Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

72<br />

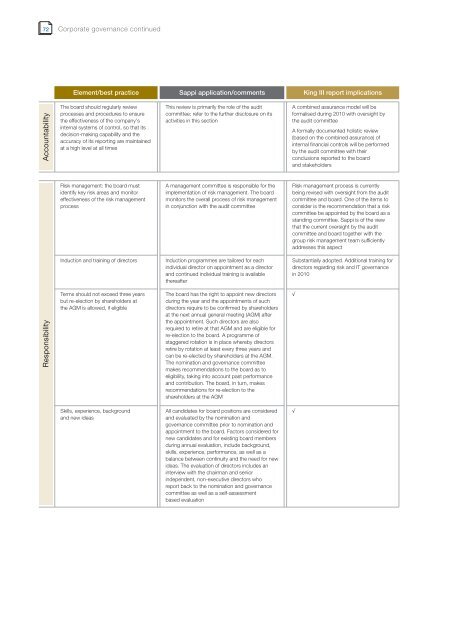

Accountability<br />

Responsibility<br />

Corporate governance cont<strong>in</strong>ued<br />

Element/best practice <strong>Sappi</strong> application/comments K<strong>in</strong>g III report implications<br />

The board should regularly review<br />

processes and procedures to ensure<br />

the effectiveness of the company’s<br />

<strong>in</strong>ternal systems of control, so that its<br />

decision-mak<strong>in</strong>g capability and the<br />

accuracy of its report<strong>in</strong>g are ma<strong>in</strong>ta<strong>in</strong>ed<br />

at a high level at all times<br />

Risk management: the board must<br />

identify key risk areas and monitor<br />

effectiveness of the risk management<br />

process<br />

This review is primarily the role of the audit<br />

committee; refer to the further disclosure on its<br />

activities <strong>in</strong> this section<br />

A management committee is responsible for the<br />

implementation of risk management. The board<br />

monitors the overall process of risk management<br />

<strong>in</strong> conjunction with the audit committee<br />

Induction and tra<strong>in</strong><strong>in</strong>g of directors Induction programmes are tailored for each<br />

<strong>in</strong>dividual director on appo<strong>in</strong>tment as a director<br />

and cont<strong>in</strong>ued <strong>in</strong>dividual tra<strong>in</strong><strong>in</strong>g is available<br />

thereafter<br />

Terms should not exceed three years<br />

but re-election by shareholders at<br />

the AGM is allowed, if eligible<br />

Skills, experience, background<br />

and new ideas<br />

The board has the right to appo<strong>in</strong>t new directors<br />

dur<strong>in</strong>g the year and the appo<strong>in</strong>tments of such<br />

directors require to be confirmed by shareholders<br />

at the next annual general meet<strong>in</strong>g (AGM) after<br />

the appo<strong>in</strong>tment. Such directors are also<br />

required to retire at that AGM and are eligible for<br />

re-election to the board. A programme of<br />

staggered rotation is <strong>in</strong> place whereby directors<br />

retire by rotation at least every three years and<br />

can be re-elected by shareholders at the AGM.<br />

The nom<strong>in</strong>ation and governance committee<br />

makes recommendations to the board as to<br />

eligibility, tak<strong>in</strong>g <strong>in</strong>to account past <strong>performance</strong><br />

and contribution. The board, <strong>in</strong> turn, makes<br />

recommendations for re-election to the<br />

shareholders at the AGM<br />

All candidates for board positions are considered<br />

and evaluated by the nom<strong>in</strong>ation and<br />

governance committee prior to nom<strong>in</strong>ation and<br />

appo<strong>in</strong>tment to the board. Factors considered for<br />

new candidates and for exist<strong>in</strong>g board members<br />

dur<strong>in</strong>g annual evaluation, <strong>in</strong>clude background,<br />

skills, experience, <strong>performance</strong>, as well as a<br />

balance between cont<strong>in</strong>uity and the need for new<br />

ideas. The evaluation of directors <strong>in</strong>cludes an<br />

<strong>in</strong>terview with the chairman and senior<br />

<strong>in</strong>dependent, non-executive directors who<br />

report back to the nom<strong>in</strong>ation and governance<br />

committee as well as a self-assessment<br />

based evaluation<br />

A comb<strong>in</strong>ed assurance model will be<br />

formalised dur<strong>in</strong>g 2010 with oversight by<br />

the audit committee<br />

A formally documented holistic review<br />

(based on the comb<strong>in</strong>ed assurance) of<br />

<strong>in</strong>ternal f<strong>in</strong>ancial controls will be performed<br />

by the audit committee with their<br />

conclusions reported to the board<br />

and stakeholders<br />

Risk management process is currently<br />

be<strong>in</strong>g revised with oversight from the audit<br />

committee and board. One of the items to<br />

consider is the recommendation that a risk<br />

committee be appo<strong>in</strong>ted by the board as a<br />

stand<strong>in</strong>g committee. <strong>Sappi</strong> is of the view<br />

that the current oversight by the audit<br />

committee and board together with the<br />

group risk management team sufficiently<br />

addresses this aspect<br />

Substantially adopted. Additional tra<strong>in</strong><strong>in</strong>g for<br />

directors regard<strong>in</strong>g risk and IT governance<br />

<strong>in</strong> 2010<br />

√<br />

√