- Page 1 and 2:

Standards& Guidelines e GE Identity

- Page 3 and 4:

Basic Standards e GE Identity Progr

- Page 5 and 6:

To: GE Identity Program participant

- Page 7 and 8:

What is the GE Identity Program? 11

- Page 9 and 10:

Who is included in the GE Identity

- Page 11 and 12:

field (which includes outline circl

- Page 13 and 14:

g positive Monogram e reverse Monog

- Page 15 and 16:

Trademark Practices & Protections G

- Page 17 and 18:

Definitions trademark or service ma

- Page 19 and 20:

Design Marks In all applications, u

- Page 21 and 22:

These guidelines apply to affiliate

- Page 23 and 24:

For examples of resellers’ use of

- Page 25 and 26:

Suppliers Suppliers of materials, e

- Page 27 and 28:

Secondary Trademarks & Service Mark

- Page 29 and 30:

g 2nd’ryMarq g 2nd’ryMarq 2nd

- Page 31 and 32:

Select secondary word marks accordi

- Page 33 and 34:

In copy, use secondary word marks a

- Page 35 and 36:

Trade Names, Trademarks, &theGE Ide

- Page 37 and 38:

Appendices, continued Appendix B: C

- Page 39 and 40:

I. Requirements A. General All GE b

- Page 41 and 42:

III. Responsibilities of leaders A.

- Page 43 and 44:

III. Responsibilities of leaders, c

- Page 45 and 46:

III. Responsibilities of leaders, c

- Page 47 and 48:

I. General A. All created or acquir

- Page 49 and 50:

III. Trademarks: Created or acquire

- Page 51 and 52:

I. General II.Trade name A. All joi

- Page 53 and 54:

III. Identification alternatives fo

- Page 55 and 56:

V. Summary of requirements for join

- Page 57 and 58:

II. Third-party license review fact

- Page 59 and 60:

Graphic Signatures g GE Identity Pr

- Page 61 and 62:

Graphic Signature General Guideline

- Page 63 and 64:

Grow your kitchen with Gg Spacemake

- Page 65 and 66:

g g g GE Plastics Spacemaker We bri

- Page 67 and 68:

g g g g g g g GE Transportation Sys

- Page 69 and 70:

g g g GE Typography GE Typography G

- Page 71 and 72:

To construct the primary signature

- Page 73 and 74:

To construct the compact signature

- Page 75 and 76:

To construct the vertical signature

- Page 77 and 78:

Use the special signatures only in

- Page 79 and 80:

Gg Gg Gg Idling with others? Get th

- Page 81 and 82:

ITC New Baskerville Italic ABCDEFGH

- Page 83 and 84:

g g g g Profile We bring good thing

- Page 85 and 86:

g g g g g Signature Typography As s

- Page 87 and 88:

GE Plastics GE PLASTICS We bring go

- Page 89 and 90:

g 2nd’ryMarq g 2nd’ryMarq 2nd

- Page 91 and 92:

Color These guidelines apply to the

- Page 93 and 94:

Laser Red* Platinum Grey* *When mat

- Page 95 and 96:

g g g g We bring good things to lif

- Page 97 and 98:

e e e e Gg We bring good things to

- Page 99 and 100:

e g e g Gg We bring good things to

- Page 101 and 102:

e g Gg We bring good things to life

- Page 103 and 104:

e g Gg e g We bring good things to

- Page 105 and 106:

Typography g GE Identity Program Pr

- Page 107 and 108:

The Univers series of typefaces has

- Page 109 and 110:

The ITC New Baskerville series of t

- Page 111 and 112:

Dynamic Monogram Contents GE Identi

- Page 113 and 114:

When using this version, follow the

- Page 115 and 116:

When using this version, follow the

- Page 117 and 118:

Horizontal Left-Bleeding Dynamic Mo

- Page 119 and 120:

When using any of the bar versions

- Page 121 and 122:

Gg e GE Typography Dynamic Monogram

- Page 123 and 124:

e g GE Typography Dynamic Monogram

- Page 125 and 126:

Application Standards Gg GE Identit

- Page 127 and 128:

Products Contents GE Identity Progr

- Page 129 and 130:

e g 2nd’ryMarq g 2nd’ryMarq 2nd

- Page 131 and 132:

