Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

166<br />

Notes to the group annual f<strong>in</strong>ancial statements cont<strong>in</strong>ued<br />

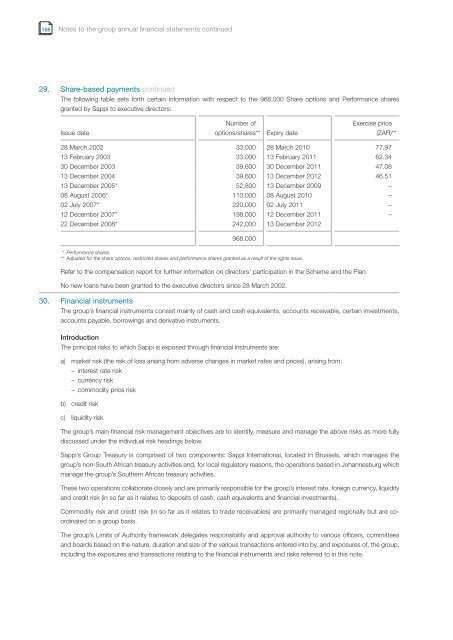

29. Share-based payments cont<strong>in</strong>ued<br />

The follow<strong>in</strong>g table sets forth certa<strong>in</strong> <strong>in</strong>formation with respect to the 968,000 Share options and Performance shares<br />

granted by <strong>Sappi</strong> to executive directors:<br />

Issue date<br />

Number of<br />

options/shares** Expiry date<br />

Exercise price<br />

28 March 2002 33,000 28 March 2010 77.97<br />

13 February 2003 33,000 13 February 2011 62.34<br />

30 December 2003 39,600 30 December 2011 47.08<br />

13 December 2004 39,600 13 December 2012 46.51<br />

13 December 2005* 52,800 13 December <strong>2009</strong> –<br />

08 August 2006* 110,000 08 August 2010 –<br />

02 July 2007* 220,000 02 July 2011 –<br />

12 December 2007* 198,000 12 December 2011 –<br />

22 December 2008* 242,000 13 December 2012<br />

968,000<br />

** Performance shares.<br />

** Adjusted for the share options, restricted shares and <strong>performance</strong> shares granted as a result of the rights issue.<br />

Refer to the compensation report for further <strong>in</strong>formation on directors’ participation <strong>in</strong> the Scheme and the Plan.<br />

No new loans have been granted to the executive directors s<strong>in</strong>ce 28 March 2002.<br />

(ZAR)**<br />

30. F<strong>in</strong>ancial <strong>in</strong>struments<br />

The group’s f<strong>in</strong>ancial <strong>in</strong>struments consist ma<strong>in</strong>ly of cash and cash equivalents, accounts receivable, certa<strong>in</strong> <strong>in</strong>vestments,<br />

accounts payable, borrow<strong>in</strong>gs and derivative <strong>in</strong>struments.<br />

Introduction<br />

The pr<strong>in</strong>cipal risks to which <strong>Sappi</strong> is exposed through f<strong>in</strong>ancial <strong>in</strong>struments are:<br />

a) market risk (the risk of loss aris<strong>in</strong>g from adverse changes <strong>in</strong> market rates and prices), aris<strong>in</strong>g from:<br />

– <strong>in</strong>terest rate risk<br />

– currency risk<br />

– commodity price risk<br />

b) credit risk<br />

c) liquidity risk<br />

The group’s ma<strong>in</strong> f<strong>in</strong>ancial risk management objectives are to identify, measure and manage the above risks as more fully<br />

discussed under the <strong>in</strong>dividual risk head<strong>in</strong>gs below.<br />

<strong>Sappi</strong>’s Group Treasury is comprised of two components: <strong>Sappi</strong> International, located <strong>in</strong> Brussels, which manages the<br />

group’s non-South African treasury activities and, for local regulatory reasons, the operations based <strong>in</strong> Johannesburg which<br />

manage the group’s Southern African treasury activities.<br />

These two operations collaborate closely and are primarily responsible for the group’s <strong>in</strong>terest rate, foreign currency, liquidity<br />

and credit risk (<strong>in</strong> so far as it relates to deposits of cash, cash equivalents and f<strong>in</strong>ancial <strong>in</strong>vestments).<br />

Commodity risk and credit risk (<strong>in</strong> so far as it relates to trade receivables) are primarily managed regionally but are coord<strong>in</strong>ated<br />

on a group basis.<br />

The group’s Limits of Authority framework delegates responsibility and approval authority to various officers, committees<br />

and boards based on the nature, duration and size of the various transactions entered <strong>in</strong>to by, and exposures of, the group,<br />

<strong>in</strong>clud<strong>in</strong>g the exposures and transactions relat<strong>in</strong>g to the f<strong>in</strong>ancial <strong>in</strong>struments and risks referred to <strong>in</strong> this note.