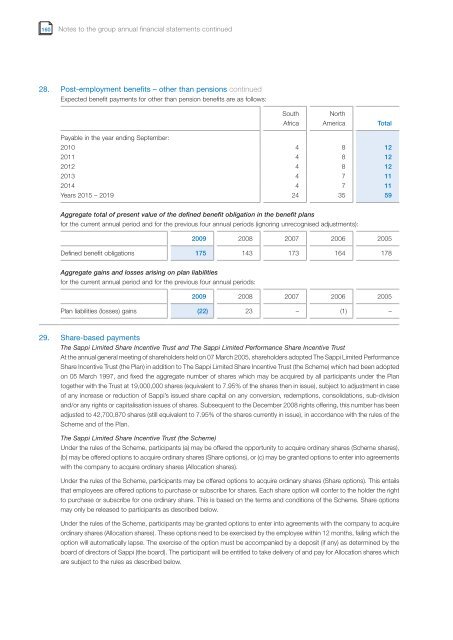

28. Post-employment benefits – other than pensions cont<strong>in</strong>ued<br />

Expected benefit payments for other than pension benefits are as follows:<br />

Payable <strong>in</strong> the year end<strong>in</strong>g September:<br />

South<br />

Africa<br />

North<br />

America Total<br />

2010 4 8 12<br />

2011 4 8 12<br />

2012 4 8 12<br />

2013 4 7 11<br />

2014 4 7 11<br />

Years 2015 – 2019 24 35 59<br />

Aggregate total of present value of the def<strong>in</strong>ed benefit obligation <strong>in</strong> the benefit plans<br />

for the current annual period and for the previous four annual periods (ignor<strong>in</strong>g unrecognised adjustments):<br />

<strong>2009</strong> 2008 2007 2006 2005<br />

Def<strong>in</strong>ed benefit obligations 175 143 173 164 178<br />

Aggregate ga<strong>in</strong>s and losses aris<strong>in</strong>g on plan liabilities<br />

for the current annual period and for the previous four annual periods:<br />

<strong>2009</strong> 2008 2007 2006 2005<br />

Plan liabilities (losses) ga<strong>in</strong>s (22) 23 – (1) –<br />

29. Share-based payments<br />

The <strong>Sappi</strong> Limited Share Incentive Trust and The <strong>Sappi</strong> Limited Performance Share Incentive Trust<br />

At the annual general meet<strong>in</strong>g of shareholders held on 07 March 2005, shareholders adopted The <strong>Sappi</strong> Limited Performance<br />

Share Incentive Trust (the Plan) <strong>in</strong> addition to The <strong>Sappi</strong> Limited Share Incentive Trust (the Scheme) which had been adopted<br />

on 05 March 1997, and fixed the aggregate number of shares which may be acquired by all participants under the Plan<br />

together with the Trust at 19,000,000 shares (equivalent to 7.95% of the shares then <strong>in</strong> issue), subject to adjustment <strong>in</strong> case<br />

of any <strong>in</strong>crease or reduction of <strong>Sappi</strong>’s issued share capital on any conversion, redemptions, consolidations, sub-division<br />

and/or any rights or capitalisation issues of shares. Subsequent to the December 2008 rights offer<strong>in</strong>g, this number has been<br />

adjusted to 42,700,870 shares (still equivalent to 7.95% of the shares currently <strong>in</strong> issue), <strong>in</strong> accordance with the rules of the<br />

Scheme and of the Plan.<br />

The <strong>Sappi</strong> Limited Share Incentive Trust (the Scheme)<br />

Under the rules of the Scheme, participants (a) may be offered the opportunity to acquire ord<strong>in</strong>ary shares (Scheme shares),<br />

(b) may be offered options to acquire ord<strong>in</strong>ary shares (Share options), or (c) may be granted options to enter <strong>in</strong>to agreements<br />

with the company to acquire ord<strong>in</strong>ary shares (Allocation shares).<br />

Under the rules of the Scheme, participants may be offered options to acquire ord<strong>in</strong>ary shares (Share options). This entails<br />

that employees are offered options to purchase or subscribe for shares. Each share option will confer to the holder the right<br />

to purchase or subscribe for one ord<strong>in</strong>ary share. This is based on the terms and conditions of the Scheme. Share options<br />

may only be released to participants as described below.<br />

Under the rules of the Scheme, participants may be granted options to enter <strong>in</strong>to agreements with the company to acquire<br />

ord<strong>in</strong>ary shares (Allocation shares). These options need to be exercised by the employee with<strong>in</strong> 12 months, fail<strong>in</strong>g which the<br />

option will automatically lapse. The exercise of the option must be accompanied by a deposit (if any) as determ<strong>in</strong>ed by the<br />

board of directors of <strong>Sappi</strong> (the board). The participant will be entitled to take delivery of and pay for Allocation shares which<br />

are subject to the rules as described below.