Identification Elements: Primary si

- Page 133 and 134:

Identification Elements: Vertical s

- Page 135 and 136:

Identification Elements: Compact si

- Page 137 and 138:

Identification Elements: Monogram o

- Page 139 and 140:

e Product Examples 210.19 Diesel-El

- Page 141 and 142:

Although the guidelines that apply

- Page 143 and 144:

Packaging g GE Identity Program The

- Page 145 and 146:

g Signature Typography Featured Typ

- Page 147 and 148:

e Supporting Typography Signature T

- Page 149 and 150:

e Signature Typography Featured Typ

- Page 151 and 152:

This example demonstrates the use o

- Page 153 and 154:

g GE Plastics NorylThermoplastic Re

- Page 155 and 156:

e MPI g MPI TM Hand Held 2-Way Radi

- Page 157 and 158:

e Rangr Mobile Radio Rangr Mobile R

- Page 159 and 160:

Packaging outside the U.S.A. Packag

- Page 161 and 162:

Shipping Cases&Cartons g GE Identit

- Page 163 and 164:

g Signature Typography Featured Typ

- Page 165 and 166:

e Supporting Typography Signature T

- Page 167 and 168:

Featured Typography generic product

- Page 169 and 170:

g Refrigerator The examples on this

- Page 171 and 172:

g Silicone Auto Product 12 Tubes pa

- Page 173 and 174:

OEM Shipping Cases & Cartons Origin

- Page 175 and 176:

Advertising g GE Identity Program T

- Page 177 and 178:

The advertising standards consist o

- Page 179 and 180:

2. Use the structure of the adverti

- Page 181 and 182:

Why we take Print Advertising Examp

- Page 183 and 184:

e GE Medical Systems We bring good

- Page 185 and 186:

T 7 0 0 6500 HOURS. In the most dem

- Page 187 and 188:

When the advertising format is narr

- Page 189 and 190:

For headlines and text, any typefac

- Page 191 and 192:

In short headlines, ITC New Baskerv

- Page 193 and 194:

Against colored backgrounds, graphi

- Page 195 and 196:

Laser Red and the minimum 133-line

- Page 197 and 198:

e GE Aircraft Engines We bring good

- Page 199 and 200:

e e e e We bring good things to lif

- Page 201 and 202:

g Yellow Pages Advertising Examples

- Page 203 and 204:

1. 2. 3. 4. 5. 6. GE COMPANY PRODUC

- Page 205 and 206:

Recruitment Advertising g GE Identi

- Page 207 and 208:

Engineers GE is looking for imagina

- Page 209 and 210:

Engineers GE is looking for brillia

- Page 211 and 212:

Engineers GE is looking for imagina

- Page 213 and 214:

Sales Support Professionals Experts

- Page 215 and 216:

Although no two GE recruitment adve

- Page 217 and 218:

Promotional Brochures g GE Identity

- Page 219 and 220:

Use a grid. A grid is an underlying

- Page 221 and 222:

The first step in developing a prom

- Page 223 and 224:

A 4 B 4 g e e CAA GE Center for Adv

- Page 225 and 226:

The examples on pages 08 to 11 demo

- Page 227 and 228:

When multiple photographs or illust

- Page 229 and 230:

This example demonstrates the third

- Page 231 and 232:

e GE Signa The MR Reference Point S

- Page 233 and 234:

e Signature Content: Communicative

- Page 235 and 236:

On the back of promotional brochure

- Page 237 and 238:

Product Literature Contents GE Iden

- Page 239 and 240:

Use color correctly. • In a graph

- Page 241 and 242:

For an explanation of the product l

- Page 243 and 244:

When it is necessary to emphasize,

- Page 245 and 246:

When multiple photographs or illust

- Page 247 and 248:

When developing the inside of produ

- Page 249 and 250:

On the back of product brochures, a

- Page 251 and 252:

When a large number of specificatio

- Page 253 and 254:

Use & Care Guides are developed acc

- Page 255 and 256:

Promotional Materials Contents GE I

- Page 257 and 258:

Poster e e Appliances Sale! Product

- Page 259 and 260:

