- Page 1 and 2:

USER INFORMATION You can look up Ca

- Page 3 and 4:

CW 42-100 Age CW 42-101 - Age Requi

- Page 5 and 6:

CW 44-200 AU Composition and Need C

- Page 7 and 8:

CW 81-200 Diversion Services CW 81-

- Page 9 and 10:

CW 40-100 RECEPTION AND APPLICATION

- Page 11 and 12:

need to complete the form. The pote

- Page 13 and 14:

The PA 4033, National Voter Registr

- Page 15 and 16:

NOTE: When difficulties develop in

- Page 17 and 18:

• Each applicant or aided adult;

- Page 19 and 20:

to be temporarily exempt from finge

- Page 21 and 22:

• Within 30 days of determining e

- Page 23 and 24:

• Illness of a parent/caretaker r

- Page 25 and 26:

PART B, is used by the school to ve

- Page 27 and 28:

• The PA 1725, School Attendance/

- Page 29 and 30:

Update the Prior Current Aid screen

- Page 31 and 32:

For time on aid requests from other

- Page 33 and 34:

“High Risk” EW. The participant

- Page 35 and 36:

second home call is scheduled by ap

- Page 37 and 38:

CW 40-107.8 - WIC Referrals When is

- Page 39 and 40:

• If no, continue with current in

- Page 41 and 42:

If the participant requests TMTT an

- Page 43 and 44:

Will the 50 percent unemployment ra

- Page 45 and 46:

CW 40-119.3 - Adding a Person to th

- Page 47 and 48:

• If an AU requests restoration o

- Page 49 and 50:

appointment. The next day, the Elig

- Page 51 and 52:

• The documentation is missing fr

- Page 53 and 54:

Can an IN payment be issued if the

- Page 55 and 56:

What is “apparent” eligibility?

- Page 57 and 58:

An applicant family is eligible for

- Page 59 and 60:

If any one of the above is not avai

- Page 61 and 62:

• Full cooperation from the appli

- Page 63 and 64:

If the PA 2322 is returned as undel

- Page 65 and 66:

• A mail back due date for the re

- Page 67 and 68:

In addition, for telephone redeterm

- Page 69 and 70:

• Review LEADER claims. Identify

- Page 71 and 72:

• Complete the Master Case Review

- Page 73 and 74:

How is an applicant/participant not

- Page 75 and 76:

For example: CalWORKs case is termi

- Page 77 and 78:

• Verification of the AU’s MAP

- Page 79 and 80:

What action is taken when the distr

- Page 81 and 82:

payment require an appropriate NOA

- Page 83 and 84:

NOTE: As interim, a PA 853 (out of

- Page 85 and 86:

How is the four-week period calcula

- Page 87 and 88:

When the unemployed PE becomes empl

- Page 89 and 90:

CW 41-440.2 Unemployment [Deprivati

- Page 91 and 92:

CW 41-450 - Absence What is the def

- Page 93 and 94:

What evidence documents continued a

- Page 95 and 96:

services at school in accordance wi

- Page 97 and 98:

See CW 40-105.5 School Attendance R

- Page 99 and 100:

When the teen requests his/her own

- Page 101 and 102:

documents in the teen’s case. 2.

- Page 103 and 104:

participant must present evidence f

- Page 105 and 106:

erroneous. If the original PA 230 i

- Page 107 and 108:

the ES. o Files the first copy of t

- Page 109 and 110:

CW 42-111.1 - Evidence/ Documents W

- Page 111 and 112:

See CW 42-433 Child Born Outside of

- Page 113 and 114:

etc.). Real property is not cash, b

- Page 115 and 116:

Some payments are considered proper

- Page 117 and 118:

more information. If the applicant/

- Page 119 and 120:

If the property (other than a home/

- Page 121 and 122:

the applicant/participant decides n

- Page 123 and 124:

inaccessible to the AU if all of th

- Page 125 and 126:

What household items are excluded f

- Page 127 and 128:

application, the personal property:

- Page 129 and 130:

the property/resource limit. Also,

- Page 131 and 132:

have ownership interest in or a lie

- Page 133 and 134:

Property held by the AU +1,400 $2,8

- Page 135 and 136:

• Step-parent(s); and • Caretak

- Page 137 and 138:

• A victim of domestic abuse. •

- Page 139 and 140:

*The MAP amount is subject to chang

- Page 141 and 142:

• Grant amounts of $10 or less.

