Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Follow<strong>in</strong>g this ref<strong>in</strong>anc<strong>in</strong>g, we have a much improved liquidity position with cash of US$770 million<br />

available at the end of September <strong>2009</strong> and no major debt maturities before 2012. We are of the<br />

op<strong>in</strong>ion that it is prudent to ma<strong>in</strong>ta<strong>in</strong> an <strong>in</strong>creased cash balance as a cushion <strong>in</strong> times of economic<br />

uncerta<strong>in</strong>ty. <strong>Our</strong> f<strong>in</strong>ance costs have <strong>in</strong>creased significantly and at current <strong>in</strong>terest rates we expect<br />

our net f<strong>in</strong>ance costs for 2010 to <strong>in</strong>crease to approximately US$250 million. In order to cont<strong>in</strong>ue<br />

reduc<strong>in</strong>g our net debt we will focus on cash generation and will manage our capital expenditures<br />

tightly but at a level which ensures that we ma<strong>in</strong>ta<strong>in</strong> our assets <strong>in</strong> good condition and meet our<br />

commitments to health, safety and environmental standards.<br />

The major elements of the ref<strong>in</strong>anc<strong>in</strong>g are discussed below.<br />

<strong>2009</strong> annual report 57<br />

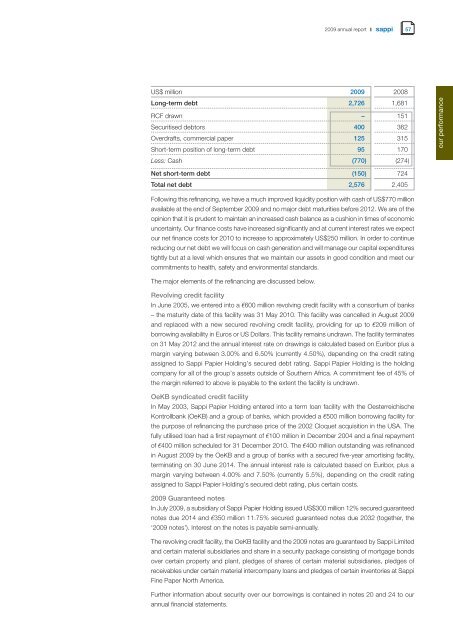

US$ million <strong>2009</strong> 2008<br />

Long-term debt 2,726 1,681<br />

RCF drawn – 151<br />

Securitised debtors 400 362<br />

Overdrafts, commercial paper 125 315<br />

Short-term position of long-term debt 95 170<br />

Less: Cash (770) (274)<br />

Net short-term debt (150) 724<br />

Total net debt 2,576 2,405<br />

Revolv<strong>in</strong>g credit facility<br />

In June 2005, we entered <strong>in</strong>to a r600 million revolv<strong>in</strong>g credit facility with a consortium of banks<br />

– the maturity date of this facility was 31 May 2010. This facility was cancelled <strong>in</strong> August <strong>2009</strong><br />

and replaced with a new secured revolv<strong>in</strong>g credit facility, provid<strong>in</strong>g for up to r209 million of<br />

borrow<strong>in</strong>g availability <strong>in</strong> Euros or US Dollars. This facility rema<strong>in</strong>s undrawn. The facility term<strong>in</strong>ates<br />

on 31 May 2012 and the annual <strong>in</strong>terest rate on draw<strong>in</strong>gs is calculated based on Euribor plus a<br />

marg<strong>in</strong> vary<strong>in</strong>g between 3.00% and 6.50% (currently 4.50%), depend<strong>in</strong>g on the credit rat<strong>in</strong>g<br />

assigned to <strong>Sappi</strong> Papier Hold<strong>in</strong>g’s secured debt rat<strong>in</strong>g. <strong>Sappi</strong> Papier Hold<strong>in</strong>g is the hold<strong>in</strong>g<br />

company for all of the group’s assets outside of Southern Africa. A commitment fee of 45% of<br />

the marg<strong>in</strong> referred to above is payable to the extent the facility is undrawn.<br />

OeKB syndicated credit facility<br />

In May 2003, <strong>Sappi</strong> Papier Hold<strong>in</strong>g entered <strong>in</strong>to a term loan facility with the Oesterreichische<br />

Kontrollbank (OeKB) and a group of banks, which provided a r500 million borrow<strong>in</strong>g facility for<br />

the purpose of ref<strong>in</strong>anc<strong>in</strong>g the purchase price of the 2002 Cloquet acquisition <strong>in</strong> the USA. The<br />

fully utilised loan had a first repayment of r100 million <strong>in</strong> December 2004 and a f<strong>in</strong>al repayment<br />

of r400 million scheduled for 31 December 2010. The r400 million outstand<strong>in</strong>g was ref<strong>in</strong>anced<br />

<strong>in</strong> August <strong>2009</strong> by the OeKB and a group of banks with a secured five-year amortis<strong>in</strong>g facility,<br />

term<strong>in</strong>at<strong>in</strong>g on 30 June 2014. The annual <strong>in</strong>terest rate is calculated based on Euribor, plus a<br />

marg<strong>in</strong> vary<strong>in</strong>g between 4.00% and 7.50% (currently 5.5%), depend<strong>in</strong>g on the credit rat<strong>in</strong>g<br />

assigned to <strong>Sappi</strong> Papier Hold<strong>in</strong>g’s secured debt rat<strong>in</strong>g, plus certa<strong>in</strong> costs.<br />

<strong>2009</strong> Guaranteed notes<br />

In July <strong>2009</strong>, a subsidiary of <strong>Sappi</strong> Papier Hold<strong>in</strong>g issued US$300 million 12% secured guaranteed<br />

notes due 2014 and r350 million 11.75% secured guaranteed notes due 2032 (together, the<br />

‘<strong>2009</strong> notes’). Interest on the notes is payable semi-annually.<br />

The revolv<strong>in</strong>g credit facility, the OeKB facility and the <strong>2009</strong> notes are guaranteed by <strong>Sappi</strong> Limited<br />

and certa<strong>in</strong> material subsidiaries and share <strong>in</strong> a security package consist<strong>in</strong>g of mortgage bonds<br />

over certa<strong>in</strong> property and plant, pledges of shares of certa<strong>in</strong> material subsidiaries, pledges of<br />

receivables under certa<strong>in</strong> material <strong>in</strong>tercompany loans and pledges of certa<strong>in</strong> <strong>in</strong>ventories at <strong>Sappi</strong><br />

F<strong>in</strong>e Paper North America.<br />

Further <strong>in</strong>formation about security over our borrow<strong>in</strong>gs is conta<strong>in</strong>ed <strong>in</strong> notes 20 and 24 to our<br />

annual f<strong>in</strong>ancial statements.<br />

our <strong>performance</strong>