Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Our performance in 2009 - Sappi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

122<br />

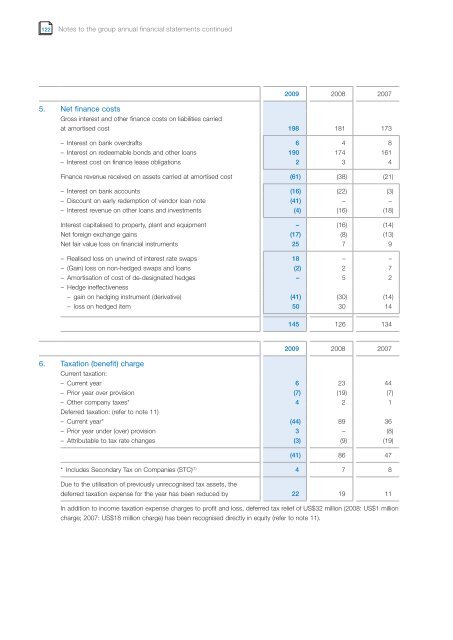

Notes to the group annual f<strong>in</strong>ancial statements cont<strong>in</strong>ued<br />

5. Net f<strong>in</strong>ance costs<br />

Gross <strong>in</strong>terest and other f<strong>in</strong>ance costs on liabilities carried<br />

<strong>2009</strong> 2008 2007<br />

at amortised cost 198 181 173<br />

– Interest on bank overdrafts 6 4 8<br />

– Interest on redeemable bonds and other loans 190 174 161<br />

– Interest cost on f<strong>in</strong>ance lease obligations 2 3 4<br />

F<strong>in</strong>ance revenue received on assets carried at amortised cost (61) (38) (21)<br />

– Interest on bank accounts (16) (22) (3)<br />

– Discount on early redemption of vendor loan note (41) – –<br />

– Interest revenue on other loans and <strong>in</strong>vestments (4) (16) (18)<br />

Interest capitalised to property, plant and equipment – (16) (14)<br />

Net foreign exchange ga<strong>in</strong>s (17) (8) (13)<br />

Net fair value loss on f<strong>in</strong>ancial <strong>in</strong>struments 25 7 9<br />

– Realised loss on unw<strong>in</strong>d of <strong>in</strong>terest rate swaps 18 – –<br />

– (Ga<strong>in</strong>) loss on non-hedged swaps and loans (2) 2 7<br />

– Amortisation of cost of de-designated hedges – 5 2<br />

– Hedge <strong>in</strong>effectiveness<br />

– ga<strong>in</strong> on hedg<strong>in</strong>g <strong>in</strong>strument (derivative) (41) (30) (14)<br />

– loss on hedged item 50 30 14<br />

6. Taxation (benefit) charge<br />

Current taxation:<br />

145 126 134<br />

<strong>2009</strong> 2008 2007<br />

– Current year 6 23 44<br />

– Prior year over provision (7) (19) (7)<br />

– Other company taxes* 4 2 1<br />

Deferred taxation: (refer to note 11)<br />

– Current year* (44) 89 36<br />

– Prior year under (over) provision 3 – (8)<br />

– Attributable to tax rate changes (3) (9) (19)<br />

(41) 86 47<br />

* Includes Secondary Tax on Companies (STC) (1) 4 7 8<br />

Due to the utilisation of previously unrecognised tax assets, the<br />

deferred taxation expense for the year has been reduced by 22 19 11<br />

In addition to <strong>in</strong>come taxation expense charges to profit and loss, deferred tax relief of US$32 million (2008: US$1 million<br />

charge; 2007: US$18 million charge) has been recognised directly <strong>in</strong> equity (refer to note 11).