These guidelines cover a wide range

- Page 261 and 262:

e GE GE Capital Fleet Services Cell

- Page 263 and 264:

When developing novelties to promot

- Page 265 and 266:

• Do not use - group, division, d

- Page 267 and 268:

Exhibits g GE Identity Program The

- Page 269 and 270:

History The GE exhibit program was

- Page 271 and 272:

01 Section 01: Overview Typical Exh

- Page 273 and 274:

01 Section 01: Overview Typical Exh

- Page 275 and 276:

For assistance executing a GE exhib

- Page 277 and 278:

The project scheduling outline at t

- Page 279 and 280:

1. Budget Review 2. Establish annua

- Page 281 and 282:

53. Live Show and Presenters 54. De

- Page 283 and 284:

The GE exhibit program is built on

- Page 285 and 286:

Standard header background colors g

- Page 287 and 288:

03 Zone 1: Brand Identity • Zone

- Page 289 and 290:

g GE Medical Systems 39"x 39" 39"x

- Page 291 and 292:

g Heading on 2 lines: ITC New Baske

- Page 293 and 294:

5m (195") a g GE Aircraft Engines 3

- Page 295 and 296:

Presentations g GE Identity Program

- Page 297 and 298:

Producing a presentation layout is

- Page 299 and 300:

01 Section 01: Introduction Recomme

- Page 301 and 302:

Examples are reductions of 11 x 8 1

- Page 303 and 304:

Examples are reductions of a 4 5

- Page 305 and 306:

Examples are reductions of 11 x 8 1

- Page 307 and 308:

The same basic style for text is us

- Page 309 and 310:

Examples are reductions of 11 x 8 1

- Page 311 and 312:

Examples are reductions of 11 x 8 1

- Page 313 and 314:

Examples are reductions of 11 x 8 1

- Page 315 and 316:

03 Section 03: Headlines, Text, & T

- Page 317 and 318:

Examples are reductions of 11 x 8 1

- Page 319 and 320:

Examples are reductions of 11 x 8 1

- Page 321 and 322:

Examples are reductions of 11 x 8 1

- Page 323 and 324:

Edward Tufte’s book, The Visual D

- Page 325 and 326:

Examples are reductions of 11 x 8 1

- Page 327 and 328:

Examples are reductions of 11 x 8 1

- Page 329 and 330:

Examples are reductions of 11 x 8 1

- Page 331 and 332:

Employee Communications Gg Newslett

- Page 333:

Newsletters Contents GE Identity Pr

- Page 336 and 337:

*For computer artwork, the followin

- Page 338 and 339:

2 HQnews / April 11, 2003 Confessio

- Page 340 and 341:

Justifying narrow columns of text c

- Page 342 and 343:

Employee Identification g GE Identi

- Page 344 and 345:

When designing security badges, fol

- Page 346 and 347:

Stationery for North American Busin

- Page 348 and 349:

g Robert W. Holmes Vice President G

- Page 350 and 351:

A. Address block ——————

- Page 352 and 353:

Employee’s Name & Job Title Subco

- Page 354 and 355:

Business Communicative Name Certifi

- Page 356 and 357:

GE Identity Program 261, Stationery

- Page 358 and 359:

GE Identity Program 261, Stationery

- Page 360 and 361:

GE Identity Program 261, Stationery

- Page 362 and 363:

GE Identity Program 261, Stationery

- Page 364 and 365:

GE Identity Program 261, Stationery

- Page 366 and 367:

GE Identity Program 261, Stationery

- Page 368 and 369:

GE Identity Program 261, Stationery

- Page 370 and 371:

GE Identity Program 261, Stationery

- Page 372 and 373:

GE Identity Program 261, Stationery

- Page 374 and 375:

GE Identity Program 261, Stationery

- Page 376 and 377:

GE Identity Program 261, Stationery

- Page 378 and 379:

GE Identity Program 261, Stationery

- Page 380 and 381:

Stationery for Corporate Staff g GE

- Page 382 and 383:

g Stuart L. Barber Staff Executive

- Page 384 and 385:

General Specifications Too tight An

- Page 386 and 387:

E-mail Address Andrew.Harman@corpor

- Page 388 and 389:

GE Identity Program 262, Stationery

- Page 390 and 391:

