Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

70<br />

Corporate governance<br />

We are committed to the highest standards of corporate governance and cont<strong>in</strong>ue to seek areas of improvement by measur<strong>in</strong>g<br />

ourselves aga<strong>in</strong>st <strong>in</strong>ternational best practice.<br />

The group endorses the Code of Corporate Practices and Conduct as conta<strong>in</strong>ed <strong>in</strong> the South African K<strong>in</strong>g II Report issued <strong>in</strong> 2002,<br />

and cont<strong>in</strong>ues to apply the pr<strong>in</strong>ciples <strong>in</strong>corporated there<strong>in</strong>. The K<strong>in</strong>g III Report issued on 01 September <strong>2009</strong> for implementation by<br />

March 2010, is currently be<strong>in</strong>g studied with<strong>in</strong> <strong>Sappi</strong> and preparations are <strong>in</strong> progress for adoption of <strong>in</strong>cremental new pr<strong>in</strong>ciples<br />

conta<strong>in</strong>ed there<strong>in</strong>, to the extent not already adopted. The group ma<strong>in</strong>ta<strong>in</strong>s its primary list<strong>in</strong>g on the JSE Limited as well as a list<strong>in</strong>g<br />

on the New York Stock Exchange. The group delisted from the London Stock Exchange, effective 02 November <strong>2009</strong>. The group<br />

complies <strong>in</strong> all material aspects with the regulations and codes of these exchanges as they apply to <strong>Sappi</strong>.<br />

Summary<br />

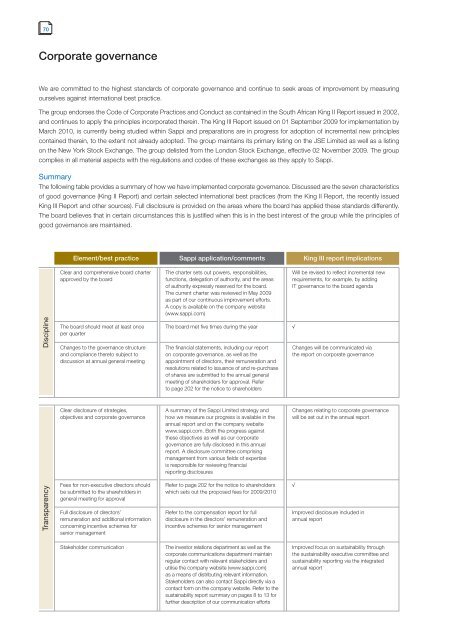

The follow<strong>in</strong>g table provides a summary of how we have implemented corporate governance. Discussed are the seven characteristics<br />

of good governance (K<strong>in</strong>g II Report) and certa<strong>in</strong> selected <strong>in</strong>ternational best practices (from the K<strong>in</strong>g II Report, the recently issued<br />

K<strong>in</strong>g III Report and other sources). Full disclosure is provided on the areas where the board has applied these standards differently.<br />

The board believes that <strong>in</strong> certa<strong>in</strong> circumstances this is justified when this is <strong>in</strong> the best <strong>in</strong>terest of the group while the pr<strong>in</strong>ciples of<br />

good governance are ma<strong>in</strong>ta<strong>in</strong>ed.<br />

Transparency Discipl<strong>in</strong>e<br />

Element/best practice <strong>Sappi</strong> application/comments K<strong>in</strong>g III report implications<br />

Clear and comprehensive board charter<br />

approved by the board<br />

The board should meet at least once<br />

per quarter<br />

Changes to the governance structure<br />

and compliance thereto subject to<br />

discussion at annual general meet<strong>in</strong>g<br />

Clear disclosure of strategies,<br />

objectives and corporate governance<br />

Fees for non-executive directors should<br />

be submitted to the shareholders <strong>in</strong><br />

general meet<strong>in</strong>g for approval<br />

Full disclosure of directors’<br />

remuneration and additional <strong>in</strong>formation<br />

concern<strong>in</strong>g <strong>in</strong>centive schemes for<br />

senior management<br />

The charter sets out powers, responsibilities,<br />

functions, delegation of authority, and the areas<br />

of authority expressly reserved for the board.<br />

The current charter was reviewed <strong>in</strong> May <strong>2009</strong><br />

as part of our cont<strong>in</strong>uous improvement efforts.<br />

A copy is available on the company website<br />

(www.sappi.com)<br />

The board met five times dur<strong>in</strong>g the year √<br />

The f<strong>in</strong>ancial statements, <strong>in</strong>clud<strong>in</strong>g our report<br />

on corporate governance, as well as the<br />

appo<strong>in</strong>tment of directors, their remuneration and<br />

resolutions related to issuance of and re-purchase<br />

of shares are submitted to the annual general<br />

meet<strong>in</strong>g of shareholders for approval. Refer<br />

to page 202 for the notice to shareholders<br />

A summary of the <strong>Sappi</strong> Limited strategy and<br />

how we measure our progress is available <strong>in</strong> the<br />

annual report and on the company website<br />

www.sappi.com. Both the progress aga<strong>in</strong>st<br />

these objectives as well as our corporate<br />

governance are fully disclosed <strong>in</strong> this annual<br />

report. A disclosure committee compris<strong>in</strong>g<br />

management from various fields of expertise<br />

is responsible for review<strong>in</strong>g f<strong>in</strong>ancial<br />

report<strong>in</strong>g disclosures<br />

Refer to page 202 for the notice to shareholders<br />

which sets out the proposed fees for <strong>2009</strong>/2010<br />

Refer to the compensation report for full<br />

disclosure <strong>in</strong> the directors’ remuneration and<br />

<strong>in</strong>centive schemes for senior management<br />

Stakeholder communication The <strong>in</strong>vestor relations department as well as the<br />

corporate communications department ma<strong>in</strong>ta<strong>in</strong><br />

regular contact with relevant stakeholders and<br />

utilise the company website (www.sappi.com)<br />

as a means of distribut<strong>in</strong>g relevant <strong>in</strong>formation.<br />

Stakeholders can also contact <strong>Sappi</strong> directly via a<br />

contact form on the company website. Refer to the<br />

susta<strong>in</strong>ability report summary on pages 8 to 13 for<br />

further description of our communication efforts<br />

Will be revised to reflect <strong>in</strong>cremental new<br />

requirements, for example, by add<strong>in</strong>g<br />

IT governance to the board agenda<br />

Changes will be communicated via<br />

the report on corporate governance<br />

Changes relat<strong>in</strong>g to corporate governance<br />

will be set out <strong>in</strong> the annual report<br />

√<br />

Improved disclosure <strong>in</strong>cluded <strong>in</strong><br />

annual report<br />

Improved focus on susta<strong>in</strong>ability through<br />

the susta<strong>in</strong>ability executive committee and<br />

susta<strong>in</strong>ability report<strong>in</strong>g via the <strong>in</strong>tegrated<br />

annual report