Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

US$ million<br />

<strong>2009</strong> annual report<br />

<strong>2009</strong> 2008<br />

Assets Liabilities Assets Liabilities<br />

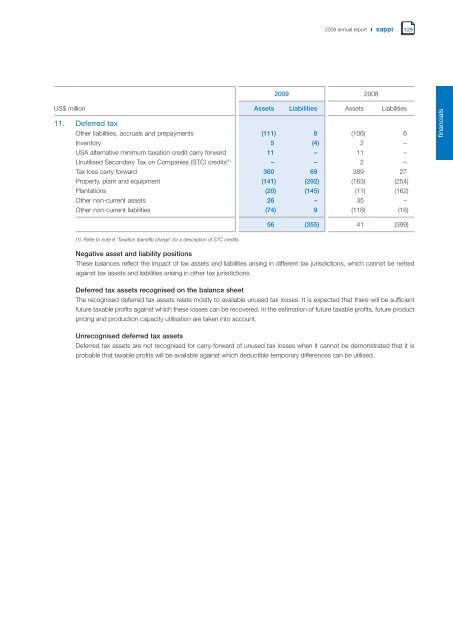

11. Deferred tax<br />

Other liabilities, accruals and prepayments (111) 8 (106) 6<br />

Inventory 5 (4) 2 –<br />

USA alternative m<strong>in</strong>imum taxation credit carry forward 11 – 11 –<br />

Unutilised Secondary Tax on Companies (STC) credits (1) – – 2 –<br />

Tax loss carry forward 360 69 389 27<br />

Property, plant and equipment (141) (292) (163) (254)<br />

Plantations (20) (145) (11) (162)<br />

Other non-current assets 26 – 35 –<br />

Other non-current liabilities (74) 9 (118) (16)<br />

(1) Refer to note 6 ‘Taxation (benefit) charge’ for a description of STC credits.<br />

Negative asset and liability positions<br />

56 (355) 41 (399)<br />

These balances reflect the impact of tax assets and liabilities aris<strong>in</strong>g <strong>in</strong> different tax jurisdictions, which cannot be netted<br />

aga<strong>in</strong>st tax assets and liabilities aris<strong>in</strong>g <strong>in</strong> other tax jurisdictions.<br />

Deferred tax assets recognised on the balance sheet<br />

The recognised deferred tax assets relate mostly to available unused tax losses. It is expected that there will be sufficient<br />

future taxable profits aga<strong>in</strong>st which these losses can be recovered. In the estimation of future taxable profits, future product<br />

pric<strong>in</strong>g and production capacity utilisation are taken <strong>in</strong>to account.<br />

Unrecognised deferred tax assets<br />

Deferred tax assets are not recognised for carry-forward of unused tax losses when it cannot be demonstrated that it is<br />

probable that taxable profits will be available aga<strong>in</strong>st which deductible temporary differences can be utilised.<br />

129<br />

f<strong>in</strong>ancials