- Page 143 and 144:

CW 42-400 RESIDENCE CW 42-400 - Res

- Page 145 and 146:

Can aid be continued if the partici

- Page 147 and 148:

CW 42-417 - Recipients from Other S

- Page 149 and 150:

How is a Noncitizen’s eligibility

- Page 151 and 152:

• LEADER will fail the individual

- Page 153 and 154:

I-181-A I-181-B No Yes - PRS grante

- Page 155 and 156:

What is an alien registration numbe

- Page 157 and 158:

In addition to comparing the SAVE d

- Page 159 and 160:

Document Valid-appearing I-551, I-1

- Page 161 and 162:

• In the case of an adopted child

- Page 163 and 164:

Can a foreign passport be used to v

- Page 165 and 166:

What is the I-94? The I-94 is issue

- Page 167 and 168:

The I-551 and I-151 contain “clas

- Page 169 and 170:

How are non-citizens referred to th

- Page 171 and 172:

Who is eligible to VAWA? Applicant/

- Page 173 and 174:

Same I-797C I-797/ I-797C Same Indi

- Page 175 and 176:

I-551 Z13 may indicate battery, nee

- Page 177 and 178:

What are the family relationship re

- Page 179 and 180:

• On the right side of the screen

- Page 181 and 182:

Can confidential information about

- Page 183 and 184:

Who are Amerasians? Amerasians are

- Page 185 and 186:

Specialized Supportive Services Wor

- Page 187 and 188:

What are the “New Exemption/Good

- Page 189 and 190:

What action is taken when the GAIN

- Page 191 and 192:

EXAMPLE An exemption for caring for

- Page 193 and 194:

Is a GAIN sanction a mandatory coun

- Page 195 and 196:

Updating the sanction “end date

- Page 197 and 198:

Can the County and the Tribal TANF

- Page 199 and 200:

CW 42-762 - Introduction to the Cal

- Page 201 and 202:

Teens ages 18 & 19 For 18 and 19 ye

- Page 203 and 204:

Failure of the parent or stepparent

- Page 205 and 206:

See CW 89-200 Minor Parent for more

- Page 207 and 208:

needy/indigent when the sponsored n

- Page 209 and 210:

See CW 42.433 Eligible Alien Status

- Page 211 and 212:

CW 44-101 - Definition CW 44-100 IN

- Page 213 and 214:

CW 44-101 (m) - Income Reporting Th

- Page 215 and 216:

How is the income received from the

- Page 217 and 218:

A child/spousal payment is received

- Page 219 and 220:

If an applicant/participant receive

- Page 221 and 222:

NOTE: In 1994, Congress transferred

- Page 223 and 224:

See Income - Earned for LEADER proc

- Page 225 and 226:

occupant’s rent payment to the la

- Page 227 and 228:

$400 DBI -225 DBI disregard $175 Re

- Page 229 and 230:

See CW 43-100 Responsible Relatives

- Page 231 and 232:

The house payment (including the ta

- Page 233 and 234:

CW 44-115.3 - In-Kind Values What a

- Page 235 and 236:

CW 44-133.3 - Income From Other Pro

- Page 237 and 238:

A step-parent who is the spouse of

- Page 239 and 240:

Monthly Income Computation $700 Jul

- Page 241 and 242:

o The net non-exempt income of time

- Page 243 and 244:

If adding the father does not resul

- Page 245 and 246:

The value of in-kind income for the

- Page 247 and 248:

CW 44-207.3 - Lump Sum How is lump

- Page 249 and 250:

Laundry Telephone The participant n

- Page 251 and 252:

The PA 371 (out of drawer), Non-Rec

- Page 253 and 254:

House Repairs Interim Shelter Movin

- Page 255 and 256:

See Homeless - CalWORKs for LEADER

- Page 257 and 258:

1815, Important Notice Regarding a

- Page 259 and 260:

Is a family required to have a noti

- Page 261 and 262:

out in the amount of $350. The rema

- Page 263 and 264:

If apparent CalWORKs eligibility ca

- Page 265 and 266:

How many days of temporary shelter

- Page 267 and 268:

Name and phone number of landlord,

- Page 269 and 270:

again. The parent requests HA for t

- Page 271 and 272:

Uninhabitability of the residence -

- Page 273 and 274:

If the AU receives HA but the famil

- Page 275 and 276:

In addition to the security deposit

- Page 277 and 278:

Family locates permanent housing fo

- Page 279 and 280:

Does a family need to have an evict

- Page 281 and 282:

Is the Rent Arrearages Payment a On

- Page 283 and 284:

NOTE: For drug felons only: in a tw

- Page 285 and 286:

What should the EW do when the tota

- Page 287 and 288:

Who is eligible to receive funds un

- Page 289 and 290:

EXAMPLE An AU applies for MA under

- Page 291 and 292:

3. PA 956, Housing/Utility Verifica

- Page 293 and 294:

and MA program applications, includ

- Page 295 and 296:

Who is not eligible to receive fund

- Page 297 and 298:

EXAMPLES Example 1 After receiving

- Page 299 and 300:

How are the THAP+14 benefits issued

- Page 301 and 302:

SSI/SSP parent(s), or non-needy pay

- Page 303 and 304:

Permanent HA is issued for the move

- Page 305 and 306:

Do the 4-Month RA payments count as

- Page 307 and 308:

Can a pregnant applicant with no el

- Page 309 and 310:

When the participant does not repor

- Page 311 and 312:

PA 1675 (out of drawer), Direct Dep

- Page 313 and 314:

Instruct the participant to complet

- Page 315 and 316:

ETA is a special kind of bank accou

- Page 317 and 318:

A PA 853 (out of drawer), Affidavit

- Page 319 and 320:

If the Direct Rent payment only pay

- Page 321 and 322:

The Eligibility Worker must offer D

- Page 323 and 324:

Good cause is entered in the Direct

- Page 325 and 326:

What are the duties of the Direct R

- Page 327 and 328:

PA 6029, Direct Rent - Landlord Ver

- Page 329 and 330:

When the appointment is scheduled,

- Page 331 and 332:

Is the DR EW required to verify lan

- Page 333 and 334:

o PA 6029 Information reported in S

- Page 335 and 336:

Adds the landlord as a vendor to LE

- Page 337 and 338:

Are protective payee payments requi

- Page 339 and 340:

ESD will notify Central Print to pu

- Page 341 and 342:

The EW must inform the sanctioned i

- Page 343 and 344:

4. Determine if the AU meets any ex

- Page 345 and 346:

The following examples will illustr

- Page 347 and 348:

Is the MFG rule applied when a fami

- Page 349 and 350:

CW 2102 (LDR generated), The Maximu

- Page 351 and 352:

If a pregnancy occurs due to the fa

- Page 353 and 354:

When is the waiver of the MFG rule

- Page 355 and 356:

What form is used to inform the par

- Page 357 and 358:

If the inconsistency is not related

- Page 359 and 360:

What is the processing timeframe fo

- Page 361 and 362:

When a Tribal TANF program requests

- Page 363 and 364:

Which Region receives the higher MB

- Page 365 and 366:

How is the monthly grant amount cal

- Page 367 and 368:

The father is added to the existing

- Page 369 and 370:

At the request of the individual AU

- Page 371 and 372:

What are the county-initiated mid-q

- Page 373 and 374:

What is the beginning date of aid (

- Page 375 and 376:

What is the beginning date of aid (

- Page 377 and 378:

See Individual-Remove From Assistan

- Page 379 and 380:

CW 44-317.6 - Foster Care/Kin-GAP W

- Page 381 and 382:

Unreported Mandatory Included Perso

- Page 383 and 384:

CW 44-340.1 - Underpayment- Definit

- Page 385 and 386:

When an underpayment is discovered,

- Page 387 and 388:

CW 44-350.2 - Overpayment Types Wha

- Page 389 and 390:

On what is the “good faith” det

- Page 391 and 392:

will probably be mailed to the dist

- Page 393 and 394:

efugees. Children do not need to be

- Page 395 and 396:

enefits, adult victims do not need

- Page 397 and 398:

members need to have a certain immi

- Page 399 and 400:

The Aid Payment is the Maximum Aid

- Page 401 and 402:

• I-688B section 274A.12(a)(3)

- Page 403 and 404:

Removal (INA Section 243(h), 241(b)

- Page 405 and 406:

U.S. citizen children born of a ref

- Page 407 and 408:

• Use the PA 203-4, Voluntary Res

- Page 409 and 410:

and Food Stamps? RCA families/indiv

- Page 411 and 412:

month time clock for cash aid. They

- Page 413 and 414:

eligible to RCA if they are full-ti

- Page 415 and 416:

applicants/participants required to

- Page 417 and 418:

• The EW is to complete the RS 3

- Page 419 and 420:

Eligibility Worker should ask for v

- Page 421 and 422:

Are Match Grant funds counted again

- Page 423 and 424:

CW 69-211 - Aid Payments Are Refuge

- Page 425 and 426:

assistance ceases for the RCA progr

- Page 427 and 428:

Where appropriate, “child” shal

- Page 429 and 430:

Minor Parent Optional Person Otherw

- Page 431 and 432:

determines to be necessary for a re

- Page 433 and 434:

CW 80-310 FORMS CW 2.1, Notice of A

- Page 435 and 436:

(CalWORKs) Program CW 2103, Reminde

- Page 437 and 438:

CW 81-215.1 - Definition CW 81-200

- Page 439 and 440:

Who does not qualify for diversion?