GE Identity Program 262, Stationery

- Page 392 and 393:

GE Identity Program 262, Stationery

- Page 394 and 395:

GE Identity Program 262, Stationery

- Page 396 and 397:

Formatting Stationery in North Amer

- Page 398 and 399:

one-third fold line The salutation

- Page 400 and 401:

one-third fold line The salutation

- Page 402 and 403:

Standard Corporate Envelope The add

- Page 404 and 405:

g GE NEWS RELEASE General Electric

- Page 406 and 407:

Stationery for Businesses outside N

- Page 408 and 409:

g Richard A. Eason Research Directo

- Page 410 and 411:

A. Address block ——————

- Page 412 and 413:

Employee’s Name & Job Title Subco

- Page 414 and 415:

Business Communicative Name Certifi

- Page 416 and 417:

GE Identity Program 264, Stationery

- Page 418 and 419:

GE Identity Program 264, Stationery

- Page 420 and 421:

GE Identity Program 264, Stationery

- Page 422 and 423:

GE Identity Program 264, Stationery

- Page 424 and 425:

Formatting Stationery outside North

- Page 426 and 427:

Addressee’s Name Day Month Year P

- Page 428 and 429:

Forms& Checks g GE Identity Program

- Page 430 and 431:

Understanding the requirements of g

- Page 432 and 433:

Predesign Planning Before tackling

- Page 434 and 435:

Vertical format 8 1 ⁄2 "x 11" 8 1

- Page 436 and 437:

Example 1 g Example 2 Example 3 Exa

- Page 438 and 439:

To differentiate and emphasize item

- Page 440 and 441:

Consolidating forms by adapting an

- Page 442 and 443:

If the amount of information to com

- Page 444 and 445:

Forms used by GE’s business partn

- Page 446 and 447:

Rule Weights • To structure infor

- Page 448 and 449:

The Laser Line may bleed left, but

- Page 450 and 451:

Facility Signs Contents GE Identity

- Page 452 and 453:

The pylon sign is a three-faced mon

- Page 454 and 455:

The monument is a single-faced sign

- Page 456 and 457:

The pole sign is a double-faced sig

- Page 458 and 459:

The ground sign is identical to the

- Page 460 and 461:

The cantilever-mounted wall sign is

- Page 462 and 463:

The flush-mounted wall sign is sing

- Page 464 and 465:

A graphic signature may be fabricat

- Page 466 and 467:

The roof sign is a custom-built sig

- Page 468 and 469:

Decals of graphic signatures, the M

- Page 470 and 471:

The standard directional sign provi

- Page 472 and 473:

Vehicles g These standards apply ge

- Page 474 and 475:

