Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>2009</strong> annual report<br />

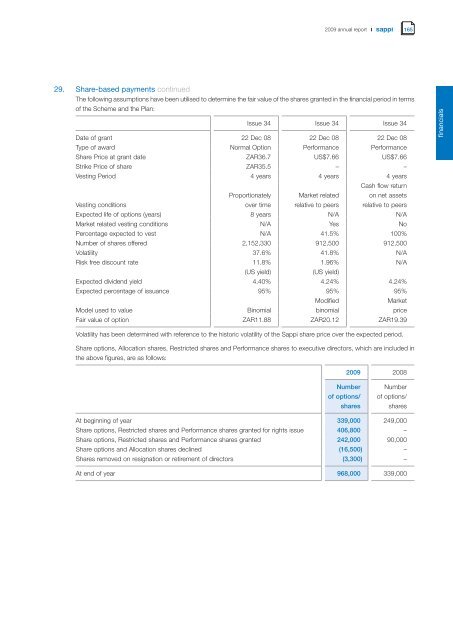

29. Share-based payments cont<strong>in</strong>ued<br />

The follow<strong>in</strong>g assumptions have been utilised to determ<strong>in</strong>e the fair value of the shares granted <strong>in</strong> the f<strong>in</strong>ancial period <strong>in</strong> terms<br />

of the Scheme and the Plan:<br />

Issue 34 Issue 34 Issue 34<br />

Date of grant 22 Dec 08 22 Dec 08 22 Dec 08<br />

Type of award Normal Option Performance Performance<br />

Share Price at grant date ZAR36.7 US$7.66 US$7.66<br />

Strike Price of share ZAR35.5 – –<br />

Vest<strong>in</strong>g Period 4 years 4 years 4 years<br />

Vest<strong>in</strong>g conditions<br />

Proportionately<br />

over time<br />

Market related<br />

relative to peers<br />

Cash flow return<br />

on net assets<br />

relative to peers<br />

Expected life of options (years) 8 years N/A N/A<br />

Market related vest<strong>in</strong>g conditions N/A Yes No<br />

Percentage expected to vest N/A 41.5% 100%<br />

Number of shares offered 2,152,330 912,500 912,500<br />

Volatility 37.6% 41.8% N/A<br />

Risk free discount rate 11.8%<br />

(US yield)<br />

1.96%<br />

(US yield)<br />

Expected dividend yield 4.40% 4.24% 4.24%<br />

Expected percentage of issuance 95% 95% 95%<br />

Model used to value B<strong>in</strong>omial<br />

Modified<br />

b<strong>in</strong>omial<br />

N/A<br />

Market<br />

Fair value of option ZAR11.88 ZAR20.12 ZAR19.39<br />

Volatility has been determ<strong>in</strong>ed with reference to the historic volatility of the <strong>Sappi</strong> share price over the expected period.<br />

Share options, Allocation shares, Restricted shares and Performance shares to executive directors, which are <strong>in</strong>cluded <strong>in</strong><br />

the above figures, are as follows:<br />

price<br />

<strong>2009</strong> 2008<br />

Number<br />

of options/<br />

shares<br />

Number<br />

of options/<br />

shares<br />

At beg<strong>in</strong>n<strong>in</strong>g of year 339,000 249,000<br />

Share options, Restricted shares and Performance shares granted for rights issue 406,800 –<br />

Share options, Restricted shares and Performance shares granted 242,000 90,000<br />

Share options and Allocation shares decl<strong>in</strong>ed (16,500) –<br />

Shares removed on resignation or retirement of directors (3,300) –<br />

At end of year 968,000 339,000<br />

165<br />

f<strong>in</strong>ancials