- Page 441 and 442:

of how much is paid for those servi

- Page 443 and 444:

• Apply an overpayment if the app

- Page 445 and 446:

CW 81-215.6 - Child Support Income

- Page 447 and 448:

Duties of CSSD Child Support Office

- Page 449 and 450: See Sanction/Penalties/POI for LEAD

- Page 451 and 452: insurance benefits, military allotm

- Page 453 and 454: How is an applicant/participant ref

- Page 455 and 456: tabs are updated with the absent pa

- Page 457 and 458: • For DPSS districts 03, 04, 20,

- Page 459 and 460: Declaration of Paternity, the EW mu

- Page 461 and 462: • Provide the applicant/participa

- Page 463 and 464: If the CW 371 cannot be located and

- Page 465 and 466: as a child on his/her case, parent

- Page 467 and 468: CSSD only makes a determination of

- Page 469 and 470: • Provide documentation within 20

- Page 471 and 472: What services are available when th

- Page 473 and 474: CW 82-610 - Potentially Available I

- Page 475 and 476: What is the referral process for a

- Page 477 and 478: Or • Mail or fax - a paper applic

- Page 479 and 480: Employment Development Department (

- Page 481 and 482: (handicapped, mentally challenged,

- Page 483 and 484: • If the case has been transferre

- Page 485 and 486: CW 82-800 ASSISTANCE UNIT (AU) CW 8

- Page 487 and 488: What are examples of persons who do

- Page 489 and 490: EXAMPLE The applicant states that s

- Page 491 and 492: The exact relationship of the child

- Page 493 and 494: See CW 82-500 Child Support Enforce

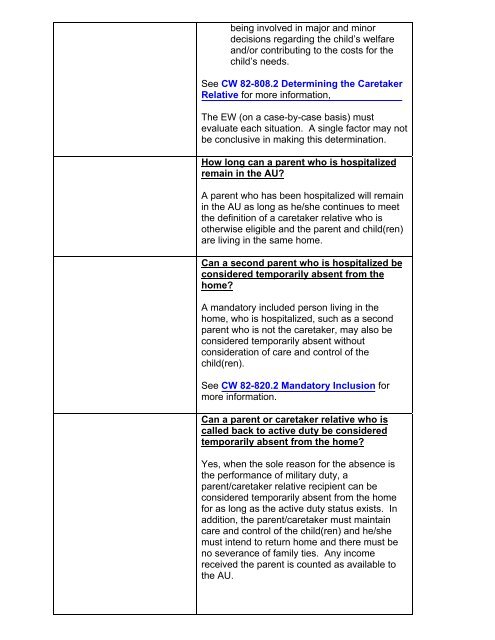

- Page 495 and 496: CW 82-808.2 - Determining the Caret

- Page 497 and 498: EXAMPLE The eligible child lives wi

- Page 499: Example 3 In a non-leap year an ind

- Page 503 and 504: Can a parent who is in a rehabilita

- Page 505 and 506: Is a parent, who is an excluded Ass

- Page 507 and 508: How is the EW notified when there i

- Page 509 and 510: • Update Case Comments and the FR

- Page 511 and 512: CW 82-820.2 - Assistance Unit (AU)

- Page 513 and 514: EXAMPLE AU consists of mom and her

- Page 515 and 516: • A person who is fleeing to avoi

- Page 517 and 518: CW 89-100 EXEMPT/NON-EXEMPT MAP AND

- Page 519 and 520: CW 89-130(4) - No Expense Incurred

- Page 521 and 522: occur or was less than expected. o

- Page 523 and 524: CW 89-130(n) - Shortening the Perio

- Page 525 and 526: EXAMPLE The QR Payment Quarter is O

- Page 527 and 528: When a minor parent exemption occur

- Page 529 and 530: NOTE: If verification provided appe

- Page 531 and 532: 3. Check the “Risk Assessment for

- Page 533 and 534: payee. Both the adult and the minor

- Page 535 and 536: Example 2 A minor parent is receivi