Use white as the base color of the

- Page 476 and 477: Note: See the general guidelines on

- Page 478 and 479: Note: See the general guidelines on

- Page 480 and 481: g GE Utility & Industrial Service A

- Page 482 and 483: g e g Industrial Haulage 290.10 Bec

- Page 484 and 485: If a tarpaulin is designed to fit a

- Page 486 and 487: g Shelton, Connecticut GE Supply Sh

- Page 488 and 489: Component Names g GE Identity Progr

- Page 490 and 491: As the Company simplifies its organ

- Page 492 and 493: The Communicative Name “GE” In

- Page 494 and 495: Summary Standards &Guidelines g GE

- Page 496 and 497: g Summary of Graphic Signatures GE

- Page 498 and 499: g GE g Spacemaker g We g Medical Sy

- Page 500 and 501: Univers 68 ABCDEFGHIJKLMNOPQRSTUVWX

- Page 502 and 503: g e e e e g Gg Gg Gg Gg e g e e e e

- Page 504 and 505: g a We bring good things to life. e

- Page 506 and 507: WE’VE JUST TOPPED THE TOP COOKTOP

- Page 508 and 509: Grow your kitchen with Gg Spacemake

- Page 510 and 511: New Businesses Name&Trademark Pract

- Page 512 and 513: Joint Ventures Name &Trademark Prac

- Page 514 and 515: e FANUC A good example of the benef

- Page 516 and 517: e g GE Similar benefits accrued whe

- Page 518 and 519: Monogram Laser Line Signature Typog

- Page 520 and 521: Graphic Identifier e FANUC e FANUC

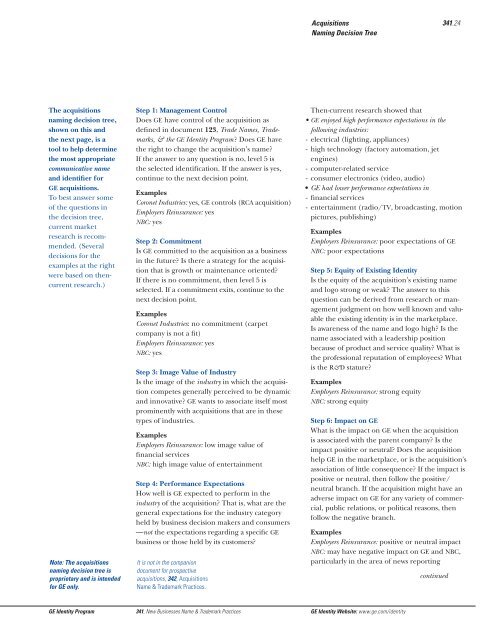

- Page 522 and 523: Acquisitions Name &Trademark Practi

- Page 524 and 525: A primary purpose of the GE Identit

- Page 528 and 529: Note: Before permitting an acquisit

- Page 530 and 531: Market Considerations & GE Ownershi

- Page 532 and 533: 1 ⁄4 D D 1 ⁄4 D 1 ⁄4 D e Mark

- Page 534 and 535: Once the • design and layout of t

- Page 536 and 537: Company applications Company applic

- Page 538 and 539: Product Literature Advertising g Sp

- Page 540 and 541: Acquisitions Name & Trademark Pract

- Page 542 and 543: g GE We bring good things to life.

- Page 544 and 545: A primary purpose of the GE Identit

- Page 546 and 547: Note: Before an acquisition may ado

- Page 548 and 549: Joint Ventures Name & Trademark Pra

- Page 550 and 551: g GE We bring good things to life.

- Page 552 and 553: Market Considerations & GE Ownershi

- Page 554 and 555: 1 ⁄4 D D 1 ⁄4 D 1 ⁄4 D e Mark

- Page 556 and 557: Once the • design and layout of t

- Page 558 and 559: Company applications Company applic

- Page 560 and 561: Product Literature Advertising g Sp

- Page 562 and 563: Licensees Trademark Practices Conte

- Page 564 and 565: In 1987, GE introduced an identity

- Page 566 and 567: 1. Do not use the GE graphic system

- Page 568 and 569: Stationery Business forms specific

- Page 570 and 571: Products Packages Gg Spacemaker Gg

- Page 572 and 573: Advertising Exhibits re te feugait

- Page 574 and 575: Dealers& Distributors Trademark &Gr

- Page 576 and 577:

Introduction 360.02 As a GE dealer,

- Page 578 and 579:

In 1987, GE introduced an identity

- Page 580 and 581:

1 ⁄2 D D D D 1 ⁄2 D D g GE Prim

- Page 582 and 583:

Five Basic Rules for Dealers & Dist

- Page 584 and 585:

Five Basic Rules for Dealers & Dist

- Page 586 and 587:

Prova en lada av any ER energi-soar

- Page 588 and 589:

Television and Radio Advertising Gu

- Page 590 and 591:

Gg Lampa Prova! e Authorized Distri

- Page 592 and 593:

e 7 8 * # 0 Authorized Dealer CV 20

- Page 594 and 595:

e Mobile Communications Authorized

- Page 596 and 597:

Weyburn’s Home Appliances Barnsdo

- Page 598 and 599:

g e Correct reproduction Correct re

- Page 600 and 601:

Original Equipment Manufacturer (OE

- Page 602 and 603:

OEM Shipping Cases & Cartons Origin

- Page 604 and 605:

Using the Adobe ® Acrobat ® famil

- Page 606 and 607:

Standard Guidel thumbnail navigatio

- Page 608 and 609:

last page scroll bar dards&. uideli

- Page 610 and 611:

GE Logo Font Contents 382.01 Introd

- Page 612 and 613:

field (which includes the outline c

- Page 614 and 615:

` shift 1 2 q a When the Monogram i

- Page 616 and 617:

` shift 1 2 q a Gg We bring To prod

- Page 618 and 619:

For artwork only. Use these only wh

- Page 620 and 621:

g Signature g Signature g Signature

- Page 622 and 623:

g g g g Signature Typography Signat

- Page 624 and 625:

FAQ : g Basic Standards Frequently

- Page 626 and 627:

FAQ: Basic Standards, continued 391

- Page 628 and 629:

FAQ: Advertising & Branding, contin

- Page 630 and 631:

Reproduction Materials e Contained

- Page 632 and 633:

16 15 14 13 12 11 10 9 8 7 6 5 4 3

- Page 634 and 635:

16 15 14 13 12 11 10 9 8 7 6 5 4 3

- Page 636 and 637:

Standards& Guidelines e GE Identity

- Page 638 and 639:

Products g GE Identity Program The

- Page 640 and 641:

Follow these general guidelines to

- Page 642 and 643:

Identification Elements: Primary si

- Page 644 and 645:

Identification Elements: Compact si

- Page 646 and 647:

Identification Elements: Special si

- Page 648 and 649:

Identification Elements: Special si

- Page 650 and 651:

Identification Elements: Compact si

- Page 652 and 653:

Identification Elements: Compact si

- Page 654 and 655:

Original Equipment Manufacturer (OE

- Page 656 and 657:

Packaging Contents GE Identity Prog

- Page 658 and 659:

e Supporting Typography Signature T

- Page 660 and 661:

Packaging Guidelines, continued GE

- Page 662 and 663:

Featured Typography generic product

- Page 664 and 665:

e e e The Home Pro Line Silicone II

- Page 666 and 667:

e Keep Do not drop Carry-Cool Porta

- Page 668 and 669:

The examples on this page cannot be

- Page 670 and 671:

V e r s a t i l e T o a s t i n g e

- Page 672 and 673:

OEM Packaging Original Equipment Ma

- Page 674 and 675:

Shipping Cases & Cartons Contents G

- Page 676 and 677:

e Supporting Typography Signature T

- Page 678 and 679:

e Signature Typography Featured Typ

- Page 680 and 681:

g GE Silicones Gesil N 2600 Silicon

- Page 682 and 683:

e Permanent Split Capacitor g Energ

- Page 684 and 685:

Shipping Cases & Cartons outside th

- Page 686 and 687:

Marketing Communications Gg GE Iden

- Page 688 and 689:

Advertising Contents GE Identity Pr

- Page 690 and 691:

g g g g GE Aircraft Engines We brin

- Page 692 and 693:

man at 203 326-4199 r choice in inv

- Page 694 and 695:

To align the graphic signature with

- Page 696 and 697:

Graphic signatures should be sized

- Page 698 and 699:

e Print Advertising Examples F 1 1

- Page 700 and 701:

Graphic support elements such as ph

- Page 702 and 703:

Introducing a line of built-in appl

- Page 704 and 705:

Against light grey backgrounds, the

- Page 706 and 707:

The minimum 133-line screen require

- Page 708 and 709:

Outdoor advertisement A ding-free c

- Page 710 and 711:

e e GE GE Aircraft Engines We bring

- Page 712 and 713:

These guidelines apply to Yellow Pa

- Page 714 and 715:

These guidelines apply to White Pag

- Page 716 and 717:

Advertising outside the U.S.A. GE I

- Page 718 and 719:

Recruitment Advertising Contents 24

- Page 720 and 721:

1/3 2/3 Engineers GE is looking for

- Page 722 and 723:

Engineers GE is looking for bright

- Page 724 and 725:

A Director of Quality. Leeds Financ

- Page 726 and 727:

A Director of Quality. Leeds Financ

- Page 728 and 729:

Advertising outside the U.S.A. GE I

- Page 730 and 731:

Promotional Brochures Contents GE I

- Page 732 and 733:

Use color correctly. • In a graph

- Page 734 and 735:

For an explanation of the promotion

- Page 736 and 737:

The content of a graphic signature

- Page 738 and 739:

When a single photograph or illustr

- Page 740 and 741:

A thematic graphic is an image used

- Page 742 and 743:

The examples on pages 20 to 25 demo

- Page 744 and 745:

Gg Signature Content: Communicative

- Page 746 and 747:

When developing the inside of promo

- Page 748 and 749:

Literature Product g GE Identity Pr

- Page 750 and 751:

These guidelines apply to all produ

- Page 752 and 753:

The first step in developing a prod

- Page 754 and 755:

The content of a graphic signature

- Page 756 and 757:

Information can be emphasized by us

- Page 758 and 759:

Product literature covers can appea

- Page 760 and 761:

Product literature of different sha

- Page 762 and 763:

Specification sheets are developed

- Page 764 and 765:

The typefaces used outside a graphi

- Page 766 and 767:

Promotional Materials g GE Identity

- Page 768 and 769:

In all promotional materials, use a

- Page 770 and 771:

Counter card Display header band e

- Page 772 and 773:

When preparing direct mail material

- Page 774 and 775:

In these direct mail brochures, GE

- Page 776 and 777:

When designing T-shirts for promoti

- Page 778 and 779:

e GE Aircraft Engines Conditioned t

- Page 780 and 781:

01 02 03 Exhibits Contents GE Ident

- Page 782 and 783:

01 Section 01: Overview Typical Exh

- Page 784 and 785:

01 Section 01: Overview Typical Exh

- Page 786 and 787:

01 Section 01: Overview Typical Exh

- Page 788 and 789:

02 GE’s most frequent exhibitors

- Page 790 and 791:

02 XI. Live Show and Presenters A.

- Page 792 and 793:

27. Project Planning with Exhibit S

- Page 794 and 795:

77. Final Team Strategy Meeting Att

- Page 796 and 797:

Wall panel White Carpet Solid grey

- Page 798 and 799:

Zone 1: Brand Identity Zone 2: Prod

- Page 800 and 801:

g 1m white graphic signature overla

- Page 802 and 803:

g Heading on 2 lines: ITC New Baske

- Page 804 and 805:

g GE Plastics x g GE Plastics Secti

- Page 806 and 807:

a g GE Appliances a g GE Appliances

- Page 808 and 809:

01 02 03 04 Presentations Contents

- Page 810 and 811:

again again 01 Which form is best:

- Page 812 and 813:

Sequence and Emphasis of Informatio

- Page 814 and 815:

Examples are reductions of 11 x 8 1

- Page 816 and 817:

Examples are reductions of 11 x 8 1

- Page 818 and 819:

Examples are reductions of a 4 5

- Page 820 and 821:

Examples are reductions of 11 x 8 1

- Page 822 and 823:

Examples are reductions of a 4 5

- Page 824 and 825:

Examples are reductions of 11 x 8 1

- Page 826 and 827:

Examples are reductions of a 4 5

- Page 828 and 829:

Examples are reductions of 11 x 8 1

- Page 830 and 831:

Examples are reductions of a 4 5

- Page 832 and 833:

Examples are reductions of a 4 5

- Page 834 and 835:

Examples are reductions of a 4 5

- Page 836 and 837:

Examples are reductions of 11 x 8 1

- Page 838 and 839:

Examples are reductions of 11 x 8 1

- Page 840 and 841:

Examples are reductions of 11 x 8 1

- Page 842 and 843:

Examples are reductions of 11 x 8 1

- Page 844 and 845:

Newsletters g These standards apply

- Page 847 and 848:

HQ to link with live videoconferenc

- Page 849 and 850:

Keep the masthead clear of any symb

- Page 851 and 852:

Typeset headlines in ITC New Basker

- Page 853 and 854:

HQnews / April 11, 2003 Visiting Ch

- Page 855 and 856:

g Virginia Wilson GE Transportation

- Page 857 and 858:

g GE Consumer Service Uniform Patch

- Page 859 and 860:

Stationery for North American Busin

- Page 861 and 862:

A. Address block g 1. Employee’s

- Page 863 and 864:

General Specifications Too tight Co

- Page 865 and 866:

Contact Numbers E-mail Address Robe

- Page 867 and 868:

GE Identity Program 261, Stationery

- Page 869 and 870:

GE Identity Program 261, Stationery

- Page 871 and 872:

GE Identity Program 261, Stationery

- Page 873 and 874:

GE Identity Program 261, Stationery

- Page 875 and 876:

GE Identity Program 261, Stationery

- Page 877 and 878:

GE Identity Program 261, Stationery

- Page 879 and 880:

GE Identity Program 261, Stationery

- Page 881 and 882:

GE Identity Program 261, Stationery

- Page 883 and 884:

GE Identity Program 261, Stationery

- Page 885 and 886:

GE Identity Program 261, Stationery

- Page 887 and 888:

GE Identity Program 261, Stationery

- Page 889 and 890:

GE Identity Program 261, Stationery

- Page 891 and 892:

GE Identity Program 261, Stationery

- Page 893 and 894:

Stationery for Corporate Staff Cont

- Page 895 and 896:

Address block 1. Employee’s name

- Page 897 and 898:

Employee’s Name & Title Corporate

- Page 899 and 900:

GE Identity Program 262, Stationery

- Page 901 and 902:

GE Identity Program 262, Stationery

- Page 903 and 904:

GE Identity Program 262, Stationery

- Page 905 and 906:

GE Identity Program 262, Stationery

- Page 907 and 908:

GE Identity Program 262, Stationery

- Page 909 and 910:

Formatting Stationery in North Amer

- Page 911 and 912:

Addressee’s Name Month Day, Year

- Page 913 and 914:

Standard Envelope The address is ty

- Page 915 and 916:

Airmail Envelope The address is typ

- Page 917 and 918:

The address is typed to align with

- Page 919 and 920:

Stationery for Businesses outside N

- Page 921 and 922:

A. Address block g 1. Employee’s

- Page 923 and 924:

General Specifications Typesetting

- Page 925 and 926:

Contact Numbers Website Address (Op

- Page 927 and 928:

All dimensions are given in millime

- Page 929 and 930:

GE Identity Program 264, Stationery

- Page 931 and 932:

GE Identity Program 264, Stationery

- Page 933 and 934:

GE Identity Program 264, Stationery

- Page 935 and 936:

Formatting Stationery outside North

- Page 937 and 938:

one-third fold line The salutation

- Page 939 and 940:

center line The address is typed to

- Page 941 and 942:

Forms & Checks Contents GE Identity

- Page 943 and 944:

• Speak in a language your audien

- Page 945 and 946:

The word “form” generally shoul

- Page 947 and 948:

Horizontal format 11" x 8 1 ⁄2 "

- Page 949 and 950:

Example 5 g Example 6 g Beneficiary

- Page 951 and 952:

For general information, use 8/8 -p

- Page 953 and 954:

The standard format sizes include

- Page 955 and 956:

To collect a small amount of inform

- Page 957 and 958:

To differentiate and emphasize item

- Page 959 and 960:

Typeset the address block in 8/8-po

- Page 961 and 962:

Facility Signs g GE Identity Progra

- Page 963 and 964:

The guidelines summarized here help

- Page 965 and 966:

Graphic Signature To maximize the c

- Page 967 and 968:

Graphic Signatures To take advantag

- Page 969 and 970:

Graphic Signature To maximize the h

- Page 971 and 972:

Graphic Signatures To take advantag

- Page 973 and 974:

Graphic Signatures To take advantag

- Page 975 and 976:

Graphic Signatures To take advantag

- Page 977 and 978:

Graphic Signatures Depending on the

- Page 979 and 980:

Graphic Signatures Depending on the

- Page 981 and 982:

Graphic Signatures Depending on the

- Page 983 and 984:

Follow this procedure to order faci

- Page 985 and 986:

Vehicles Contents GE Identity Progr

- Page 987 and 988:

Use black or an appropriate color i

- Page 989 and 990:

g v GE Motors Tractor-Trailers, con

- Page 991 and 992:

gGE Computer Service g GE Computer

- Page 993 and 994:

e g e In-Plant Vehicles 290.09 Beca

- Page 995 and 996:

g e Heavy Construction Equipment 29

- Page 997 and 998:

Note: See the general guidelines on

- Page 999 and 1000:

affiliate an independent legal enti

- Page 1001 and 1002:

gletters /curlicues Laser Line the

- Page 1003:

signature content the message conta